In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as they usually switch to more stable foreign currencies. When measured in stable foreign currencies, prices typically remain stable. Effective capital controls and currency substitution (“dollarization”) are the orthodox solutions to ending short-term hyperinflation; however there are significant social and economic costs to these policies. Ineffective implementations of these solutions often exacerbate the situation. Many governments choose to attempt to solve structural issues without resorting to those solutions, with the goal of bringing inflation down slowly while minimizing social costs of further economic shocks.

In economics, a local currency is a currency that can be spent in a particular geographical locality at participating organisations. A regional currency is a form of local currency encompassing a larger geographical area, while a community currency might be local or be used for exchange within an online community. A local currency acts as a complementary currency to a national currency, rather than replacing it, and aims to encourage spending within a local community, especially with locally owned businesses. Such currencies may not be backed by a national government nor be legal tender. About 300 complementary currencies, including local currencies, are listed in the Complementary Currency Resource Center worldwide database.

As part of the theory of Freiwirtschaft, Freigeld is a monetary unit proposed by Silvio Gesell.

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed. The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed.

Social credit is a distributive philosophy of political economy developed by C. H. Douglas. Douglas attributed economic downturns to discrepancies between the cost of goods and the compensation of the workers who made them. To combat what he saw as a chronic deficiency of purchasing power in the economy, Douglas prescribed government intervention in the form of the issuance of debt-free money directly to consumers or producers in order to combat such discrepancy.

A scrip is any substitute for legal tender. It is often a form of credit. Scrips have been created and used for a variety of reasons, including exploitative payment of employees under truck systems; or for use in local commerce at times when regular currency was unavailable, for example in remote coal towns, military bases, ships on long voyages, or occupied countries in wartime. Besides company scrip, other forms of scrip include land scrip, vouchers, token coins such as subway tokens, IOUs, arcade tokens and tickets, and points on some credit cards.

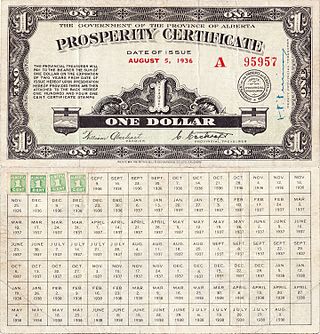

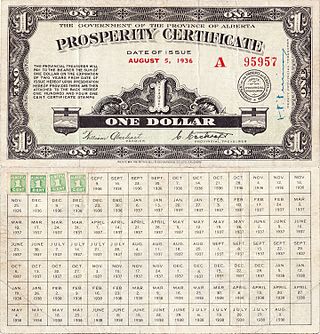

In 1936, the Alberta Social Credit Party-led government of the Province of Alberta, Canada, introduced prosperity certificates in an attempt to alleviate the effects of the Great Depression. Premier William Aberhart's government had won power in the 1935 provincial election partly on the scheme.

A complementary currency is a currency or medium of exchange that is not necessarily a national currency, but that is thought of as supplementing or complementing national currencies. Complementary currencies are usually not legal tender and their use is based on agreement between the parties exchanging the currency. According to Jérôme Blanc of Laboratoire d'Économie de la Firme et des Institutions, complementary currencies aim to protect, stimulate or orientate the economy. They may also be used to advance particular social, environmental, or political goals.

Chiemgauer is a regional local currency started in 2003 in Prien am Chiemsee, Bavaria, Germany. Named after the Chiemgau, a region around the Chiemsee lake, it is intended to increase local employment, supporting local culture, and make the local food supply more resilient. The Chiemgauer operates with a fixed exchange rate, tied to the value of the euro: 1 Chiemgauer = €1.

Modern monetary theory or modern money theory (MMT) is a heterodox macroeconomic theory that describes currency as a public monopoly and unemployment as evidence that a currency monopolist is overly restricting the supply of the financial assets needed to pay taxes and satisfy savings desires. According to MMT, governments do not need to worry about accumulating debt since they can create new money by using fiscal policy in order to pay interest. MMT argues that the primary risk once the economy reaches full employment is inflation, which acts as the only constraint on spending. MMT also argues that inflation can be addressed by increasing taxes on everyone to reduce the spending capacity of the private sector.

"Mutual credit" is a term mostly used in the field of complementary currencies to describe a common, usually small-scale, endogenous money system.

The WIR Bank, formerly the Swiss Economic Circle, or WIR, is an independent complementary currency system in Switzerland that serves businesses in hospitality, construction, manufacturing, retail and professional services. WIR issues and manages a private currency, called the WIR franc, which is used in combination with the Swiss franc to generate dual-currency transactions.

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are: medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment.

Terra is the name of a proposed "world currency". The concept was revived by Belgian economist and expert on monetary systems Bernard Lietaer in 2001, based on a similar proposal from the 1930s.

The Future of Money: Beyond Greed and Scarcity is a book written by Bernard Lietaer, published by Random House in 2001, and currently out of print. It was written as an overview of how money and the financial system works, the effects of modern money paradigms, especially relating to debt and interest, and how it can work to everyone's benefit to solve a wide range of problems, especially with the use of complementary currencies. The book is meant to be written for the layperson, while bringing light to subjects that only relatively few are aware of at all levels of society.

Fiat money is a type of currency that is not backed by a precious metal, such as gold or silver. It is typically designated by the issuing government to be legal tender, and is authorized by government regulation. Since the end of the Bretton Woods system in 1971, the major currencies in the world are fiat money.

Abeille is the name of a community currency started in 2010 in Villeneuve-sur-Lot, France. It is named after the French word for bee. The Abeille program is intended to promote local commerce. The Abeille operates with a fixed exchange rate: 1 Abeille = €1.

Occitan is the name of a community currency started in 2010 in Pézenas, Languedoc-Roussillon, France. It is named after the Occitan language.

The Wära was a demurrage-charged currency used in Germany introduced in 1926 as a free economy experiment. It was introduced by Hans Timm and Helmut Rödiger, who were followers of Silvio Gesell. The Wära is comparable to current models of local currencies.

In macroeconomics, chartalism is a heterodox theory of money that argues that money originated historically with states' attempts to direct economic activity rather than as a spontaneous solution to the problems with barter or as a means with which to tokenize debt, and that fiat currency has value in exchange because of sovereign power to levy taxes on economic activity payable in the currency they issue.