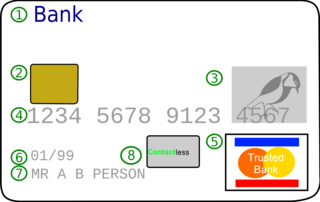

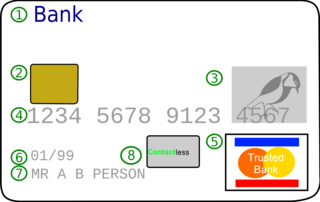

A debit card, also known as a check card or bank card is a payment card that can be used in place of cash to make purchases. The term plastic card includes the above and as an identity document. These are similar to a credit card, but unlike a credit card, the money for the purchase must be in the cardholder's bank account at the time of a purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase.

Visa Inc. is an American multinational financial services corporation headquartered in San Francisco, California. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards. Visa is one of the world's most valuable companies.

Mastercard Inc. is the second-largest payment-processing corporation worldwide. It offers a range of financial services. Its headquarters are in Purchase, New York. Throughout the world, its principal business is to process payments between the banks of merchants and the card-issuing banks or credit unions of the purchasers who use the Mastercard-brand debit, credit and prepaid cards to make purchases. Mastercard has been publicly traded since 2006.

A transaction account, also called a checking account, chequing account, current account, demand deposit account, or share draft account at credit unions, is a deposit account held at a bank or other financial institution. It is available to the account owner "on demand" and is available for frequent and immediate access by the account owner or to others as the account owner may direct. Access may be in a variety of ways, such as cash withdrawals, use of debit cards, cheques (checks) and electronic transfer. In economic terms, the funds held in a transaction account are regarded as liquid funds. In accounting terms, they are considered as cash.

Navy Federal Credit Union is a global credit union headquartered in Vienna, Virginia, chartered and regulated under the authority of the National Credit Union Administration (NCUA). Navy Federal is the largest natural member credit union in the United States, both in asset size and in membership. As of October 2022, Navy Federal has $156.7 billion USD in assets and has 12.1 million members.

ATM usage fees are the fees that many banks and interbank networks charge for the use of their automated teller machines (ATMs). In some cases, these fees are assessed solely for non-members of the bank; in other cases, they apply to all users.

CU Cooperative Systems, Inc. doing business as Co-op Solutions, is a company that operates an interbank network connecting the ATMs of credit unions in the United States, with locations also in Canada and certain United States Navy bases overseas. It is the largest credit union-owned interbank network in the US.

Interchange fee is a term used in the payment card industry to describe a fee paid between banks for the acceptance of card-based transactions. Usually for sales/services transactions it is a fee that a merchant's bank pays a customer's bank.

America First Credit Union (AFCU) is a federally chartered credit union headquartered in Riverdale, Utah, United States. As of January 2020, America First was the sixth largest credit union in the United States in terms of total membership and eight largest credit union in assets in the U.S.

Discover Financial Services is an American financial services company that owns and operates Discover Bank, which offers checking and savings accounts, personal loans, home equity loans, student loans and credit cards. It also owns and operates the Discover and Pulse networks, and owns Diners Club International. Discover Card is the third largest credit card brand in the United States, when measured by cards in force, with nearly 50 million cardholders. Discover is currently headquartered in the Chicago suburb of Riverwoods, Illinois.

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt. The card issuer creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance. There are two credit card groups: consumer credit cards and business credit cards. Most cards are plastic, but some are metal cards, and a few gemstone-encrusted metal cards.

First Tech Federal Credit Union is a federally chartered credit union headquartered in Hillsboro, Oregon. It is regulated under the authority of the National Credit Union Administration (NCUA). First Tech has over 620,000 members, and over 12 billion dollars in assets with 41 branches located mostly in high technology business centers of California, Colorado, Oregon, Washington and five other states and Puerto Rico. It was the first financial institution to offer telephone interactive voice response access and online banking.

One Nevada Credit Union, headquartered in Winchester, Nevada, is the largest locally based federally insured, state-chartered credit union in Nevada with locations in Las Vegas, Henderson, Reno, and North Las Vegas.

Citibank Berhad is a licensed commercial bank operating in Malaysia with its headquarters in Jalan Ampang, Kuala Lumpur. Citibank Berhad operates as a subsidiary of Citigroup Holding (Singapore) Private Limited, commencing its banking operations in Malaysia since 1959. Citibank Berhad was locally incorporated in 1994.

Credit unions in the United States served 100 million members, comprising 43.7% of the economically active population, in 2014. U.S. credit unions are not-for-profit, cooperative, tax-exempt organizations. The clients of the credit unions become partners of the financial institution and their presence focuses in certain neighborhoods because they center their services in one specific community. As of March 2020, the largest American credit union was Navy Federal Credit Union, serving U.S. Department of Defense employees, contractors, and families of servicepeople, with over $125 billion in assets and over 9.1 million members. Total credit union assets in the U.S. reached $1 trillion as of March 2012. Approximately 236,000 people were directly employed by credit unions per data derived from the 2012 National Credit Union Administration (NCUA) Credit Union Directory. As of 2019, there were 5,236 federally insured credit unions with 120.4 million members, and deposits of $1.22 trillion.

Altura Credit Union (Altura) is the largest credit union headquartered in Riverside County, California, with over 175,000 members and assets in excess of $2 billion. As a federally insured, state-chartered financial institution, Altura operates 21 full-service branches and its deposit assets are insured by the National Credit Union Share Insurance Fund (NCUSIF). Altura offers a wide range of financial products and services that include checking and savings accounts, new and used auto loans, commercial and residential mortgage loans, and wealth management services. Altura's banking platform includes online banking, mobile banking, web bill pay, and online/mobile loan applications. Altura also belongs to the CO-OP shared branching network, which provides its members with fee-free access to over 5,200 branches and more than 30,000 ATMs.

Call Federal Credit Union is a federally insured, not-for-profit financial cooperative headquartered in Richmond, Virginia. It is regulated under the authority of the National Credit Union Administration (NCUA) of the U.S. federal government. Call Federal Credit Union is the second-largest Richmond-based credit union. As of December 31, 2018, Call Federal Credit Union had $400 million USD in assets and 33,000 members. In accordance with the Federal Credit Union Act of 1934, Call Federal Credit Union is a tax-exempt, federally chartered, federally insured, not-for-profit financial cooperative. Call Federal Credit Union accounts are insured up to $250,000 through the NCUA, which is comparable to the insurance provided to accounts at traditional banks via the Federal Deposit Insurance Corporation.

Arsenal Credit Union (ACU) provides financial products and services to people who live and work in the St. Louis metropolitan area. The credit union is chartered and regulated under the authority of the Missouri Division of Credit Unions. Member deposits are federally insured to at least $250,000 by the National Credit Union Administration (NCUA), a U.S. government agency. The credit union has five branches and is headquartered in Arnold, Missouri. ACU is the 8th-largest credit union in St. Louis and the 11th-largest in Missouri based on asset size.

Robins Financial Credit Union is a credit union based in Warner Robins, Georgia. Robins Financial is the 2nd largest credit union in the state of Georgia. As of March 31, 2022, Robins Financial has over 243,000 members and over $4 billion in assets. Robins Financial operates 22 branch locations throughout the state of Georgia.

Citibank National Association, United Arab Emirates commonly known as Citibank U.A.E., is a franchise subsidiary of Citigroup, a multinational financial services corporation headquartered in New York City, United States. Citi U.A.E. is connected by a network spanning 98 markets across the world. The phone support call center for Citibank U.A.E. retail banking clients is based at Citibank Bahrain.