Related Research Articles

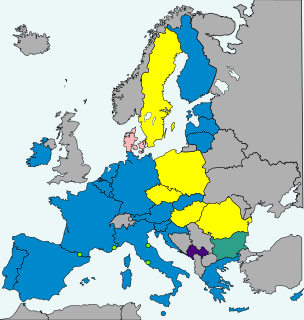

The euro is the official currency of 19 out of the 27 member states of the European Union. This group of states is known as the eurozone or, officially, the euro area, and includes about 340 million citizens as of 2019. The euro is divided into 100 cents.

The eurozone (EZ), officially called the euro area, is a monetary union of 19 member states of the European Union (EU) that have adopted the euro (€) as their primary currency and sole legal tender. The monetary authority of the eurozone is the Eurosystem. Eight members of the European Union continue to use their own national currencies, although most of them have agreed to adopt the euro in the future.

The pound was the currency of the Republic of Ireland until 2002. Its ISO 4217 code was IEP, and the symbol was £. The Irish pound was replaced by the euro on 1 January 1999. Euro currency did not begin circulation until the beginning of 2002.

The European Exchange Rate Mechanism (ERM) II is a system introduced by the European Economic Community on 1 January 1999 alongside the introduction of a single currency, the euro as part of the European Monetary System (EMS), to reduce exchange rate variability and achieve monetary stability in Europe.

The five economic tests were the criteria defined by the UK treasury under Gordon Brown that were to be used to assess the UK's readiness to join the Economic and Monetary Union of the European Union (EMU), and so adopt the euro as its official currency. In principle, these tests were distinct from any political decision to join.

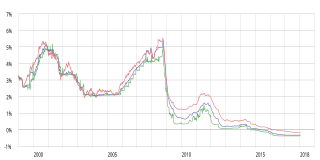

The Euro Interbank Offered Rate (Euribor) is a daily reference rate, published by the European Money Markets Institute, based on the averaged interest rates at which Eurozone banks offer to lend unsecured funds to other banks in the euro wholesale money market. Prior to 2015, the rate was published by the European Banking Federation.

Eonia is computed as a weighted average of all overnight unsecured lending transactions in the interbank market, undertaken in the European Union and European Free Trade Association (EFTA) countries by the Panel Banks. It is reported on an ACT/360 day count convention and is displayed to three decimal places. "Overnight" means from one TARGET day to the next. The panel of reporting banks is the same as for Euribor, and a list is provided by the overseers of the publication of the index. There is no clear definition of 'interbank market' leading to the potential of subjective assessment of what is an 'interbank loan', albeit all panel banks are subject to the Eonia Code of Conduct.

A currency crisis is a situation in which serious doubt exists as to whether a country's central bank has sufficient foreign exchange reserves to maintain the country's fixed exchange rate. The crisis is often accompanied by a speculative attack in the foreign exchange market. A currency crisis results from chronic balance of payments deficits, and thus is also called a balance of payments crisis. Often such a crisis culminates in a devaluation of the currency.

SONIA is the effective reference for overnight indexed swaps for unsecured transactions in the Sterling market. SONIA is a risk-free rate.

Poland does not use the euro as its currency. However, under the terms of their Treaty of Accession with the European Union, all new Member States "shall participate in the Economic and Monetary Union from the date of accession as a Member State with a derogation", which means that Poland is obliged to eventually replace its currency, the złoty, with the euro.

Romania's national currency is the leu. After Romania joined the European Union (EU) in 2007, the country became required to replace the leu with the euro once it meets all four euro convergence criteria, as stated in article 140 of the Treaty on the Functioning of the European Union. As of 2022, the only currency on the market is the leu and the euro is not yet used in shops. The Romanian leu is not part of the European Exchange Rate Mechanism, although Romanian authorities are working to prepare the changeover to the euro. To achieve the currency changeover, Romania must undergo at least two years of stability within the limits of the convergence criteria. The current Romanian government established a self-imposed criterion to reach a certain level of real convergence as a steering anchor to decide the appropriate target year for ERM II membership and Euro adoption. In March 2018, the National Plan for the Adoption of the Euro scheduled the date for euro adoption in Romania as 2024. Nevertheless, in early 2021, this date was postponed to 2027 or 2028, and once again to 2029 in late 2021.

