Related Research Articles

James Robert Edgar is an American politician who served as the 38th governor of Illinois from 1991 to 1999. A moderate Republican, he previously served in the Illinois House of Representatives from 1977 to 1979 and as the 35th Secretary of State of Illinois from 1981 to 1991.

Tax increment financing (TIF) is a public financing method that is used as a subsidy for redevelopment, infrastructure, and other community-improvement projects in many countries, including the United States. The original intent of a TIF program is to stimulate private investment in a blighted area that has been designated to be in need of economic revitalization. Similar or related value capture strategies are used around the world.

The government of the City of Chicago, Illinois, United States is divided into executive and legislative branches. The Mayor of Chicago is the chief executive, elected by general election for a term of four years, with no term limits. The mayor appoints commissioners and other officials who oversee the various departments. In addition to the mayor, Chicago's two other citywide elected officials are the City Clerk and the City Treasurer.

Michael Joseph Madigan is an American politician who is the former speaker of the Illinois House of Representatives. He was the longest-serving leader of any state or federal legislative body in the history of the United States, having held the position for all but two years from 1983 to 2021. He served in the Illinois House from 1971 to 2021. He represented the 27th District from 1971 to 1983, the 30th district from 1983 to 1993, and the 22nd district from 1993 to 2021. This made him the body's longest-serving member and the last legislator elected before the Cutback Amendment.

Patrick Joseph Quinn Jr. is an American politician who served as the 41st governor of Illinois from 2009 to 2015. A Democrat, Quinn began his career as an activist by founding the Coalition for Political Honesty. He was elected lieutenant governor in 2002 and served under governor Rod Blagojevich, and as of 2024 he is the most recent male to serve as Illinois's Lieutenant Governor.

The Regional Transportation Authority (RTA) is the financial and oversight body for the three transit agencies in northeastern Illinois; the Chicago Transit Authority (CTA), Metra, and Pace, which are called Service Boards in the RTA Act. RTA serves Cook, DuPage, Kane, Lake, McHenry and Will counties.

John Alden Fritchey IV is a former Democratic Cook County Commissioner of the Cook County Board of Commissioners who represented the 12th district in Chicago from 2010 until 2018 and was a Democratic State Representative in the Illinois House of Representatives, representing the 11th District in Chicago from 1997 to 2010. He additionally served as the elected Democratic Committeeman for Chicago's 32nd Ward from 2008 to 2012. According to the Arab-American Institute, Fritchey was one of the longest-serving Arab-American officials in the United States. He is presently President of F4 Consulting, Ltd. In 1998, he created the John Fritchey Youth Foundation, designed to create educational and recreational opportunities for local children through the sponsorship of academic and sports programs. He has additionally supported the Chicago Special Olympics as a repeated participant in the annual Polar Plunge. He presently serves on the Board of Directors of Chicago Gateway Green, a non-profit, public-private partnership dedicated to the greening and beautification of Chicago's expressways, gateways and neighborhoods through landscape enhancement, litter and graffiti removal and the installation of public art.

The Urban-Brookings Tax Policy Center, typically shortened to the Tax Policy Center (TPC), is a nonpartisan think tank based in Washington D.C., United States. A joint venture of the Urban Institute and the Brookings Institution, it aims to provide independent analyses of current and longer-term tax issues, and to communicate its analyses to the public and to policymakers. TPC combines national specialists in tax, expenditure, budget policy, and microsimulation modeling to concentrate on five overarching areas of tax policy: fair, simple and efficient taxation, social policy in the tax code, business tax reform, long-term implications of tax and budget choices, and state tax issues.

The Committee for a Responsible Federal Budget (CRFB) is a non-profit public policy organization based in Washington, D.C. that addresses federal budget and fiscal issues. It was founded in 1981 by former United States Representative Robert Giaimo (D-CT) and United States Senator Henry Bellmon (R-OK), and its board of directors includes past heads of the House and Senate Budget Committees, the Congressional Budget Office, the Office of Management and Budget, and the Government Accountability Office.

The Oklahoma State Budget for Fiscal Year 2011, is a spending request by Governor Brad Henry to fund government operations for July 1, 2010–June 30, 2011. Governor Henry and legislative leader approved the budget in May 2010. This was Governor Henry's eight and final budget submitted as governor.

The Euro-Plus Pact was adopted in March 2011 under EU's Open Method of Coordination, as an intergovernmental agreement between all member states of the European Union, in which concrete commitments were made to be working continuously within a new commonly agreed political general framework for the implementation of structural reforms intended to improve competitiveness, employment, financial stability and the fiscal strength of each country. The plan was advocated by the French and German governments as one of many needed political responses to strengthen the EMU in areas which the European sovereign-debt crisis had revealed as being too poorly constructed.

Clayton Mark, one of the pioneer makers of steel pipe in the United States, was an industrialist in the Chicago area who founded the Mark Manufacturing Company in 1888, a firm for the fabrication and sale of water-well supplies and Clayton Mark and Company in 1900. In addition, Mark founded Marktown, a planned worker community in Northwest Indiana on the National Register of Historic Places. He was known for his philanthropy and civic contributions.

