Silicon Valley is a region in Northern California that serves as a global center for high technology and innovation. Located in the southern part of the San Francisco Bay Area, it corresponds roughly to the geographical area of the Santa Clara Valley. San Jose is Silicon Valley's largest city, the third-largest in California, and the 12th-most populous in the United States. Other major Silicon Valley cities include Sunnyvale, Santa Clara, Redwood City, Mountain View, Palo Alto, Menlo Park, and Cupertino. The San Jose Metropolitan Area has the third-highest GDP per capita in the world, according to the Brookings Institution, and, as of June 2021, has the highest percentage of homes valued at $1 million or more in the United States.

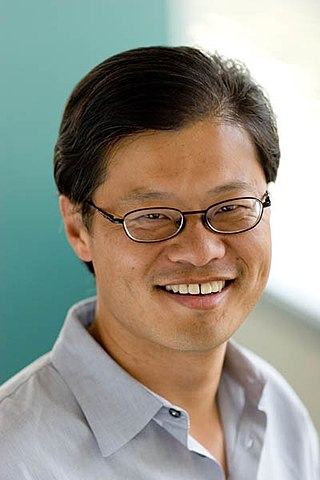

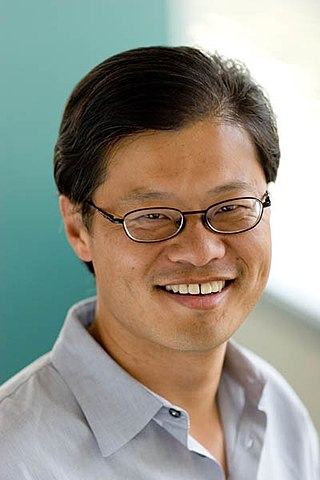

Jerry Chih-Yuan Yang is a Taiwanese-American billionaire computer programmer, internet entrepreneur, and venture capitalist. He is the co-founder and former CEO of Yahoo! Inc.

Vinod Khosla is an Indian-American businessman and venture capitalist. He is a co-founder of Sun Microsystems and the founder of Khosla Ventures. Khosla made his wealth from early venture capital investments in areas such as networking, software, and alternative energy technologies. He is considered one of the most successful and influential venture capitalists.

Venture capital is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth. Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing risky start-ups in the hopes that some of the companies they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. The start-ups are usually based on an innovative technology or business model and they are usually from high technology industries, such as information technology (IT), clean technology or biotechnology.

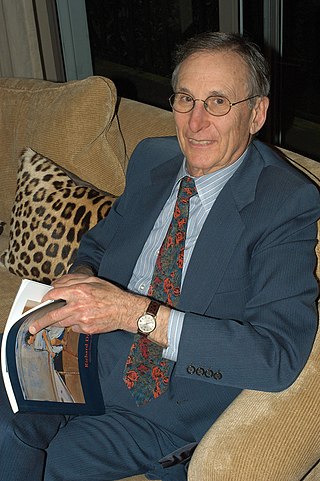

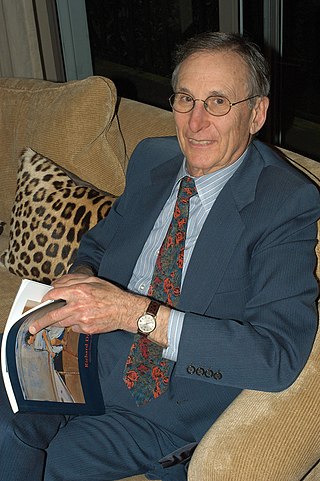

William Henry Draper III is an American venture capitalist.

Arthur Rock is an American businessman and investor. Based in Silicon Valley, California, he was an early investor in major firms including Intel, Apple, Scientific Data Systems and Teledyne.

Stephen T. Jurvetson is an American billionaire businessman and venture capitalist. Formerly a partner of the firm Draper Fisher Jurvetson (DFJ), he was an early investor in Hotmail, Memphis Meats, Mythic and Nervana Systems. He is currently a board member of SpaceX and served on Tesla's board from 2006–2020, among others. He later co-founded the firm Future Ventures with Maryanna Saenko, who worked with him at DFJ.

Ronald Crawford Conway is an American venture capitalist and philanthropist. He has been described as one of Silicon Valley's "super angels".

