Related Research Articles

Financial economics is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on both sides of a trade". Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus: asset pricing and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance.

Franco Modigliani was an Italian-American economist and the recipient of the 1985 Nobel Memorial Prize in Economics. He was a professor at University of Illinois at Urbana–Champaign, Carnegie Mellon University, and MIT Sloan School of Management.

The Modigliani–Miller theorem is an influential element of economic theory; it forms the basis for modern thinking on capital structure. The basic theorem states that in the absence of taxes, bankruptcy costs, agency costs, and asymmetric information, and in an efficient market, the enterprise value of a firm is unaffected by how that firm is financed. This is not to be confused with the value of the equity of the firm. Since the value of the firm depends neither on its dividend policy nor its decision to raise capital by issuing shares or selling debt, the Modigliani–Miller theorem is often called the capital structure irrelevance principle.

William Jack Baumol was an American economist. He was a professor of economics at New York University, Academic Director of the Berkley Center for Entrepreneurship and Innovation, and Professor Emeritus at Princeton University. He was a prolific author of more than eighty books and several hundred journal articles. He is the namesake of the Baumol effect.

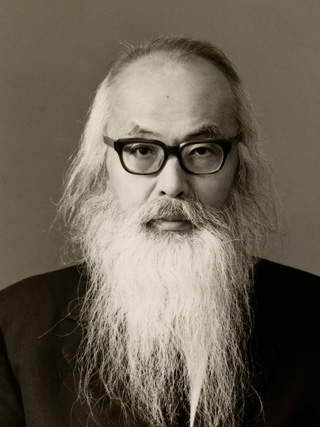

Hirofumi Uzawa was a Japanese economist.

Sanford "Sandy" Jay Grossman is an American economist and hedge fund manager specializing in quantitative finance. Grossman’s research has spanned the analysis of information in securities markets, corporate structure, property rights, and optimal dynamic risk management. He has published widely in leading economic and business journals, including American Economic Review, Journal of Econometrics, Econometrica, and Journal of Finance. His research in macroeconomics, finance, and risk management has earned numerous awards. Grossman is currently Chairman and CEO of QFS Asset Management, an affiliate of which he founded in 1988. QFS Asset Management shut down its sole remaining hedge fund in January 2014.

Jacob Marschak was an American economist.

Merton's portfolio problem is a well known problem in continuous-time finance and in particular intertemporal portfolio choice. An investor must choose how much to consume and must allocate their wealth between stocks and a risk-free asset so as to maximize expected utility. The problem was formulated and solved by Robert C. Merton in 1969 both for finite lifetimes and for the infinite case. Research has continued to extend and generalize the model to include factors like transaction costs and bankruptcy.

Ricardo Jorge Caballero is a Chilean macroeconomist who is the Ford International Professor of Economics at the Massachusetts Institute of Technology. He also served as the Chairman of MIT's Economic Department from 2008 to 2011. He is a director of the World Economic Laboratory at MIT and an NBER Research Associate. Caballero received his PhD from MIT in 1988, and he taught at Columbia University before returning to the MIT faculty.

Stochastic control or stochastic optimal control is a sub field of control theory that deals with the existence of uncertainty either in observations or in the noise that drives the evolution of the system. The system designer assumes, in a Bayesian probability-driven fashion, that random noise with known probability distribution affects the evolution and observation of the state variables. Stochastic control aims to design the time path of the controlled variables that performs the desired control task with minimum cost, somehow defined, despite the presence of this noise. The context may be either discrete time or continuous time.

Sir Vito Antonio Muscatelli is the Principal of the University of Glasgow and one of the United Kingdom's top economists.

Financial innovation is the act of creating new financial instruments as well as new financial technologies, institutions, and markets. Recent financial innovations include hedge funds, private equity, weather derivatives, retail-structured products, exchange-traded funds, multi-family offices, and Islamic bonds (Sukuk). The shadow banking system has spawned an array of financial innovations including mortgage-backed securities products and collateralized debt obligations (CDOs).

Jacques H. Drèze was a Belgian economist noted for his contributions to economic theory, econometrics, and economic policy as well as for his leadership in the economics profession. Drèze was the first President of the European Economic Association in 1986 and was the President of the Econometric Society in 1970.

