Related Research Articles

Proposition 13 is an amendment of the Constitution of California enacted during 1978, by means of the initiative process. The initiative was approved by California voters on June 6, 1978. It was upheld as constitutional by the United States Supreme Court in the case of Nordlinger v. Hahn, 505 U.S. 1 (1992). Proposition 13 is embodied in Article XIII A of the Constitution of the State of California.

A metropolitan planning organization (MPO) is a federally mandated and federally funded transportation policy-making organization in the United States that is made up of representatives from local government and governmental transportation authorities. They were created to ensure regional cooperation in transportation planning. MPOs were introduced by the Federal-Aid Highway Act of 1962, which required the formation of an MPO for any urbanized area (UZA) with a population greater than 50,000. Federal funding for transportation projects and programs are channeled through this planning process. Congress created MPOs in order to ensure that existing and future expenditures of governmental funds for transportation projects and programs are based on a continuing, cooperative, and comprehensive ("3-C") planning process. Statewide and metropolitan transportation planning processes are governed by federal law. Transparency through public access to participation in the planning process and electronic publication of plans now is required by federal law. As of 2015, there are 408 MPOs in the United States.

Massachusetts shares with the five other New England states a governmental structure known as the New England town. Only the southeastern third of the state has functioning county governments; in western, central, and northeastern Massachusetts, traditional county-level government was eliminated in the late 1990s. Generally speaking, there are four kinds of public school districts in Massachusetts: local schools, regional schools, vocational/technical schools, and charter schools.

A hotel tax or lodging tax is charged in most of the United States, to travelers when they rent accommodations in a hotel, inn, tourist home or house, motel, or other lodging, generally unless the stay is for a period of 30 days or more. In addition to sales tax, it is collected when payment is made for the accommodation, and it is then remitted by the lodging operator to the city or county. It can also be called hotel occupancy tax, in places like New York city and Texas. Despite its name, it generally applies to the same range of accommodations.

The Historic Preservation Fund (HPF) provides financial support for historic preservation projects throughout the United States. The fund is administered by the National Park Service (NPS), pursuant to the National Historic Preservation Act of 1966 (NHPA). The fund provides state historic preservation agencies with matching funds to implement the act.

The 2007 Texas Constitutional Amendment Election took place 6 November 2007.

The 75th Oregon Legislative Assembly convened beginning on January 12, 2009, for its biennial regular session. All of the 60 seats in the House of Representatives and half of the 30 seats in the State Senate were up for election in 2008; the general election for those seats took place on November 4.

The November 2008 San Francisco general elections were held on November 4, 2008 in San Francisco, California. The elections included seven seats to the San Francisco Board of Supervisors, one seat to the San Francisco County Superior Court, and twenty-two San Francisco ballot measures.

The Board of Commissioners of Public Lands, otherwise known as BCPL, is a state agency responsible for investing Wisconsin's school trust funds in support of public education, for managing the state's remaining school trust lands, and for maintaining an extensive archive of land records. The agency was established in Article X, Sections 7 and 8 of the Wisconsin Constitution, ratified in 1848.

Kentucky Housing Corporation (KHC), the Kentucky state housing agency, was created by the 1972 Kentucky General Assembly to provide affordable housing opportunities. KHC is a self-supporting, public corporation.

Housing trust funds are established sources of funding for affordable housing construction and other related purposes created by governments in the United States (U.S.). Housing Trust Funds (HTF) began as a way of funding affordable housing in the late 1970s. Since then, elected government officials from all levels of government in the U.S. have established housing trust funds to support the construction, acquisition, and preservation of affordable housing and related services to meet the housing needs of low-income households. Ideally, HTFs are funded through dedicated revenues like real estate transfer taxes or document recording fees to ensure a steady stream of funding rather than being dependent on regular budget processes. As of 2016, 400 state, local and county trust funds existed across the U.S.

Non-profit housing developers build affordable housing for individuals under-served by the private market. The non-profit housing sector is composed of community development corporations (CDC) and national and regional non-profit housing organizations whose mission is to provide for the needy, the elderly, working households, and others that the private housing market does not adequately serve. Of the total 4.6 million units in the social housing sector, non-profit developers have produced approximately 1.547 million units, or roughly one-third of the total stock. Since non-profit developers seldom have the financial resources or access to capital that for-profit entities do, they often use multiple layers of financing, usually from a variety of sources for both development and operation of these affordable housing units.

The 2010 Virginia State Elections took place on Election Day, November 2, 2010, the same day as the U.S. House elections in the state. The only statewide elections on the ballot were three constitutional referendums to amend the Virginia State Constitution. Because Virginia state elections are held on off-years, no statewide officers or state legislative elections were held. All referendums were referred to the voters by the Virginia General Assembly.

The 2002 Virginia State Elections took place on Election Day, November 5, 2002, the same day as the U.S. Senate and the U.S. House elections in the state. The only statewide elections on the ballot were two constitutional referendums to amend the Virginia State Constitution and two government bond referendums. Because Virginia state elections are held on off-years, no statewide officers or state legislative elections were held. All referendums were referred to the voters by the Virginia General Assembly.

The 1992 Virginia State Elections took place on Election Day, November 3, 1992, the same day as the U.S. Presidential and the U.S. House elections in the state. The only statewide elections on the ballot were one constitutional referendum to amend the Virginia State Constitution and three government bond referendums. Because Virginia state elections are held on off-years, no statewide officers or state legislative elections were held. All referendums were referred to the voters by the Virginia General Assembly.

Proposition 53 was a California ballot proposition on the November 8, 2016 ballot. It would have required voter approval for issuing revenue bonds exceeding $2 billion.

The Seattle head tax, officially the employee hours tax (EHT), was a proposed head tax to be levied on large employers in Seattle, Washington, United States. The head tax was proposed in 2017 to fund homeless services and outreach and was set at a rate of $275 annually per employee, with hopes of raising up to $50 million annually.

Proposition 13 was a failed California proposition on the March 3, 2020, ballot that would have authorized the issuance of $15 billion in bonds to finance capital improvements for public and charter schools statewide. The proposition would have also raised the borrowing limit for some school districts and eliminated school impact fees for multifamily housing near transit stations.

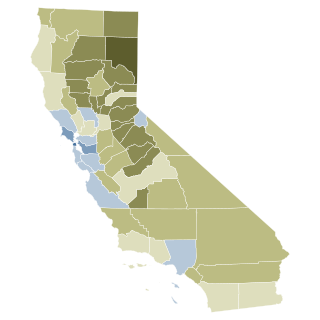

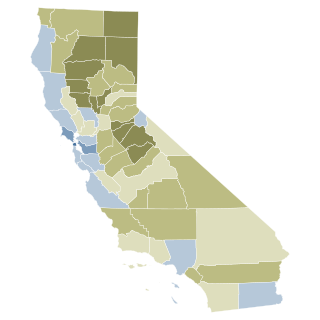

California Proposition 15 was a failed citizen-initiated proposition on the November 3, 2020, ballot. It would have provided $6.5 billion to $11.5 billion in new funding for public schools, community colleges, and local government services by creating a "split roll" system that increased taxes on large commercial properties by assessing them at market value, without changing property taxes for small business owners or residential properties for homeowners or renters. The measure failed by a small margin of about four percentage points.

References

- ↑ "CPA: An Overview (Community Preservation Coalition)". www.communitypreservation.org.