Fiscal sustainability, or public finance sustainability, is the ability of a government to sustain its current spending, tax and other policies in the long run without threatening government solvency or defaulting on some of its liabilities or promised expenditures. There is no consensus among economists on a precise operational definition for fiscal sustainability, rather different studies use their own, often similar, definitions. However, the European Commission defines public finance sustainability as: the ability of a government to sustain its current spending, tax and other policies in the long run without threatening the government's solvency or without defaulting on some of the government's liabilities or promised expenditures. Many countries and research institutes have published reports which assess the sustainability of fiscal policies based on long-run projections of country's public finances. These assessments attempt to determine whether an adjustment to current fiscal policies that is required to reconcile projected revenues with projected expenditures. The size of the required adjustment is given with measures such as the Fiscal gap. In empirical works, weak and strong fiscal sustainability are distinguished. Differences are related to both econometric techniques used for examination and variables involved.

Don Drummond, is a noted Canadian economist, having served extensively in the federal Department of Finance Canada, as Chief Economist at Toronto-Dominion Bank and as a scholar at Queen's University. He is known for his wide contributions to public policy in Canada and extensive citation on economic issues.

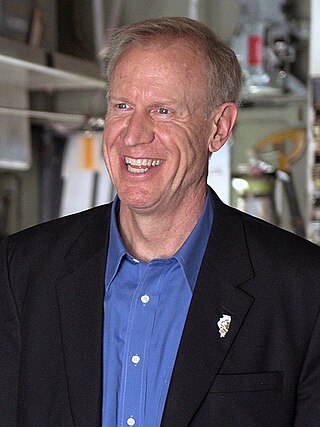

Bruce Vincent Rauner is an American businessman, philanthropist, and politician who served as the 42nd governor of Illinois from 2015 to 2019. A member of the Republican Party, he was the chairman of R8 Capital Partners and chairman of the Chicago-based private equity firm GTCR.

The Pension Fund of the Russian Federation (PFR) is the principal national pension fund in Russia. It is the largest organization of Russia to provide socially important public services to Russian citizens. Founded December 22, 1990 decision of the Supreme Soviet of the RSFSR No. 442-1 "On the organization of the Pension Fund of the Russian Federation". The fund has branches across all Federal Subjects of Russia. The labor collective FIU - is more than 133 thousand social workers.

The Illinois Fair Tax was a proposed amendment to the Illinois state constitution that would have effectively changed the state income tax system from a flat tax to a graduated income tax. The proposal, formally titled the "Allow for Graduated Income Tax Amendment", appeared on the ballot in the November 3, 2020 election in Illinois as a legislatively referred constitutional amendment striking language from the Constitution of Illinois requiring a flat state income tax. Concurrent with the proposed constitutional amendment, the Illinois legislature passed legislation setting a new set of graduated income tax rates that would have taken effect had the amendment been approved by voters.

This article details the fourteen austerity packages passed by the Government of Greece between 2010 and 2017. These austerity measures were a result of the Greek government-debt crisis and other economic factors. All of the legislation listed remains in force.

Irish Fiscal Advisory Council is a non-departmental statutory body providing independent assessments and analysis of the Irish Government's fiscal stance, its economic and budgetary forecasts, and its compliance with fiscal rules. The Fiscal Council was created as part of a wider agenda of budgetary reform after the financial crisis.

The Illinois pension crisis refers to the rising gap between the pension benefits owed to eligible state employees and the amount of funding set aside by the state to make these future pension payments. As of 2020, the size of Illinois' pension obligation is $237B, but the state's pension funds have only $96B available for payouts to retirees.

References

- ↑ The Civic Federation, "About Us". Retrieved 2011-04-4.

- ↑ David Paul Nord, "The Paradox of Municipal Reform in the Late Nineteenth Century." Wisconsin Magazine of History 66.2 (1982): 128-142.

- ↑ The Civic Federation, "Press Room". Retrieved 2011-04-4.

- ↑ The Civic Federation, "Civic Federation Achievements". Retrieved 2011-04-4.

- ↑ The Civic Federation, "Local Government Pensions". Retrieved 2011-04-4.

- ↑ The Civic Federation, "Civic Federation Property Tax Primers". Retrieved 2011-04-4.

- ↑ The Civic Federation, "Special Projects". Retrieved 2011-04-4.

- ↑ The Civic Federation, "Blog". Retrieved 2011-04-4.

- ↑ The Civic Federation, "Cost of the Crisis: An Analysis of the Additional Bond Costs Paid by the State of Illinois Due to the State’s Ongoing Fiscal Crisis". Retrieved 2011-04-4.

- ↑ The Civic Federation, "Fiscal Rehabilitation Plan for the State of Illinois". Retrieved 2011-04-4.

- ↑ The Civic Federation, "Illinois Medicaid Program: An Issue Brief" Retrieved 2011-04-4.

- ↑ Gary Scott Smith, "When Stead Came to Chicago: The 'Social Gospel Novel' and the Chicago Civic Federation." American Presbyterians 68.3 (1990): 193-205. online

- ↑ Smith, S. & Mark, S. (2011). Marktown: Clayton Mark's Planned Worker Community in Northwest Indiana. South Shore Journal, 4. "South Shore Journal - Marktown: Clayton Mark's Planned Worker Community in Northwest Indiana". Archived from the original on 2012-09-13. Retrieved 2012-08-29.

- ↑ Douglas Sutherland, "Fifty Years on the Civic Front"], The Civic Federation, 1943. Pp. 16-17.

- ↑ The Civic Federation, "Civic Federation History" Retrieved 2011-04-4.

- ↑ Civic Federation Records, DePaul University Special Collections and Archives. Accessed 21 February 2017.