Related Research Articles

The British Virgin Islands (BVI), officially the Virgin Islands, is a British Overseas Territory in the Caribbean, to the east of Puerto Rico and the US Virgin Islands and north-west of Anguilla. The islands are geographically part of the Virgin Islands archipelago and are located in the Leeward Islands of the Lesser Antilles and part of the West Indies.

Puerto Rico, officially the Commonwealth of Puerto Rico, is a Caribbean island and unincorporated territory of the United States with official Commonwealth status. It is located in the northeast Caribbean Sea, approximately 1,000 miles (1,600 km) southeast of Miami, Florida, between the Dominican Republic and the U.S. Virgin Islands, and includes the eponymous main island and several smaller islands, such as Mona, Culebra, and Vieques. It has roughly 3.2 million residents, and its capital and most populous city is San Juan. Spanish and English are the official languages of the executive branch of government, though Spanish predominates.

The United States Virgin Islands, officially the Virgin Islands of the United States, are a group of Caribbean islands and an unincorporated and organized territory of the United States. The islands are geographically part of the Virgin Islands archipelago and are located in the Leeward Islands of the Lesser Antilles.

The economy of the United States Virgin Islands is primarily dependent upon tourism, trade, and other services, accounting for nearly 60% of the Virgin Island's GDP and about half of total civilian employment. Close to two million tourists per year visit the islands. The government is the single largest employer. The agriculture sector is small, with most food being imported. The manufacturing sector consists of rum distilling, electronics, pharmaceuticals, and watch assembly. Rum production is significant. Shipments during a six-month period of fiscal year 2016 totaled 8,136.6 million proof gallons.

The government of the Commonwealth of Puerto Rico is a republican form of government with separation of powers, subject to the jurisdiction and sovereignty of the United States. Article I of the Constitution of Puerto Rico defines the government and its political power and authority. The powers of the government of Puerto Rico are all delegated by the United States Congress and lack full protection under the U.S. Constitution. Because of this, the head of state of Puerto Rico is the President of the United States.

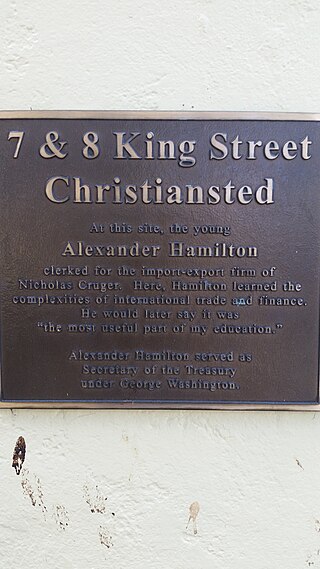

Saint Croix is an island in the Caribbean Sea, and a county and constituent district of the United States Virgin Islands (USVI), an unincorporated territory of the United States.

In the law of the United States, an insular area is a U.S.-associated jurisdiction that is not part of the 50 states or the District of Columbia. This includes fourteen U.S. territories administered under U.S. sovereignty, as well as three sovereign states each with a Compact of Free Association with the United States. The term also may be used to refer to the previous status of the Philippine Islands and the Trust Territory of the Pacific Islands when it existed.

Territories of the United States are sub-national administrative divisions overseen by the federal government of the United States. The various American territories differ from the U.S. states and Indian reservations as they are not sovereign entities. In contrast, each state has a sovereignty separate from that of the federal government and each federally recognized Native American tribe possesses limited tribal sovereignty as a "dependent sovereign nation." Territories are classified by incorporation and whether they have an "organized" government through an organic act passed by the Congress. American territories are under American sovereignty and, consequently, may be treated as part of the United States proper in some ways and not others. Unincorporated territories in particular are not considered to be integral parts of the United States, and the Constitution of the United States applies only partially in those territories.

Commonwealth is a term used by two unincorporated territories of the United States in their full official names, which are the Northern Mariana Islands, whose full name is Commonwealth of the Northern Mariana Islands, and Puerto Rico, which is named Commonwealth of Puerto Rico in English and Estado Libre Asociado de Puerto Rico in Spanish, translating to "Free Associated State of Puerto Rico." The term was also used by the Philippines during most of its period under U.S. sovereignty, when it was officially called the Commonwealth of the Philippines.

The Jones–Shafroth Act —also known as the Jones Act of Puerto Rico, Jones Law of Puerto Rico, or as the Puerto Rican Federal Relations Act of 1917— was an Act of the United States Congress, signed by President Woodrow Wilson on March 2, 1917. The act superseded the Foraker Act and granted U.S. citizenship to anyone born in Puerto Rico on or after April 11, 1899. It also created the Senate of Puerto Rico, established a bill of rights, and authorized the election of a Resident Commissioner to a four-year term. The act also exempted Puerto Rican bonds from federal, state, and local taxes regardless of where the bondholder resides.

