Electronic funds transfer at point of sale is an electronic payment system involving electronic funds transfers based on the use of payment cards, such as debit or credit cards, at payment terminals located at points of sale. EFTPOS technology originated in the United States in 1981 and was adopted by other countries. In Australia and New Zealand, it is also the brand name of a specific system used for such payments; these systems are mainly country-specific and do not interconnect.

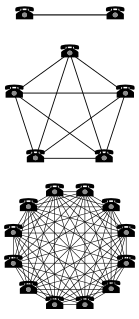

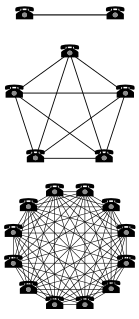

In economics, a network effect is the phenomenon by which the value or utility a user derives from a good or service depends on the number of users of compatible products. Network effects are typically positive, resulting in a given user deriving more value from a product as other users join the same network. The adoption of a product by an additional user can be broken into two effects: an increase in the value to all other users and also the enhancement of other non-users motivation for using the product.

The subscription business model is a business model in which a customer must pay a recurring price at regular intervals for access to a product. The model was pioneered by publishers of books and periodicals in the 17th century, and is now used by many businesses and websites.

A charge card is a card that enables the cardholder to make purchases which are paid for by the card issuer. The cardholder is obligated to repay the debt to the card issuer in full by the due date, usually on a monthly basis, or be subject to late fees and restrictions on further card use. Charge cards are typically issued without spending limits, but credit cards usually have a specified credit limit that the cardholder may not exceed. Most charge cards are business and corporate charge cards, not personal charge cards. Charge cards are issued to customers with good or excellent credit score.

Financial services are the economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, credit-card companies, insurance companies, accountancy companies, consumer-finance companies, stock brokerages, investment funds, individual managers and some government-sponsored enterprises. Financial services companies are present in all economically developed geographic locations and tend to cluster in local, national, regional and international financial centers such as London, New York City, and Tokyo.

Diners Club International (DCI), founded as Diners Club, is a charge card company owned by Discover Financial Services. Formed in 1950 by Frank X. McNamara, Ralph Schneider, Matty Simmons, and Alfred S. Bloomingdale, it was the first independent payment card company in the world, and it established the concept of a self-sufficient company producing credit cards for travel and entertainment. Diners Club International and its franchises serve individuals from around the globe with operations in 59 countries.

Referral marketing is a word-of-mouth initiative designed by a company to incentivize existing customers to introduce their family, friends and contacts to become new customers. Different to pure word-of-mouth strategies which are primarily customer directed with the company unable to track, influence and measure message content; referral marketing encourages and rewards the referrer for allowing a company to do so. Different to multi-level marketing, there is no incentive for the original existing customer to drive or influence the subsequent referrals of the new customer – only the conversion of the initial, primary customer is rewarded.

A two-sided market, also called a two-sided network, is an intermediary economic platform having two distinct user groups that provide each other with network benefits. The organization that creates value primarily by enabling direct interactions between two distinct types of affiliated customers is called a multi-sided platform. This concept of two-sided markets has been mainly theorised by the French economists Jean Tirole and Jean-Charles Rochet.

An online marketplace is a type of e-commerce website where product or service information is provided by multiple third parties. Online marketplaces are the primary type of multichannel ecommerce and can be a way to streamline the production process.

Catalyst Code: The Strategies Behind the World’s Most Dynamic Companies is a book by Market Platform Dynamics founder David S. Evans and MIT economist Richard L. Schmalensee published in 2007.

A value proposition is a promise of value to be delivered, communicated, and acknowledged. It is also a belief from the customer about how value (benefit) will be delivered, experienced and acquired.

A payment card number, primary account number (PAN), or simply a card number, is the card identifier found on payment cards, such as credit cards and debit cards, as well as stored-value cards, gift cards and other similar cards. In some situations the card number is referred to as a bank card number. The card number is primarily a card identifier and does not directly identify the bank account number/s to which the card is/are linked by the issuing entity. The card number prefix identifies the issuer of the card, and the digits that follow are used by the issuing entity to identify the cardholder as a customer and which is then associated by the issuing entity with the customer's designated bank accounts. In the case of stored-value type cards, the association with a particular customer is only made if the prepaid card is reloadable. Card numbers are allocated in accordance with ISO/IEC 7812. The card number is usually prominently embossed on the front of a payment card, and is encoded on the magnetic stripe and chip, but may be imprinted on the back of the card.

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's promise to the card issuer to pay them for the amounts plus the other agreed charges. The card issuer creates a revolving account and grants a line of credit to the cardholder, from which the cardholder can borrow money for payment to a merchant or as a cash advance.

A payment processor is some sort of transactor for financial calculations, technically an invertible currency exchange appointed by a merchant to handle transactions from various channels such as credit cards and debit cards for merchant acquiring banks. They are usually broken down into two types: front-end and back-end.

Consumer to consumer (C2C) markets provide an innovative way to allow customers to interact with each other. Traditional markets require business to customer relationships, in which a customer goes to the business in order to purchase a product or service. In customer to customer markets, the business facilitates an environment where customers can sell goods or services to each other. Other types of markets include business to business (B2B) and business to customer (B2C).

RuPay is a domestic card payment service conceived and launched by the National Payments Corporation of India (NPCI) on 26 March 2012. It was created to fulfil the Reserve Bank of India's (RBI) vision of establishing a domestic, open and multilateral system of payments.

A surcharge, also known as checkout fee, is an extra fee charged by a merchant when receiving a payment by cheque, credit card, charge card or debit card which at least covers the cost to the merchant of accepting that means of payment, such as the merchant service fee imposed by a credit card company. Retailers generally incur higher costs when consumers choose to pay by credit card due to higher merchant service fees compared to traditional payment methods such as cash.

Vocalink is a payment systems company headquartered in the United Kingdom, created in 2007 from the merger between Voca and LINK. It designs, builds and operates the UK payments infrastructure, which underpins the provision of the Bacs payment system and the UK ATM LINK switching platform covering 65,000 ATMs and the UK Faster Payments systems.

Afterpay Limited is an Australian financial technology company operating in the United States, United Kingdom, Australia and New Zealand. Afterpay and Touchcorp merged in June 2017 to form Afterpay Touch Group. In November 2019, the name of the head entity was renamed Afterpay Limited.

The Platform Canvas is a conceptual framework dedicated to explain the mechanisms of multi-sided platform organizations, and how value is created, captured and delivered in the platform economy. Multi-sided platforms, also called two-sided markets, like Amazon, Uber and Airbnb, create value primarily by enabling direct interactions between distinct groups of affiliated customers. The framework serves as a strategic management tool to assist academics, entrepreneurs and managers identify the essential elements in platform businesses, understand the interrelations of these element and recognize the dynamics of associated network effects. The 12 components of the canvas highlight the internal and external factors of the business model, and the orchestration of the affiliated ecosystems.