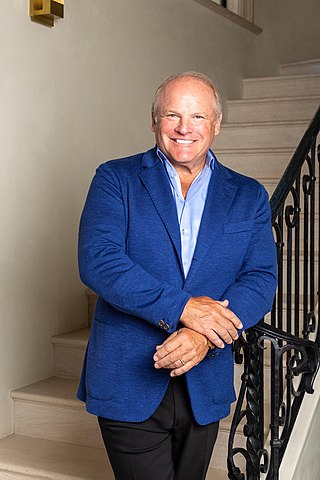

Timothy Cook Draper is an American venture capital investor, and founder of Draper Fisher Jurvetson (DFJ), Draper University, Draper Venture Network, Draper Associates and Draper Goren Holm. His most prominent investments include Baidu, Hotmail, Skype, Tesla, SpaceX, AngelList, SolarCity, Ring, Twitter, DocuSign, Coinbase, Robinhood, Ancestry.com, Twitch, Cruise Automation, PrettyLitter and Focus Media. In July 2014, Draper received wide coverage for his purchase at a US Marshals Service auction of seized bitcoins from the Silk Road website. Draper is a proponent of Bitcoin and decentralization. Draper was also one of the first investors in Theranos.

Andrew S. Rappaport, also known as Andy Rappaport, is an American venture capitalist partner, and philanthropist. He is a partner emeritus at August Capital, a Silicon Valley information technology venture capital firm where he worked from 1996 until 2013.

John William Gurley is an American businessman. He is a general partner at Benchmark, a Silicon Valley venture capital firm in San Francisco, California. He is listed consistently on the Forbes Midas List and is considered one of technology’s top dealmakers.

Institutional Venture Partners (IVP) is a US-based venture capital investment firm focusing on later-stage companies and growth equity investments. IVP is one of the oldest venture capital firms, founded in 1980.

Alan E. Salzman is an American venture capitalist and managing partner. He is the co-founder, CEO and Managing Partner of VantagePoint Capital Partners, a venture capital firm in the U.S. and an investor in clean technology companies.

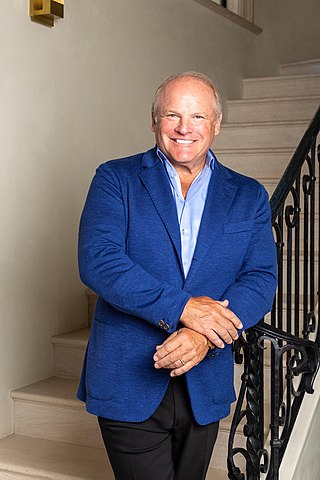

James W. Breyer is an American venture capitalist, founder and chief executive officer of Breyer Capital, an investment and venture philanthropy firm, and a former managing partner at Accel Partners, a venture capital firm. Breyer has invested in over 40 companies that have gone public or completed a merger, with some of these investments, including Facebook, earning over 100 times cost and many others over 25 times cost. On the Forbes 2021 list of the 400 richest Americans, he was ranked #389, with a net worth of US$2.9 billion.

Danny Rimer OBE is a partner at Index Ventures, a global venture capital firm founded in Geneva in 1992. Rimer opened the firm's London office in 2002 and its San Francisco office in 2012. He has become a leading voice on venture capital in Silicon Valley and Europe, and has been actively involved in various philanthropic and cultural activities.

Silicon Valley Bank (SVB) was a state-chartered commercial bank headquartered in Santa Clara, California. It operated branches in California and Massachusetts. The bank was the primary subsidiary of SVB Financial Group, a publicly traded bank holding company that had offices in 15 U.S. states and over a dozen international jurisdictions.

In business, a unicorn is a privately held startup company valued at over US$1 billion. The term was first published in 2013, coined by venture capitalist Aileen Lee, choosing the mythical animal to represent the statistical rarity of such successful ventures.

Women in venture capital or VC are investors who provide venture capital funding to startups. Women make up a small fraction of the venture capital private equity workforce. A widely used source for tracking the number of women in venture capital is the Midas List which has been published by Forbes since 2001. Research from Women in VC, a global community of women venture investors, shows that the percentage of female VC partners is just shy of 5 percent.

Josh Stein is an American businessman and venture capitalist. He is a managing partner at Threshold Ventures and was featured in the Forbes Midas List in 2013, 2014 and 2015 in recognition of his accomplishments as an investor. He was also the recipient of the 2015 Deloitte Fast 500 Venture Capitalist of the Year award. Stein holds board responsibilities at Box (company), Chartbeat, LaunchDarkley, LendKey, Lumity, and Talkdesk—and led Box’s first round of institutional investment. He is also an investor in AngelList, Doximity, Front, Loftium,Periscope Data acquired by Sisense, and Rippling,.

Institute of Contemporary Art San Francisco is an American contemporary art museum that opened in October 2022, and is located in the Dogpatch neighborhood of San Francisco, California. Admission is free.