The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the English Government's banker, and still one of the bankers for the Government of the United Kingdom, it is the world's eighth-oldest bank. It was privately owned by stockholders from its foundation in 1694 until it was nationalised in 1946 by the Attlee ministry.

A banknote—also called a bill, paper money, or simply a note—is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand. Banknotes were originally issued by commercial banks, which were legally required to redeem the notes for legal tender when presented to the chief cashier of the originating bank. These commercial banknotes only traded at face value in the market served by the issuing bank. Commercial banknotes have primarily been replaced by national banknotes issued by central banks or monetary authorities.

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt.

The Bank of Scotland plc is a commercial and clearing bank based in Scotland and is part of the Lloyds Banking Group, following the Bank of Scotland's implosion in 2008. The bank was established by the Parliament of Scotland in 1695 to develop Scotland's trade with other countries, and aimed to create a stable banking system in the Kingdom of Scotland.

Sir John Houblon was the first Governor of the Bank of England from 1694 to 1697.

A cheque, or check, is a document that orders a bank to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the drawer, has a transaction banking account where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay the amount of money stated to the payee.

The governor of the Bank of England is the most senior position in the Bank of England. It is nominally a civil service post, but the appointment tends to be from within the bank, with the incumbent grooming their successor. The governor of the Bank of England is also chairman of the Monetary Policy Committee, with a major role in guiding national economic and monetary policy, and is therefore one of the most important public officials in the United Kingdom.

The Bank of England Museum, located within the Bank of England in the City of London, is home to a collection of diverse items relating to the history of the Bank and the UK economy from the Bank’s foundation in 1694 to the present day.

A Demand Note is a type of United States paper money that was issued between August 1861 and April 1862 during the American Civil War in denominations of 5, 10, and 20 US$. Demand Notes were the first issue of paper money by the United States that achieved wide circulation and they are still in circulation today, though they are now extremely rare. The U.S. government placed the Demand Notes into circulation by using them to pay expenses incurred during the Civil War including the salaries of its workers and military personnel.

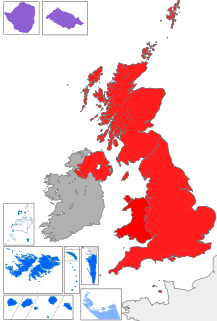

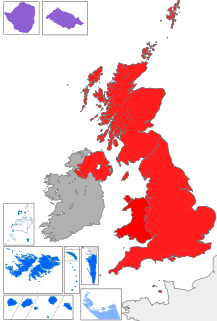

The Bank of England, which is now the central bank of the United Kingdom, British Crown Dependencies and British Overseas Territories, has issued banknotes since 1694. In 1921 the Bank of England gained a legal monopoly on the issue of banknotes in England and Wales, a process that started with the Bank Charter Act of 1844 when the ability of other banks to issue notes was restricted.

Andrew John Bailey is a British central banker who has been Governor of the Bank of England since 16 March 2020.

Thomas Speed was Chief Cashier of the Bank of England for 1694 to 1699. On 11 February 1695, the bank issued a notice in the London Gazette that Speed, and several others, were empowered to give notes on behalf of the bank in return either for payment of money or bills. Speed was replaced as Chief Cashier by Thomas Madockes.

Matthew Marshall (1791–1873) was the Chief Cashier of the Bank of England from 1835 to 1864.

The Bank of England £5 note, also known informally as a fiver, is a sterling banknote. It is the smallest denomination of banknote currently issued by the Bank of England. In September 2016, a new polymer note was introduced, featuring the image of Queen Elizabeth II on the obverse and a portrait of Winston Churchill on the reverse. The old paper note, first issued in 2002 and bearing the image of prison reformer Elizabeth Fry on the reverse, was phased out and ceased to be legal tender after 5 May 2017.

The Bank of England £10 note, also known informally as a tenner, is a sterling banknote. It is the second-lowest denomination of banknote issued by the Bank of England. The current polymer note, first issued in 2017, bears the image of Queen Elizabeth II on the obverse and the image of author Jane Austen on the reverse. The final cotton paper note featuring a portrait of naturalist Charles Darwin, first issued in 2000, was withdrawn from circulation on 1 March 2018.

The Bank of England £20 note is a sterling banknote. It is the second-highest denomination of banknote currently issued by the Bank of England. The current polymer note, first issued on 20 February 2020, bears the image of Queen Elizabeth II on the obverse and the image of painter J. M. W. Turner on the reverse. It replaced the cotton paper note featuring a portrait of economist Adam Smith, first issued in 2007.

The Bank of England £50 note is a sterling banknote. It is the highest denomination of banknote currently issued for public circulation by the Bank of England. The current note, the first of this denomination to be printed in polymer, entered circulation on 23 June 2021. It bears the image of Queen Elizabeth II on the obverse and computer scientist and World War II codebreaker Alan Turing on the reverse, with his birth date reflecting the release date. Cotton £50 notes from the previous series will remain in circulation alongside the new polymer notes until 30 September 2022, when this last 'paper' banknote issue will finally cease to be legal tender.

The Bank of England £1 note was a sterling banknote. After the ten shilling note was withdrawn in 1970, it became the smallest denomination note issued by the Bank of England. The one pound note was issued by the Bank of England for the first time in 1797 and continued to be printed until 1984. The note was withdrawn in 1988 due to inflation and was replaced by a coin.

The Bank of England 10 shilling note, colloquially known as the 10 bob note was a sterling banknote. Ten shillings in £sd was half of one pound. The ten-shilling note was the smallest denomination note ever issued by the Bank of England. The note was issued by the Bank of England for the first time in 1928 and continued to be printed until 1969. The note ceased to be legal tender in 1970 and was discontinued in favour of the fifty pence coin due to inflation.

The Bank of England £100,000,000 note, also referred to as Titan, is a non-circulating Bank of England sterling banknote used to back the value of Scottish and Northern Irish banknotes. It is the highest denomination of banknote printed by the Bank of England. As both of these regions have their own currency issued by particular local banks, the non-circulating notes provide the essential link between those currencies and that of England, and security if a local issuing bank were to fail.