Related Research Articles

Finance refers to monetary resources and to the study and discipline of money, currency, assets and liabilities. As a subject of study, it is related to but distinct from economics, which is the study of the production, distribution, and consumption of goods and services. Based on the scope of financial activities in financial systems, the discipline can be divided into personal, corporate, and public finance.

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks, which represent ownership claims on businesses; these may include securities listed on a public stock exchange as well as stock that is only traded privately, such as shares of private companies that are sold to investors through equity crowdfunding platforms. Investments are usually made with an investment strategy in mind.

Financial economics is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on both sides of a trade". Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus: asset pricing and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance.

In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. As a type of active management, it stands in contradiction to much of modern portfolio theory. The efficacy of technical analysis is disputed by the efficient-market hypothesis, which states that stock market prices are essentially unpredictable, and research on whether technical analysis offers any benefit has produced mixed results. It is distinguished from fundamental analysis, which considers a company's financial statements, health, and the overall state of the market and economy.

The Information Awareness Office (IAO) was established by the United States Defense Advanced Research Projects Agency (DARPA) in January 2002 to bring together several DARPA projects focused on applying surveillance and information technology to track and monitor terrorists and other asymmetric threats to U.S. national security by achieving "Total Information Awareness" (TIA).

The efficient-market hypothesis (EMH) is a hypothesis in financial economics that states that asset prices reflect all available information. A direct implication is that it is impossible to "beat the market" consistently on a risk-adjusted basis since market prices should only react to new information.

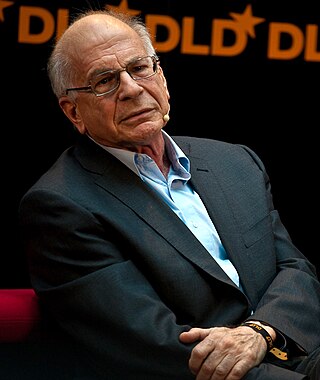

Prospect theory is a theory of behavioral economics, judgment and decision making that was developed by Daniel Kahneman and Amos Tversky in 1979. The theory was cited in the decision to award Kahneman the 2002 Nobel Memorial Prize in Economics.

The Policy Analysis Market (PAM), part of the FutureMAP project, was a proposed futures exchange developed, beginning in May 2001, by the Information Awareness Office (IAO) of the United States Defense Advanced Research Projects Agency (DARPA), and based on an idea first proposed by Net Exchange, a San Diego, California, research firm specializing in the development of online prediction markets. PAM was shut down in August 2003 after multiple US senators condemned it as an assassination and terrorism market, a characterization criticized in turn by futures-exchange expert Robin Hanson of George Mason University, and several journalists. Since PAM's closure, several private-sector variations on the idea have been launched.

Prediction markets, also known as betting markets, information markets, decision markets, idea futures or event derivatives, are open markets that enable the prediction of specific outcomes using financial incentives. They are exchange-traded markets established for trading bets in the outcome of various events. The market prices can indicate what the crowd thinks the probability of the event is. A typical prediction market contract is set up to trade between 0 and 100%. The most common form of a prediction market is a binary option market, which will expire at the price of 0 or 100%. Prediction markets can be thought of as belonging to the more general concept of crowdsourcing which is specially designed to aggregate information on particular topics of interest. The main purposes of prediction markets are eliciting aggregating beliefs over an unknown future outcome. Traders with different beliefs trade on contracts whose payoffs are related to the unknown future outcome and the market prices of the contracts are considered as the aggregated belief.

Decision theory or the theory of rational choice is a branch of probability, economics, and analytic philosophy that uses the tools of expected utility and probability to model how individuals shoud behave rationally under uncertainty. It differs from the cognitive and behavioral sciences in that it is prescriptive and concerned with identifying optimal decisions for a rational agent, rather than describing how people really do make decisions. Despite this, the field is extremely important to the study of real human behavior by social scientists, as it lays the foundations for the rational agent models used to mathematically model and analyze individuals in fields such as sociology, economics, criminology, cognitive science, and political science.

Robin Dale Hanson is an associate professor of economics at George Mason University and a former research associate at the Future of Humanity Institute of Oxford University. He is known for his work on idea futures and markets, and he was involved in the creation of the Foresight Institute's Foresight Exchange and DARPA's FutureMAP project. He invented market scoring rules like LMSR used by prediction markets such as Consensus Point, and has conducted research on signalling. He also proposed the Great Filter hypothesis.

Scenario planning, scenario thinking, scenario analysis, scenario prediction and the scenario method all describe a strategic planning method that some organizations use to make flexible long-term plans. It is in large part an adaptation and generalization of classic methods used by military intelligence.

Futurists are people whose specialty or interest is futurology or the attempt to systematically explore predictions and possibilities about the future and how they can emerge from the present, whether that of human society in particular or of life on Earth in general.

The Wisdom of Crowds: Why the Many Are Smarter Than the Few and How Collective Wisdom Shapes Business, Economies, Societies and Nations, published in 2004, is a book written by James Surowiecki about the aggregation of information in groups, resulting in decisions that, he argues, are often better than could have been made by any single member of the group. The book presents numerous case studies and anecdotes to illustrate its argument, and touches on several fields, primarily economics and psychology.

A stock trader or equity trader or share trader, also called a stock investor, is a person or company involved in trading equity securities and attempting to profit from the purchase and sale of those securities. Stock traders may be an investor, agent, hedger, arbitrageur, speculator, or stockbroker. Such equity trading in large publicly traded companies may be through a stock exchange. Stock shares in smaller public companies may be bought and sold in over-the-counter (OTC) markets or in some instances in equity crowdfunding platforms.

Prediction markets company NewsFutures (2000-2010) evolved into Lumenogic (2010-2019), "a consulting firm that specializes in developing and customizing online systems for large organizations to use to gather so-called Collective Intelligence from their employees", which in turn became Hypermind.

The following outline is provided as an overview of and topical guide to finance:

Linda Bradford Raschke (/'ræʃki/) is an American financier, operating mostly as a commodities and futures trader.

Stocks consist of all the shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets, or voting power, often dividing these up in proportion to the number of like shares each stockholder owns. Not all stock is necessarily equal, as certain classes of stock may be issued, for example, without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of shareholders.

A period of financial distress occurs when the price of a company or an asset or an index of a set of assets in a market is declining with the danger of a sudden crash of value occurring, either because the company is experiencing increasing problems of cash flow or a deteriorating credit balance or because the price had become too high as a result of a speculative bubble that has now peaked.

References

- ↑ CCC - DARPA’s Policy Analysis Market (The "Terrorism Market") Archived 2008-10-08 at the Wayback Machine

- ↑ "Pentagon's futures market plan abandoned". USA Today. July 29, 2003.

- 1 2 3 The Dumb Smart Market – James Surowiecki – Slate Magazine

- ↑ CCC - DARPA’s Policy Analysis Market (The "Terrorism Market") [ permanent dead link ]

- ↑ Surowiecki, James (2004). The Wisdom of Crowds: Why the Many Are Smarter Than the Few and How Collective Wisdom Shapes Business, Economies, Societies and Nations. Little, Brown. ISBN 0-316-86173-1.