As a topic of economics, utility is used to model worth or value. Its usage has evolved significantly over time. The term was introduced initially as a measure of pleasure or happiness as part of the theory of utilitarianism by moral philosophers such as Jeremy Bentham and John Stuart Mill. The term has been adapted and reapplied within neoclassical economics, which dominates modern economic theory, as a utility function that represents a single consumer's preference ordering over a choice set but is not comparable across consumers. This concept of utility is personal and based on choice rather than on pleasure received, and so is specified more rigorously than the original concept but makes it less useful for ethical decisions.

Satisficing is a decision-making strategy or cognitive heuristic that entails searching through the available alternatives until an acceptability threshold is met. The term satisficing, a portmanteau of satisfy and suffice, was introduced by Herbert A. Simon in 1956, although the concept was first posited in his 1947 book Administrative Behavior. Simon used satisficing to explain the behavior of decision makers under circumstances in which an optimal solution cannot be determined. He maintained that many natural problems are characterized by computational intractability or a lack of information, both of which preclude the use of mathematical optimization procedures. He observed in his Nobel Prize in Economics speech that "decision makers can satisfice either by finding optimum solutions for a simplified world, or by finding satisfactory solutions for a more realistic world. Neither approach, in general, dominates the other, and both have continued to co-exist in the world of management science".

The theory of consumer choice is the branch of microeconomics that relates preferences to consumption expenditures and to consumer demand curves. It analyzes how consumers maximize the desirability of their consumption as measured by their preferences subject to limitations on their expenditures, by maximizing utility subject to a consumer budget constraint. Factors influencing consumers' evaluation of the utility of goods: income level, cultural factors, product information and physio-psychological factors.

Managerial economics is a branch of economics involving the application of economic methods in the managerial decision-making process. Economics is the study of the production, distribution and consumption of goods and services. Managerial economics involves the use of economic theories and principles to make decisions regarding the allocation of scarce resources.

In psychology, the false consensus effect, also known as consensus bias, is a pervasive cognitive bias that causes people to “see their own behavioral choices and judgments as relatively common and appropriate to existing circumstances”. In other words, they assume that their personal qualities, characteristics, beliefs, and actions are relatively widespread through the general population.

Loss aversion is the tendency to prefer avoiding losses to acquiring equivalent gains. The principle is prominent in the domain of economics. What distinguishes loss aversion from risk aversion is that the utility of a monetary payoff depends on what was previously experienced or was expected to happen. Some studies have suggested that losses are twice as powerful, psychologically, as gains. Loss aversion was first identified by Amos Tversky and Daniel Kahneman.

A choice is the range of different things from which a being can choose. The arrival at a choice may incorporate motivators and models. For example, a traveler might choose a route for a journey based on the preference of arriving at a given destination at a specified time. The preferred route can then account for information such as the length of each of the possible routes, the amount of fuel in the vehicle, traffic conditions, etc.

The expected utility hypothesis is a popular concept in economics that serves as a reference guide for decisions when the payoff is uncertain. The theory recommends which option rational individuals should choose in a complex situation, based on their risk appetite and preferences.

Status quo bias is an emotional bias; a preference for the maintenance of one's current or previous state of affairs, or a preference to not undertake any action to change this current or previous state. The current baseline is taken as a reference point, and any change from that baseline is perceived as a loss or gain. Corresponding to different alternatives, this current baseline or default option is perceived and evaluated by individuals as a positive.

In the psychology of affective forecasting, the impact bias, a form of which is the durability bias, is the tendency for people to overestimate the length or the intensity of future emotional states.

Umbrella branding is a marketing practice involving the use of a single brand name for the sale of two or more related products. Umbrella branding is mainly used by companies with a positive brand equity. All products use the same means of identification and lack additional brand names or symbols etc. This marketing practice differs from brand extension in that umbrella branding involves the marketing of similar products, rather than differentiated products, under one brand name. Hence, umbrella branding may be considered as a type of brand extension. The practice of umbrella branding does not disallow a firm to implement different branding approaches for different product lines.

