Marketing is the process of identifying customers and "creating, communicating, delivering, and exchanging" goods and services for the satisfaction and retention of those customers. It is one of the primary components of business management and commerce.

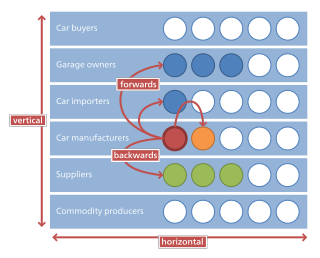

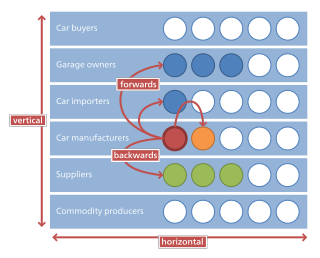

Horizontal integration is the process of a company increasing production of goods or services at the same level of the value chain, in the same industry. A company may do this via internal expansion, acquisition or merger.

Economies of scope are "efficiencies formed by variety, not volume". In economics, "economies" is synonymous with cost savings and "scope" is synonymous with broadening production/services through diversified products. Economies of scope is an economic theory stating that average total cost of production decrease as a result of increasing the number of different goods produced. For example, a gas station that sells gasoline can sell soda, milk, baked goods, etc. through their customer service representatives and thus gasoline companies achieve economies of scope.

Corporate development refers to the planning and execution of strategies to meet organizational objectives. The kinds of activities falling under corporate development may include strategic planning, market and competitor mapping and tracking, phasing in or out of markets or products, arranging strategic alliances or partnerships o joint ventures, identifying and acquiring companies (M&A), securing funding or corporate financing, divesting of assets or divisions or selling the whole company, listing on a stock exchange or undertaking various capital management initiatives.

In the field of management, strategic management involves the formulation and implementation of the major goals and initiatives taken by an organization's managers on behalf of stakeholders, based on consideration of resources and an assessment of the internal and external environments in which the organization operates. Strategic management provides overall direction to an enterprise and involves specifying the organization's objectives, developing policies and plans to achieve those objectives, and then allocating resources to implement the plans. Academics and practicing managers have developed numerous models and frameworks to assist in strategic decision-making in the context of complex environments and competitive dynamics. Strategic management is not static in nature; the models can include a feedback loop to monitor execution and to inform the next round of planning.

A marketing plan may be part of an overall business plan. Solid marketing strategy is the foundation of a well-written marketing plan so that goals may be achieved. While a marketing plan contains a list of actions, without a sound strategic foundation, it is of little use to a business.

Marketing management is the organizational discipline which focuses on the practical application of marketing orientation, techniques and methods inside enterprises and organizations and on the management of a firm's marketing resources and activities.

Competitive analysis in marketing and strategic management is an assessment of the strengths and weaknesses of current and potential competitors. This analysis provides both an offensive and defensive strategic context to identify opportunities and threats. Profiling combines all of the relevant sources of competitor analysis into one framework in the support of efficient and effective strategy formulation, implementation, monitoring and adjustment.

Porter's Five Forces Framework is a method of analysing the operating environment of a competition of a business. It draws from industrial organization (IO) economics to derive five forces that determine the competitive intensity and, therefore, the attractiveness of an industry in terms of its profitability. An "unattractive" industry is one in which the effect of these five forces reduces overall profitability. The most unattractive industry would be one approaching "pure competition", in which available profits for all firms are driven to normal profit levels. The five-forces perspective is associated with its originator, Michael E. Porter of Harvard University. This framework was first published in Harvard Business Review in 1979.

SWOT analysis is a strategic planning and strategic management technique used to help a person or organization identify Strengths, Weaknesses, Opportunities, and Threats related to business competition or project planning. It is sometimes called situational assessment or situational analysis. Additional acronyms using the same components include TOWS and WOTS-UP.

Porter's generic strategies describe how a company pursues competitive advantage across its chosen market scope. There are three/four generic strategies, either lower cost, differentiated, or focus. A company chooses to pursue one of two types of competitive advantage, either via lower costs than its competition or by differentiating itself along dimensions valued by customers to command a higher price. A company also chooses one of two types of scope, either focus or industry-wide, offering its product across many market segments. The generic strategy reflects the choices made regarding both the type of competitive advantage and the scope. The concept was described by Michael Porter in 1980.

Marketing strategy is an organization's promotional efforts to allocate its resources across a wide range of platforms and channels to increase its sales and achieve sustainable competitive advantage within its corresponding market.

Business strategies can be categorized in many ways. One popular method uses the typology put forward by American academics Raymond E. Miles and Charles C. Snow in their 1978 book on Organization Strategy.

Market penetration refers to the successful selling of a good or service in a specific market. It is measured by the amount of sales volume of an existing good or service compared to the total target market for that product or service. Market penetration is the key for a business growth strategy stemming from the Ansoff Matrix (Richardson, M., & Evans, C.. H. Igor Ansoff first devised and published the Ansoff Matrix in the Harvard Business Review in 1957, within an article titled "Strategies for Diversification". The grid/matrix is utilized across businesses to help evaluate and determine the next stages the company must take in order to grow and the risks associated with the chosen strategy. With numerous options available, this matrix helps narrow down the best fit for an organization.

A strategic alliance is an agreement between two or more parties to pursue a set of agreed upon objectives needed while remaining independent organizations.

A strategic partnership is a relationship between two commercial enterprises, usually formalized by one or more business contracts. A strategic partnership will usually fall short of a legal partnership entity, agency, or corporate affiliate relationship. Strategic partnerships can take on various forms from shake hand agreements, contractual cooperation's all the way to equity alliances, either the formation of a joint venture or cross-holdings in each other.

In marketing strategy, first-mover advantage (FMA) is the competitive advantage gained by the initial ("first-moving") significant occupant of a market segment. First-mover advantage enables a company or firm to establish strong brand recognition, customer loyalty, and early purchase of resources before other competitors enter the market segment.

Global marketing is defined as “marketing on a worldwide scale reconciling or taking global operational differences, similarities and opportunities in order to reach global objectives".

For international trade, Foreign market entry modes are the ways in which a company can expand its services into a non-domestic market.

The Ansoff matrix is a strategic planning tool that provides a framework to help executives, senior managers, and marketers devise strategies for future business growth. It is named after Russian American Igor Ansoff, an applied mathematician and business manager, who created the concept.