A revenue stamp, tax stamp, duty stamp or fiscal stamp is a (usually) adhesive label used to designate collected taxes or fees on documents, tobacco, alcoholic drinks, drugs and medicines, playing cards, hunting licenses, firearm registration, and many other things. Typically, businesses purchase the stamps from the government, and attach them to taxed items as part of putting the items on sale, or in the case of documents, as part of filling out the form.

A beedi is a thin cigarette or mini-cigar filled with tobacco flake and commonly wrapped in a tendu or Piliostigma racemosum leaf tied with a string or adhesive at one end. It originates from the Indian subcontinent. The name is derived from the Marwari word beeda—a mixture of betel nuts, herbs, and spices wrapped in a leaf. It is a traditional method of tobacco use throughout South Asia and parts of the Middle East, where beedies are popular and inexpensive. In India, beedi consumption outpaces conventional cigarettes, accounting for 48% of all Indian tobacco consumption in 2008.

An excise, or excise tax, is any duty on manufactured goods that is normally levied at the moment of manufacture for internal consumption rather than at sale. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the border, while excise is levied on goods that came into existence inland.

An excise stamp is a type of revenue stamp affixed to some exciseable goods to indicate that the required excise tax has been paid by the manufacturer. They are securities printed by the finance ministry of the relevant country.

The Tobacco MSA with New York is the particular version of the Tobacco MSA that was signed in New York City, was enabled by means of legislation in New York State, and has been interpreted since then in New York State courts.

George Hartfield Sheppard was Texas State Comptroller from 1930 until he died in office in 1949.

Revenue stamps of Malta were first issued in 1899, when the islands were a British colony. From that year to 1912, all revenue issues were postage stamps overprinted accordingly, that was either done locally or by De La Rue in London. Postage stamps also became valid for fiscal use in 1913, so no new revenues were issued until 1926–30, when a series of key type stamps depicting King George V were issued. These exist unappropriated for use as general-duty revenues, or with additional inscriptions indicating a specific use; Applications, Contracts, Registers or Stocks & Shares. The only other revenues after this series were £1 stamps depicting George VI and Elizabeth II. Postage stamps remained valid for fiscal use until at least the 1980s.

Bangladesh first issued revenue stamps in 1972, the year after independence, and continues to do so to this day. Previously there was no country named Bangladesh and it was part of India and part of Pakistan and respective revenues were used. From 1921 to 1947 various Indian revenues were overprinted BENGAL for use in modern Bangladesh and West Bengal.

The illicit cigarette trade is defined as "the production, import, export, purchase, sale, or possession of tobacco goods which fail to comply with legislation". Illicit cigarette trade activities fall under 3 categories:

- Contraband: cigarettes smuggled from abroad without domestic duty paid;

- Counterfeit: cigarettes manufactured without authorization of the rightful owners, with intent to deceive consumers and to avoid paying duty;

- Illicit whites: brands manufactured legitimately in one country, but smuggled and sold in another without duties being paid.

Kenya, formerly known as British East Africa issued revenue stamps since 1891. There were numerous types of revenue stamps for a variety of taxes and fees. Also valid for fiscal use in Kenya were postage stamps issued by the following entities:

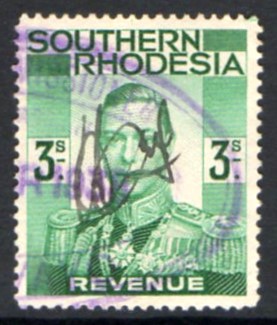

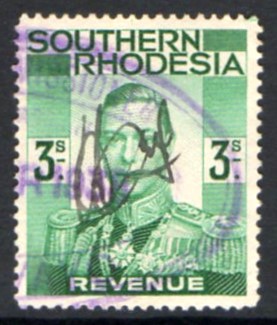

Rhodesia, now divided between Zambia and Zimbabwe, first issued revenue stamps in 1890, and Zimbabwe continues to do so to this day.

Uganda issued revenue stamps from around 1896 to the 1990s. There were numerous types of revenue stamps for a variety of taxes and fees.

Excise stamps of Ukraine are a kind of Ukrainian revenue stamps to collect excise tax. They are used in accordance with the Ukraine's presidential decree of 18 September 1995, "On approval of the excise duty on alcoholic beverages and tobacco products".

Ritz is a Portuguese brand of cigarettes, owned by multinational British American Tobacco. Ritz cigarettes are manufactured by Tabaqueira and Souza Cruz).

Revenue stamps of Hawaii were first issued in late 1876 by the Kingdom of Hawaii to pay taxes according to the Stamp Duty Act of 1876, although embossed revenue stamps had been introduced decades earlier in around 1845. The stamps issued in 1876–79 were used for over three decades, remaining in use during the Provisional Government, the Republic and after Hawaii became a U.S. Territory. Some changes were made along the years: from rouletted to perforated, and some new values, colours, designs and overprints were added. Some postage stamps were briefly valid for fiscal use in 1886–88 to pay for a tax on opium imports, and a stamp in a new design was issued for customs duties in 1897. A liquor stamp was issued in 1905.

Very few revenue stamps of the Bahamas have been issued, as most of the time dual-purpose postage and revenue stamps were used for fiscal purposes. They were used as such from around the 1860s to at least the 1950s. A couple of revenue-only impressed duty stamps embossed in vermilion ink are known used in the 1950s. Similar stamps but with colourless embossing might also exist.

Revenue stamps of China were first prepared for issue by the Qing dynasty in the late 19th century, but the first revenue stamps which were in general use were issued by the Republic of China after the 1911 revolution. A wide variety of revenue stamps have since been issued, including numerous provincial and local issues.

Revenue stamps of Guyana refer to the various revenue or fiscal stamps, whether adhesive, directly embossed or otherwise, which have been issued by Guyana since its independence in 1966. Prior to independence, the country was known as British Guiana, and it had issued its own revenue stamps since the 19th century. Guyana used dual-purpose postage and revenue stamps until 1977, and it issued revenue-only stamps between 1975 and the 2000s. The country has also issued National Insurance stamps, labels for airport departure tax and excise stamps for cigarettes and alcohol.

The 1985 United Kingdom budget was delivered by Nigel Lawson, the Chancellor of the Exchequer, to the House of Commons on 19 March 1985. The second budget to be presented by Lawson, it was held shortly after the end of the year-long 1984–85 miners' strike. The chancellor said the cost of the strike on public borrowing had impacted on his plans for tax reductions, although he did make some changes to income tax personal allowances and stamp duty. Changes to National Insurance were also announced, but threatened to place extra costs on employers.

The 1984 United Kingdom budget was delivered by Nigel Lawson, the Chancellor of the Exchequer, to the House of Commons on 13 March 1984. It was the first budget to be presented by Lawson, who had been appointed as chancellor after the 1983 general election, and saw him embark on "a radical programme of tax reform". These included a reduction in Corporation Tax and a cut in the higher rate of Transfer Tax and raised the Stamp Duty threshold.