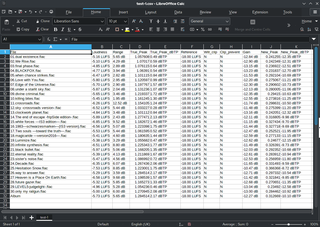

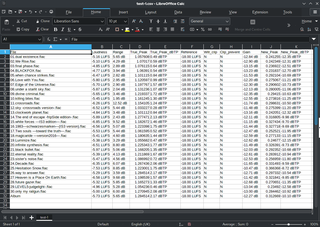

A spreadsheet is a computer application for computation, organization, analysis and storage of data in tabular form. Spreadsheets were developed as computerized analogs of paper accounting worksheets. The program operates on data entered in cells of a table. Each cell may contain either numeric or text data, or the results of formulas that automatically calculate and display a value based on the contents of other cells. The term spreadsheet may also refer to one such electronic document.

In computing, extract, transform, load (ETL) is a three-phase process where data is extracted from an input source, transformed, and loaded into an output data container. The data can be collated from one or more sources and it can also be output to one or more destinations. ETL processing is typically executed using software applications but it can also be done manually by system operators. ETL software typically automates the entire process and can be run manually or on recurring schedules either as single jobs or aggregated into a batch of jobs.

The BMP file format, or bitmap, is a raster graphics image file format used to store bitmap digital images, independently of the display device, especially on Microsoft Windows and OS/2 operating systems.

A GIS file format is a standard for encoding geographical information into a computer file, as a specialized type of file format for use in geographic information systems (GIS) and other geospatial applications. Since the 1970s, dozens of formats have been created based on various data models for various purposes. They have been created by government mapping agencies, GIS software vendors, standards bodies such as the Open Geospatial Consortium, informal user communities, and even individual developers.

Comma-separated values (CSV) is a text file format that uses commas to separate values, and newlines to separate records. A CSV file stores tabular data in plain text, where each line of the file typically represents one data record. Each record consists of the same number of fields, and these are separated by commas in the CSV file. If the field delimiter itself may appear within a field, fields can be surrounded with quotation marks.

A laboratory information management system (LIMS), sometimes referred to as a laboratory information system (LIS) or laboratory management system (LMS), is a software-based solution with features that support a modern laboratory's operations. Key features include—but are not limited to—workflow and data tracking support, flexible architecture, and data exchange interfaces, which fully "support its use in regulated environments". The features and uses of a LIMS have evolved over the years from simple sample tracking to an enterprise resource planning tool that manages multiple aspects of laboratory informatics.

A hex editor is a computer program that allows for manipulation of the fundamental binary data that constitutes a computer file. The name 'hex' comes from 'hexadecimal', a standard numerical format for representing binary data. A typical computer file occupies multiple areas on the storage medium, whose contents are combined to form the file. Hex editors that are designed to parse and edit sector data from the physical segments of floppy or hard disks are sometimes called sector editors or disk editors.

XBRL is a freely available and global framework for exchanging business information. XBRL allows the expression of semantics commonly required in business reporting. The standard was originally based on XML, but now additionally supports reports in JSON and CSV formats, as well as the original XML-based syntax. XBRL is also increasingly used in its Inline XBRL variant, which embeds XBRL tags into an HTML document. One common use of XBRL is the exchange of financial information, such as in a company's annual financial report. The XBRL standard is developed and published by XBRL International, Inc. (XII).

STEP-file is a widely used data exchange form of STEP. ISO 10303 can represent 3D objects in computer-aided design (CAD) and related information. Due to its ASCII structure, a STEP-file is easy to read, with typically one instance per line. The format of a STEP-file is defined in ISO 10303-21 Clear Text Encoding of the Exchange Structure.

An information technology audit, or information systems audit, is an examination of the management controls within an Information technology (IT) infrastructure and business applications. The evaluation of evidence obtained determines if the information systems are safeguarding assets, maintaining data integrity, and operating effectively to achieve the organization's goals or objectives. These reviews may be performed in conjunction with a financial statement audit, internal audit, or other form of attestation engagement.

Data cleansing or data cleaning is the process of identifying and correcting corrupt, inaccurate, or irrelevant records from a dataset, table, or database. It involves detecting incomplete, incorrect, or inaccurate parts of the data and then replacing, modifying, or deleting the affected data. Data cleansing can be performed interactively using data wrangling tools, or through batch processing often via scripts or a data quality firewall.

A software audit review, or software audit, is a type of software review in which one or more auditors who are not members of the software development organization conduct "An independent examination of a software product, software process, or set of software processes to assess compliance with specifications, standards, contractual agreements, or other criteria".

An entity–attribute–value model (EAV) is a data model optimized for the space-efficient storage of sparse—or ad-hoc—property or data values, intended for situations where runtime usage patterns are arbitrary, subject to user variation, or otherwise unforeseeable using a fixed design. The use-case targets applications which offer a large or rich system of defined property types, which are in turn appropriate to a wide set of entities, but where typically only a small, specific selection of these are instantiated for a given entity. Therefore, this type of data model relates to the mathematical notion of a sparse matrix. EAV is also known as object–attribute–value model, vertical database model, and open schema.

A geographic data model, geospatial data model, or simply data model in the context of geographic information systems, is a mathematical and digital structure for representing phenomena over the Earth. Generally, such data models represent various aspects of these phenomena by means of geographic data, including spatial locations, attributes, change over time, and identity. For example, the vector data model represents geography as collections of points, lines, and polygons, and the raster data model represent geography as cell matrices that store numeric values. Data models are implemented throughout the GIS ecosystem, including the software tools for data management and spatial analysis, data stored in a variety of GIS file formats, specifications and standards, and specific designs for GIS installations.

XBRL assurance is the auditor's opinion on whether a financial statement or other business report published in XBRL, is relevant, accurate, complete, and fairly presented. An XBRL report is an electronic file and called instance in XBRL terminology.

Continuous auditing is an automatic method used to perform auditing activities, such as control and risk assessments, on a more frequent basis. Technology plays a key role in continuous audit activities by helping to automate the identification of exceptions or anomalies, analyze patterns within the digits of key numeric fields, review trends, and test controls, among other activities.

The XBRL Global Ledger Taxonomy Framework is a holistic and generic XML and XBRL-based representation of the detailed data that can be found in accounting and operational systems, and is meant to be the bridge from transactional standards to reporting standards, integrating the Business Reporting Supply Chain.

The SIE format is an open standard for transferring accounting data between different software produced by different software suppliers.

SAF-T is an international standard for electronic exchange of reliable accounting data from organizations to a national tax authority or external auditors. The standard is defined by the Organisation for Economic Co-operation and Development (OECD). The file requirements are expressed using XML, but the OECD does not impose any particular file format, recommending that "It is entirely a matter for revenue bodies to develop their policies for implementation of SAF-T, including its representation in XML. However, revenue bodies should consider data formats that permit audit automation today while minimising potential costs to all stakeholders when moving to new global open standards for business and financial data such as XBRL, and XBRL_GL in particular."

Audit technology is the use of computer technology to improve an audit. Audit technology is used by accounting firms to improve the efficiency of the external audit procedures they perform.