Blackstone Inc. is an American alternative investment management company based in New York City. Blackstone's private equity business has been one of the largest investors in leveraged buyouts in the last three decades, while its real estate business has actively acquired commercial real estate across the globe. Blackstone is also active in credit, infrastructure, hedge funds, secondaries, growth equity, and insurance solutions. As of May 2024, Blackstone has more than US$1 trillion in total assets under management, making it the largest alternative investment firm globally.

Soros Fund Management, LLC is a privately held American investment management firm. It is currently structured as a family office, but formerly as a hedge fund. The firm was founded in 1970 by George Soros and, in 2010, was reported to be one of the most profitable firms in the hedge fund industry, averaging a 20% annual rate of return over four decades. It is headquartered at 250 West 55th Street in New York. As of 2023, Soros Fund Management, LLC had $25 billion in AUM.

Steven A. Cohen is an American hedge-fund manager and owner of the New York Mets of Major League Baseball since September 14, 2020, owning just over 97% of the team. He is the founder of hedge fund Point72 Asset Management and S.A.C. Capital Advisors, which closed after pleading guilty to insider trading and other financial crimes.

Point72 Asset Management is an American hedge fund. It was founded in 2014 by Steve Cohen, after his previous company S.A.C. Capital Advisors pled guilty to insider trading charges.

Citadel LLC is an American multinational hedge fund and financial services company. Founded in 1990 by Ken Griffin, it has more than $63 billion in assets under management as of June 2024. The company has over 2,800 employees, with corporate headquarters in Miami, Florida, and offices throughout North America, Asia, and Europe. Founder, CEO and Co-CIO Griffin owns approximately 85% of the firm. As of December 2022, Citadel is one of the most profitable hedge funds in the world, posting $74 billion in net gains since its inception in 1990, making it the most successful hedge fund in history, according to CNBC.

Fortress Investment Group is an American investment management firm based in New York City. It was founded as a private equity firm in 1998 by Wes Edens, Rob Kauffman, and Randal Nardone.

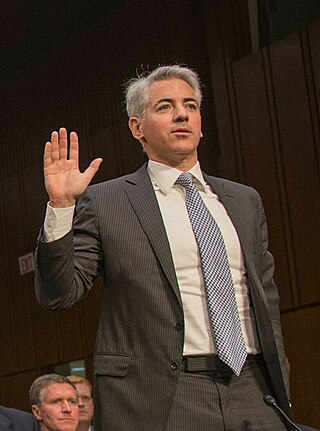

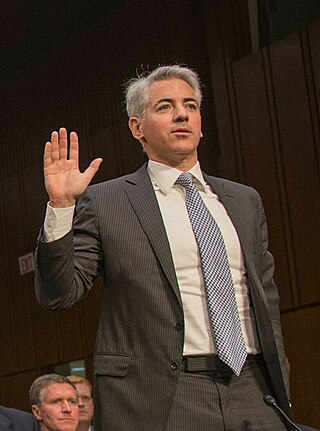

William Albert Ackman is an American billionaire hedge fund manager who is the founder and chief executive officer of Pershing Square Capital Management, a hedge fund management company. His investment approach has made him an activist investor. As of June 2024, Ackman's net worth was estimated at $9.3 billion by Forbes.

Greenlight Capital is an American hedge fund founded in 1996 by David Einhorn. Greenlight invests primarily in publicly traded North American corporate debt offerings and equities. Greenlight is most notable for its short selling of Lehman stock prior to Lehman Brothers' collapse in 2008 and the $11 million fine they received in January 2012 for insider trading in the UK. Einhorn remains the fund's manager.

Farallon Capital Management, L.L.C. is an American multi-strategy hedge fund headquartered in San Francisco, California. Founded by Tom Steyer in 1986, the firm employs approximately 230 professionals in eight countries around the world.

Sculptor Capital Management is an American global diversified alternative asset management firm. They are one of the largest institutional alternative asset managers in the world.

SkyBridge Capital is a global investment firm based in New York City, United States. It is run by founder Anthony Scaramucci, Brett S. Messing, and Raymond Nolte.

Pershing Square Capital Management is an American hedge fund management company founded and run by Bill Ackman, headquartered in New York City.

Pierre Andurand is a French businessman and hedge fund manager. His funds have approximately $2bn in assets under management and have produced cumulative returns of between 900 to 1,300% for investors since 2008. He is also the majority shareholder of the international kickboxing league Glory.

Millennium Management is an investment management firm with a multistrategy hedge fund offering. It is one of the world's largest alternative asset management firms with over $67.9 billion assets under management as of August 2024. The firm operates in America, Europe and Asia. As of 2022, Millennium had posted the fourth highest net gains of any hedge fund since its inception in 1989.

Emmanuel Lemelson is an American-born Greek Orthodox priest, social commentator and hedge fund manager.

Jane Street Capital is a global proprietary trading firm. It employs more than 2600 people in six offices in New York, London, Hong Kong, Amsterdam, Chicago, and Singapore, and trades a broad range of asset classes on more than 200 venues in 45 countries.

John Christopher Armitage is a British-Irish billionaire hedge fund manager, the chief investment officer and a co-founder of Egerton Capital.

Melvin Capital Management LP was an American investment management firm based in New York City. It was founded in 2014 by Gabriel Plotkin, who named the firm after his late grandfather.

PAG is an Asian investment firm that manages multiple asset classes, including private equity, private debt, real estate and hedge funds. It is considered one of the largest private investment firms in Asia.

Tiger Global Management, LLC is an American investment firm founded by Chase Coleman III, a former Tiger Management employee under Julian Robertson, in March 2001. It mainly focuses on internet, software, consumer, and financial technology companies.