Captain Morgan is a brand of flavored rums produced by British alcohol conglomerate Diageo. It is named after the 17th-century Welsh privateer of the Caribbean, Sir Henry Morgan.

The economy of Puerto Rico is classified as a high income economy by the World Bank and as the most competitive economy in Latin America by the World Economic Forum. The main drivers of Puerto Rico's economy are manufacturing, primarily pharmaceuticals, textiles, petrochemicals, and electronics; followed by the service industry, notably finance, insurance, real estate, and tourism. The geography of Puerto Rico and its political status are both determining factors on its economic prosperity, primarily due to its relatively small size as an island; its lack of natural resources used to produce raw materials, and, consequently, its dependence on imports; as well as its relationship with the United States federal government, which controls its foreign policies while exerting trading restrictions, particularly in its shipping industry.

Taxation in Puerto Rico consists of taxes paid to the United States federal government and taxes paid to the Government of the Commonwealth of Puerto Rico. Payment of taxes to the federal government, both personal and corporate, is done through the federal Internal Revenue Service (IRS), while payment of taxes to the Commonwealth government is done through the Puerto Rico Department of Treasury.

The political status of Puerto Rico is that of an unincorporated territory of the United States officially known as the Commonwealth of Puerto Rico. As such, the island of Puerto Rico is neither a sovereign nation nor a U.S. state. It is because of that ambiguity, the territory, as a polity, lacks certain rights but enjoys certain benefits that other polities have or lack. For instance, in contrast to U.S. states, Puerto Rico residents cannot vote in U.S. presidential elections nor can they elect their own senators and representatives to the U.S. Congress. On the other hand, in contrast to U.S. states, only some residents of Puerto Rico are subject to federal income taxes. The political status of the island thus stems from how different Puerto Rico is politically from sovereign nations and from U.S. states.

Three main alternatives are generally presented to Puerto Rican voters during a Puerto Rico political status plebiscite: full independence, maintenance or enhancement of the current commonwealth status, and full statehood into the American Union. The exact expectations for each of these status formulas are a matter of debate by a given position's adherents and detractors. Puerto Ricans have proposed positions that modify the three alternatives above, such as (a) indemnified independence with phased-out US subsidy, (b) expanded political but not fiscal autonomy, and (c) statehood with a gradual phasing out of federal tax exemption.

The Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA) is a U.S. federal law enacted in 2016 that established a financial oversight board, a process for restructuring debt, and expedited procedures for approving critical infrastructure projects in order to combat the Puerto Rican government-debt crisis. Through PROMESA, the US Congress established an appointed Fiscal Control Board (FCB), known colloquially in Puerto Rico as "la junta," to oversee the debt restructuring. With this protection the then-governor of Puerto Rico, Alejandro García Padilla, suspended payments due on July 1, 2016. The FCB's approved fiscal austerity plan for 2017-2026 cut deeply into Puerto Rico's public service budget, including cuts to health care, pensions, and education, in order to repay creditors. By May 2017, with $123 billion in debt owed by the Puerto Rican government and its corporations, the FCB requested the "immediate" appointment of a federal judge to resolve the "largest bankruptcy case in the history of the American public bond market."

Ella Gifft, also Ella Gift, was a Black entrepreneur and suffragist from the United States Virgin Islands, who founded the Suffragist League and was one of the first women to register to vote in the territory. She smuggled alcohol into the territory during the prohibition era, activity which is remembered in the folk song "Over the Side".

References

- ↑ 26 U.S.C. § 7652(b)(1), Virgin Islands, Taxes imposed in the United States

- ↑ 26 U.S.C. § 7652(a)(2), Puerto Rico, Payment of Tax, https://www.law.cornell.edu/uscode/text/26/7652-

- ↑ Matthew Murray, Rum Makers' Conflict Boiling Over, Roll Call (March 1, 2010), citing the Congressional Research Service, available at http://www.rollcall.com/issues/55_95/lobbying/43633-1.html

- ↑ Timothy P. Carney, Subsidies on trial in Caribbean rum rumble, Washington Examiner (Nov. 18, 2009), available at http://www.washingtonexaminer.com/politics/Subsidies-on-trial-in-Caribbean-rum-rumble-8546430-70300937.html#ixzz0h9QHzY8l Archived 2010-01-17 at the Wayback Machine