A job interview is an interview consisting of a conversation between a job applicant and a representative of an employer which is conducted to assess whether the applicant should be hired. Interviews are one of the most popularly used devices for employee selection. Interviews vary in the extent to which the questions are structured, from a totally unstructured and free-wheeling conversation to a structured interview in which an applicant is asked a predetermined list of questions in a specified order; structured interviews are usually more accurate predictors of which applicants will make suitable employees, according to research studies.

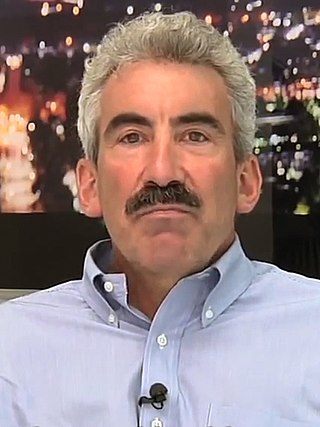

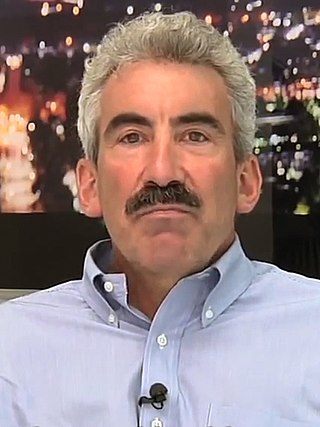

George Loewenstein is an American educator and economist. He is the Herbert A. Simon Professor of Economics and Psychology in the Social and Decision Sciences Department at Carnegie Mellon University and director of the Center for Behavioral Decision Research. He is a leader in the fields of behavioral economics and neuroeconomics.

Choice-supportive bias or post-purchase rationalization is the tendency to retroactively ascribe positive attributes to an option one has selected and/or to demote the forgone options. It is part of cognitive science, and is a distinct cognitive bias that occurs once a decision is made. For example, if a person chooses option A instead of option B, they are likely to ignore or downplay the faults of option A while amplifying or ascribing new negative faults to option B. Conversely, they are also likely to notice and amplify the advantages of option A and not notice or de-emphasize those of option B.

The Paradox of Choice – Why More Is Less is a book written by American psychologist Barry Schwartz and first published in 2004 by Harper Perennial. In the book, Schwartz argues that eliminating consumer choices can greatly reduce anxiety for shoppers. The book analyses the behavior of different types of people facing the rich choice. This book argues that the dramatic explosion in choice—from the mundane to the profound challenges of balancing career, family, and individual needs—has paradoxically become a problem instead of a solution and how our obsession with choice encourages us to seek that which makes us feel worse.

Choice architecture is the design of different ways in which choices can be presented to decision makers, and the impact of that presentation on decision-making. For example, each of the following:

In economics and other social sciences, preference is the order that an agent gives to alternatives based on their relative utility. A process which results in an "optimal choice". Preferences are evaluations and concern matters of value, typically in relation to practical reasoning. The character of the preferences is determined purely by a person's tastes instead of the good's prices, personal income, and the availability of goods. However, people are still expected to act in their best (rational) interest. Rationality, in this context, means that when individuals are faced with a choice, they would select the option that maximizes self-interest. Moreover, in every set of alternatives, preferences arise.

The less-is-better effect is a type of preference reversal that occurs when the lesser or smaller alternative of a proposition is preferred when evaluated separately, but not evaluated together. The term was first proposed by Christopher Hsee.

The memory system plays a key role in the decision-making process because individuals constantly choose among alternative options. Due to the volume of decisions made, much of the decision-making process is unconscious and automatic. Information about how a decision is made is remembered and used for future decisions. Memory is susceptible to biases, but it is integral to the formation of preferences and to differentiation between choices.