Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect against the risk of a contingent or uncertain loss.

In economics, insurance, and risk management, adverse selection is a market situation where buyers and sellers have different information. The result is the unequal distribution of benefits to both parties, with the party having the key information benefiting more.

Life insurance is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person. Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term. After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. If the life insured dies during the term, the death benefit will be paid to the beneficiary. Term insurance is typically the least expensive way to purchase a substantial death benefit on a coverage amount per premium dollar basis over a specific period of time.

Long-term care insurance is an insurance product, sold in the United States, United Kingdom and Canada that helps pay for the costs associated with long-term care. Long-term care insurance covers care generally not covered by health insurance, Medicare, or Medicaid.

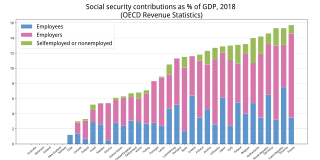

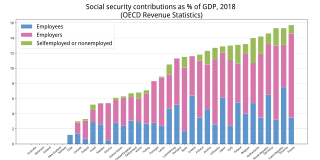

Social insurance is a form of social welfare that provides insurance against economic risks. The insurance may be provided publicly or through the subsidizing of private insurance. In contrast to other forms of social assistance, individuals' claims are partly dependent on their contributions, which can be considered insurance premiums to create a common fund out of which the individuals are then paid benefits in the future.

David Matthew Cutler is the Otto Eckstein Professor of Applied Economics at Harvard University. He was given a five-year term appointment of Harvard College Professor, which recognizes excellence in undergraduate teaching. He holds a joint appointment in the economics department and at Harvard Kennedy School and the Harvard School of Public Health, is a faculty member for the Harvard Center for Population and Development Studies, and serves as commissioner on the Massachusetts Health Policy Commission.

A reciprocal inter-insurance exchange or simply a reciprocal in the United States is an unincorporated association in which subscribers exchange insurance policies to pool and spread risk. For consumers, reciprocal exchanges often offer similar policies to those offered by a stock company or a mutual insurance company. Notable reciprocal exchanges are managed by USAA, Farmers, and Erie.

Critical illness insurance, otherwise known as critical illness cover or a dread disease policy, is an insurance product in which the insurer is contracted to typically make a lump sum cash payment if the policyholder is diagnosed with one of the specific illnesses on a predetermined list as part of an insurance policy.

Group insurance is an insurance that covers a group of people, for example the members of a society or professional association, or the employees of a particular employer for the purpose of taking insurance. Group coverage can help reduce the problem of adverse selection by creating a pool of people eligible to purchase insurance who belong to the group for reasons other than the wish to buy insurance. Grouping individuals together allows insurance companies to give lower rates to companies, "Providing large volume of business to insurance companies gives us greater bargaining power for clients, resulting in cheaper group rates." The concept varies internationally, with distinct practices and benefits in different countries, such as Canada and India. Additionally, group insurance policies can be either compulsory or voluntary, each with specific underwriting requirements and implications for coverage and premiums.

MIB Group, Inc. or MIB is a membership corporation owned by approximately 430 member insurance companies in the United States and Canada. Formed in 1902 and based in Braintree, Massachusetts, MIB provides services designed to protect insurers, policyholders, and applicants from attempts to conceal or omit information material to underwriting life & health insurance.

Medical underwriting is a health insurance term referring to the use of medical or health information in the evaluation of an applicant for coverage, typically for life or health insurance. As part of the underwriting process, an individual's health information may be used in making two decisions: whether to offer or deny coverage and what premium rate to set for the policy. The two most common methods of medical underwriting are known as moratorium underwriting, a relatively simple process, and full medical underwriting, a more indepth analysis of a client's health information. The use of medical underwriting may be restricted by law in certain insurance markets. If allowed, the criteria used should be objective, clearly related to the likely cost of providing coverage, practical to administer, consistent with applicable law, and designed to protect the long-term viability of the insurance system.

Expatriate insurance policies are designed to cover financial and other losses incurred by expatriates while living and working in a country other than one's own.

Risk equalization is a way of equalizing the risk profiles of insurance members to avoid loading premiums on the insured to some predetermined extent.

In the United States, health insurance helps pay for medical expenses through privately purchased insurance, social insurance, or a social welfare program funded by the government. Synonyms for this usage include "health coverage", "health care coverage", and "health benefits". In a more technical sense, the term "health insurance" is used to describe any form of insurance providing protection against the costs of medical services. This usage includes both private insurance programs and social insurance programs such as Medicare, which pools resources and spreads the financial risk associated with major medical expenses across the entire population to protect everyone, as well as social welfare programs like Medicaid and the Children's Health Insurance Program, which both provide assistance to people who cannot afford health coverage.

Legal protection insurance (LPI), also known as legal expenses insurance (LEI) or simply legal insurance, is a particular class of insurance which facilitates access to law and justice by providing legal advice and covering the legal costs of a dispute, regardless of whether the case is brought by or against the policyholder. Depending on the national rules, legal protection insurers can also represent the policyholder out-of-court or even in-court.

A health insurance mandate is either an employer or individual mandate to obtain private health insurance instead of a national health insurance plan.

Citizens Property Insurance Corporation (Citizens) was created in 2002 from the merger of two other entities to provide both windstorm coverage and general property insurance for home-owners who could not obtain insurance elsewhere. It was established by the Florida Legislature in Chapter 627.351(6) Florida Statutes as a not-for-profit insurer of last resort, headquartered in Tallahassee, Florida, and quickly became the largest insurer in the state. The company has no connection to Louisiana Citizens Property Insurance Corporation, the equivalent entity in Louisiana, or several similarly named "for-profit" subsidiaries in the Hanover Insurance Group.

In the United States, individually purchased health insurance is health insurance purchased directly by individuals, and not those provided through employers. Self-employed individuals receive a tax deduction for their health insurance and can buy health insurance with additional tax benefits. According to the US Census Bureau, about 9% of Americans are covered under individual health insurance. In the individual market, consumers pay the entire premium without an employer contribution, and most do not receive any tax benefit. The range of products available is similar to those provided through employers. However, average out-of-pocket spending is higher in the individual market, with higher deductibles, co-payments and other cost-sharing provisions. Major medical is the most commonly purchased form of individual health insurance.

Cancer insurance is a type of supplemental health insurance that is meant to manage the risks associated with the cancer disease and its numerous manifestations. Cancer insurance is a relatively new trend within the insurance industry. It is meant to mitigate the costs of cancer treatment and provide policyholders with a degree of financial support. This support is based upon the terms written into a particular policy by an insurance company. As with other forms of insurance, cancer insurance is subject to charges, called premiums, which change depending on the risk associated with covering the disease.