Madoff

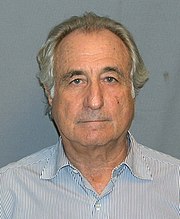

Swanson is the husband of Shana Madoff, who is daughter of Peter Madoff. She is also a niece of Bernard Madoff, who operated a Ponzi scheme that is considered to be the largest financial fraud in U.S. history. [7] [8] [9] She worked under her father at her uncle's firm, Bernard L. Madoff Investment Securities (BMIS), [8] [10] as a rules and compliance officer and attorney. [7] [11] [12] She reported to her father who was responsible for ensuring that BMIS complied with its legal and regulatory obligations, and signed documents assuring the SEC that BMIS's business records were truthful and accurate. [11] [13]

Swanson met Shana Madoff in April 2003. [7] [14] [15] The two met in 2003 at an industry event during an examination of Bernie Madoff by the SEC as to whether Bernie Madoff was front running customer orders, totally missing the multi-billion dollar Ponzi scheme that would be exposed in December 2008. The two had periodic contact thereafter in connection with Swanson speaking at industry events organized by a SIFMA committee on which Shana Madoff sat. During 2003 Swanson sent Shana's father Peter Madoff two regulatory requests, although by the time of the second request Swanson's responsibility for the examination had been transferred to a different Assistant Director at the SEC. [7] [16] [17] [18] [19] [20]

In March 2004, SEC lawyer Genevievette Walker-Lightfoot, who was reviewing Madoff's firm, raised questions to Swanson (Walker-Lightfoot's boss's supervisor) about unusual trading at a Bernie Madoff fund; Walker-Lightfoot was told to instead concentrate on an unrelated matter. [21] [22] Swanson and Walker-Lightfoot's boss asked for her research, but did not act upon it. [22]

In February 2006, Swanson was emailed by Assistant Director John Nee that the SEC's New York Regional Office was investigating a complaint that Bernard Madoff might be running "the biggest Ponzi scheme ever." [16] In April 2006, Swanson began to date Shana Madoff. Swanson reported the relationship to his supervisor who wrote in an email "I guess we won't be investigating Madoff anytime soon." [23]

In 2006, the SEC's New York Enforcement Office, of which Swanson was not a part, closed its investigation of Bernie Madoff. On 15 September 2006, Swanson left the SEC. [7] [24] On 8 December 2006, Swanson and Shana Madoff became engaged. [7] [25]

In 2009, after the scandal broke, SEC Inspector General H. David Kotz investigated, and concluded that there was no evidence that Swanson's romantic relationship with Shana Madoff influenced the closing of the SEC investigation of Madoff. [26] [27] [ failed verification ] He did conclude, however, that: "Swanson's communication with Shana during the period of time he was engaged in a cause examination of her uncle and father's firm, created the appearance of a potential conflict of interest." [23]

The September 29, 2007, wedding between Swanson and Shana Madoff was attended by Lori Richards, the SEC's Director of Compliance Investigations and Examinations, who oversaw the Division in which Swanson worked at the SEC. [15] [23] [28] [29] In 2008, Bernard Madoff spoke at a business roundtable meeting of his "very close" relationship with an SEC lawyer, and chuckled: "my niece even married one". [30] [31] In April 2009, Richards recused herself from the Madoff investigation. [28]