Supply-side economics is a macroeconomic theory that postulates economic growth can be most effectively fostered by lowering taxes, decreasing regulation, and allowing free trade. According to supply-side economics, consumers will benefit from greater supplies of goods and services at lower prices, and employment will increase. Supply-side fiscal policies are designed to increase aggregate supply, as opposed to aggregate demand, thereby expanding output and employment while lowering prices. Such policies are of several general varieties:

- Investments in human capital, such as education, healthcare, and encouraging the transfer of technologies and business processes, to improve productivity. Encouraging globalized free trade via containerization is a major recent example.

- Tax reduction, to provide incentives to work, invest and take risks. Lowering income tax rates and eliminating or lowering tariffs are examples of such policies.

- Investments in new capital equipment and research and development (R&D), to further improve productivity. Allowing businesses to depreciate capital equipment more rapidly gives them an immediate financial incentive to invest in such equipment.

- Reduction in government regulations, to encourage business formation and expansion.

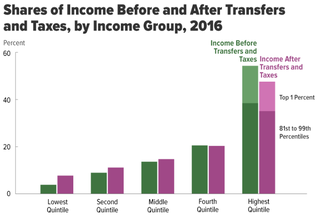

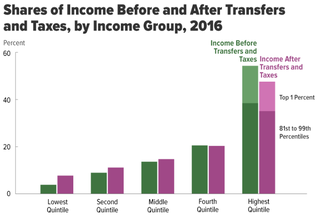

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes economic inequality which is a concern in almost all countries around the world.

Erik Brynjolfsson is an American academic, author and inventor. He is the Jerry Yang and Akiko Yamazaki Professor and a Senior Fellow at Stanford University where he directs the Digital Economy Lab at the Stanford Institute for Human-Centered AI, with appointments at SIEPR, the Stanford Department of Economics and the Stanford Graduate School of Business. He is also a research associate at the National Bureau of Economic Research and a best-selling author of several books. He is known for his contributions to the world of IT productivity research and work on the economics of information and the digital economy more generally.

Michael Jay Boskin is the T. M. Friedman Professor of Economics and senior fellow at Stanford University's Hoover Institution. He also is chief executive officer and president of Boskin & Co., an economic consulting company.

A tax incentive is an aspect of a government's taxation policy designed to incentivize or encourage a particular economic activity by reducing tax payments.

Income inequality has fluctuated considerably in the United States since measurements began around 1915, moving in an arc between peaks in the 1920s and 2000s, with a 30-year period of relatively lower inequality between 1950 and 1980.

The inequality of wealth has substantially increased in the United States in recent decades. Wealth commonly includes the values of any homes, automobiles, personal valuables, businesses, savings, and investments, as well as any associated debts.

In economics, the Laffer curve illustrates a theoretical relationship between rates of taxation and the resulting levels of the government's tax revenue. The Laffer curve assumes that no tax revenue is raised at the extreme tax rates of 0% and 100%, meaning that there is a tax rate between 0% and 100% that maximizes government tax revenue.

Nadarajan "Raj" Chetty is an Indian-American economist and the William A. Ackman Professor of Public Economics at Harvard University. Some of Chetty's recent papers have studied equality of opportunity in the United States and the long-term impact of teachers on students' performance. Offered tenure at the age of 28, Chetty became one of the youngest tenured faculty in the history of Harvard's economics department. He is a recipient of the John Bates Clark Medal and a 2012 MacArthur Fellow. Currently, he is also an advisory editor of the Journal of Public Economics. In 2020, he was awarded the Infosys Prize in Economics, the highest monetary award recognizing achievements in science and research, in India.

The economic impact of undocumented immigrants in the United States is challenging to measure, and politically contentious. Research shows that undocumented immigrants increase the size of the U.S. economy/contribute to economic growth, enhance the welfare of natives, contribute more in tax revenue than they collect, reduce American firms' incentives to offshore jobs and import foreign-produced goods, and benefit consumers by reducing the prices of goods and services.

The gender pay gap or gender wage gap is the average difference between the remuneration for men and women who are working. Women are generally found to be paid less than men. In the United States, for example, the average annual salary of a woman is 83% that of a man. However, this figure changes when controlled for confounding factors such as differences in hours worked, occupations chosen, education, job experience, and level of danger at work, which has adjusted figures in the United States from 95% to 99%. At the global level, the World Health Organization has estimated women healthcare workers earn 28% less on average than men; after adjusting for occupation and hours worked, the gap is changed to 11%.

Optimal capital income taxation is a subarea of optimal tax theory which studies the design of taxes on capital income such that a given economic criterion like utility is optimized.

Guido Wilhelmus Imbens is a Dutch-American economist whose research concerns econometrics and statistics. He holds the Applied Econometrics Professorship in Economics at the Stanford Graduate School of Business at Stanford University, where he has taught since 2012.

Mark Gregory Duggan is the Wayne and Jodi Cooperman Professor of Economics at Stanford University, where he is also the director of the Stanford Institute for Economic Policy Research (SIEPR).

Henrik Jacobsen Kleven is a Danish economist who is currently a professor of economics and public affairs at Princeton University. He is also co-editor of the American Economic Review. His research lies inside the domain of public economics and inequality, in particular questions about tax policy and welfare programs. He combines economic theory and empirical evidence to show ways of designing more effective public policies. His work has had policy impact in both developed and developing countries.

Robert Allen Moffitt is an American economist; he is currently the Krieger-Eisenhower Professor of Economics at Johns Hopkins University. His areas of research include the economics of tax and transfer programs, especially welfare programs, the analysis of earnings instability in the labor market, the economics of the family, and applied microeconometrics.

Arindrajit (Arin) Dube is a professor of economics at the University of Massachusetts Amherst, known internationally for his empirical research on the effects of minimum wage policies. He is among the foremost scholars regarding the economic impact of minimum wages. In 2019, he was asked by the UK Treasury to conduct a review of the evidence on the impact of minimum wages, which informed the decision to set the level of the National Living Wage. His work is focused on the economics of the labor market, including the role of imperfect competition, institutions, norms, and behavioral factors that affect wage setting and jobs.

Petra Persson is a Swedish economist and Assistant Professor in Economics at Stanford University. Persson is best known for her work in Public and Labour Economics where her research focuses on the interactions between family decisions and the policy environment. Specifically, Persson's research agenda is centered on studying government policy, family wellbeing, and informal institutions.

Awudu Abdulai is a Ghanaian agricultural and development economist, and professor at the Institute of Food Economics and Consumption Studies, University of Kiel, Germany. His research and teaching focus on issues related to poverty alleviation, food and nutrition security, consumer behavior, and sustainable agriculture.

Neale Mahoney is a Professor of Economics at Stanford University and the inaugural George P. Shultz Fellow at the Stanford Institute for Economic Policy Research. He is also a Research Associate at the National Bureau of Economic Research. In 2022-2023, Mahoney served in the Biden Administration's National Economic Council as a Special Policy Advisor for Economic Policy.