The overnight rate is generally the interest rate that large banks use to borrow and lend from one another in the overnight market. In some countries, the overnight rate may be the rate targeted by the central bank to influence monetary policy. In most countries, the central bank is also a participant on the overnight lending market, and will lend or borrow money to some group of banks.

The euro came into existence on 1 January 1999, although it had been a goal of the European Union (EU) and its predecessors since the 1960s. After tough negotiations, the Maastricht Treaty entered into force in 1993 with the goal of creating an economic and monetary union by 1999 for all EU states except the UK and Denmark.

The United Kingdom did not seek to adopt the euro as its official currency for the duration of its membership of the European Union (EU), and secured an opt-out at the euro's creation via the Maastricht Treaty in 1992, wherein the Bank of England would only be a member of the European System of Central Banks.

Denmark uses the krone as its currency and does not use the euro, having negotiated the right to opt out from participation under the Maastricht Treaty of 1992. In 2000, the government held a referendum on introducing the euro, which was defeated with 46.8% voting yes and 53.2% voting no. The Danish krone is part of the ERM II mechanism, so its exchange rate is tied to within 2.25% of the euro.

The enlargement of the eurozone is an ongoing process within the European Union (EU). All member states of the European Union, except Denmark which negotiated an opt-out from the provisions, are obliged to adopt the euro as their sole currency once they meet the criteria, which include: complying with the debt and deficit criteria outlined by the Stability and Growth Pact, keeping inflation and long-term governmental interest rates below certain reference values, stabilising their currency's exchange rate versus the euro by participating in the European Exchange Rate Mechanism, and ensuring that their national laws comply with the ECB statute, ESCB statute and articles 130+131 of the Treaty on the Functioning of the European Union. The obligation for EU member states to adopt the euro was first outlined by article 109.1j of the Maastricht Treaty of 1992, which became binding on all new member states by the terms of their treaties of accession.

An overnight indexed swap (OIS) is an interest rate swap (IRS) over some given term, e.g. 10Y, where the periodic fixed payments are tied to a given fixed rate while the periodic floating payments are tied to a floating rate calculated from a daily compounded overnight rate over the floating coupon period. Note that the OIS term is not overnight; it is the underlying reference rate that is an overnight rate. The exact compounding formula depends on the type of such overnight rate.

The interbank lending market is a market in which banks lend funds to one another for a specified term. Most interbank loans are for maturities of one week or less, the majority being over day. Such loans are made at the interbank rate. A sharp decline in transaction volume in this market was a major contributing factor to the collapse of several financial institutions during the financial crisis of 2007–2008.

Euro short-term rate (€STR) is a reference rate for the currency euro. The €STR is calculated by the European Central Bank (ECB) and is based on the money market statistical reporting of the Eurosystem. The working group on euro risk-free rates has recommended €STR as a replacement for the EMMI Euro Overnight Index Average (EONIA) as the Euro risk-free rate for all products and contracts.

References

- ↑ Frederic S. Mishkin and Stanley G. Eakins (2008), Financial Markets and Institutions, Pearson/Prentice Hall, ISBN 978-0-321-37421-9

- ↑ Romesh Vaitilingam (2001), The Financial Times Guide to Using the Financial Pages, Prentice Hall, ISBN 0-273-65263-X

- ↑ BBA - British Bankers' Association - Sterling Overnight Index Average (SONIA): A Guide, archived from the original on April 26, 2005, retrieved March 31, 2009

- ↑ http://markets.ft.com/ft/markets/reports/FTReport.asp?dockey=MNY-300309 , retrieved March 31, 2009

{{citation}}: Missing or empty|title=(help) - ↑ (PDF) http://www.bankofengland.co.uk/publications/other/europe/cityguide/UK%20Euro%20changeover-A4.pdf , retrieved March 31, 2009

{{citation}}: Missing or empty|title=(help) - ↑ (PDF) http://www.bankofengland.co.uk/publications/other/europe/cityguide/UK%20Euro%20changeover-glossary.pdf , retrieved March 31, 2009

{{citation}}: Missing or empty|title=(help)