Quantitative analysis is the use of mathematical and statistical methods in finance and investment management. Those working in the field are quantitative analysts (quants). Quants tend to specialize in specific areas which may include derivative structuring or pricing, risk management, investment management and other related finance occupations. The occupation is similar to those in industrial mathematics in other industries. The process usually consists of searching vast databases for patterns, such as correlations among liquid assets or price-movement patterns.

In economics, non-convexity refers to violations of the convexity assumptions of elementary economics. Basic economics textbooks concentrate on consumers with convex preferences and convex budget sets and on producers with convex production sets; for convex models, the predicted economic behavior is well understood. When convexity assumptions are violated, then many of the good properties of competitive markets need not hold: Thus, non-convexity is associated with market failures, where supply and demand differ or where market equilibria can be inefficient. Non-convex economies are studied with nonsmooth analysis, which is a generalization of convex analysis.

Douglas Warren Diamond is an American economist. He is currently the Merton H. Miller Distinguished Service Professor of Finance at the University of Chicago Booth School of Business, where he has taught since 1979. Diamond specializes in the study of financial intermediaries, financial crises, and liquidity. He is a former president of the American Finance Association (2003) and the Western Finance Association (2001-02).

Robert Stephen Pindyck is an American economist, Bank of Tokyo-Mitsubishi Professor of Economics and Finance at Sloan School of Management at Massachusetts Institute of Technology. He is also a research associate with the National Bureau of Economic Research and a Fellow of the Econometric Society. He has also been a Visiting Professor at Tel-Aviv University, Harvard University, and Columbia University.

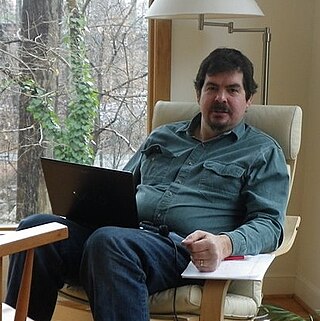

John Philip Rust is an American economist and econometrician. John Rust received his PhD from MIT in 1983 and taught at the University of Wisconsin, Yale University and University of Maryland before joining Georgetown University in 2012. John Rust was awarded Frisch Medal in 1992 and became the fellow of Econometric Society in 1993.

Lynne Pepall is a Canadian-American economist, academic and researcher. She is an Economics Professor and currently chairs the Department of Community Health at Tufts University.

References

- ↑ "Daniel Orr".

- ↑ "Daniel Orr *60". 2016-01-21.

- ↑ "Majors Handbook".

- ↑ Milwaukee Journal Sentinel: Survey says some are suspicious about 9-11 Archived 2006-08-18 at the Wayback Machine

- ↑ "9/11 Conspiracy Theories Persist, Thrive". The Washington Post . Retrieved 2018-05-09.

- ↑ Orr, Daniel (1963). "A Stochastic Income Model Using Optimal Inventory Rules". The Review of Economic Studies. 30 (2): 84–92. doi:10.2307/2295805. JSTOR 2295805.

- ↑ Orr, Daniel (1962). "A Random Walk Production-Inventory Policy: Rationale and Implementation". Management Science. 9 (1): 108–122. doi:10.1287/mnsc.9.1.108. JSTOR 2627190.

- ↑ Orr, Daniel (1963). "A Stochastic Income Model Using Optimal Inventory Rules". The Review of Economic Studies. 30 (2): 84–92. doi:10.2307/2295805. JSTOR 2295805.

- ↑ Miller, Merton H.; Orr, Daniel (1966). "A Model of the Demand for Money by Firms". The Quarterly Journal of Economics. 80 (3): 413–435. doi:10.2307/1880728. JSTOR 1880728.

- ↑ Miller, Merton H.; Orr, Daniel (1968). "The Demand for Money by Firms: Extensions of Analytic Results". The Journal of Finance. 23 (5): 735–759. doi:10.1111/j.1540-6261.1968.tb00314.x. JSTOR 2325904.

- ↑ Orr, Daniel (1974). "A Note on the Uselessness of Transaction Demand Models". The Journal of Finance. 29 (5): 1565–1572. doi:10.2307/2978560. JSTOR 2978560.

- ↑ Orr, Daniel (1993). "Reflections on the Hiring of Faculty". The American Economic Review. 83 (2): 39–43. JSTOR 2117636.