Related Research Articles

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The original Social Security Act was enacted in 1935, and the current version of the Act, as amended, encompasses several social welfare and social insurance programs.

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate.

A 529 plan, also called a Qualified Tuition Program, is a tax-advantaged investment vehicle in the United States designed to encourage saving for the future higher education expenses of a designated beneficiary. In 2017, K–12 public, private, and religious school tuition were included as qualified expenses for 529 plans along with post-secondary education costs after passage of the Tax Cuts and Jobs Act.

The Free Application for Federal Student Aid (FAFSA) is a form completed by current and prospective college students in the United States to determine their eligibility for student financial aid.

The Ontario Student Assistance Program (OSAP) (French: Régime d'aide financière aux étudiantes et étudiants de l'Ontario ) is a provincial financial aid program that offers grants and loans to help Ontario students pay for their post-secondary education. OSAP determines the amount of money that a student is eligible to receive by considering factors such as tuition, course load, and the financial resources of the student. More than 380,000 students – more than half of all full-time students –received student financial aid in 2014-15.

The Elementary and Secondary Education Act (ESEA) was passed by the 89th United States Congress and signed into law by President Lyndon B. Johnson on April 11, 1965. Part of Johnson's "War on Poverty", the act has been one of the most far-reaching pieces of federal legislation affecting education ever passed by the United States Congress, and was further emphasized and reinvented by its modern, revised No Child Left Behind Act.

A Pell Grant is a subsidy the U.S. federal government provides for students who need it to pay for college. Federal Pell Grants are limited to students with exceptional financial need, who have not earned their first bachelor's degree, or who are enrolled in certain post-baccalaureate programs, through participating institutions. Originally known as a Basic Educational Opportunity Grant, it was renamed in 1980 in honor of Democratic U.S. Senator Claiborne Pell of Rhode Island. A Pell Grant is generally considered the foundation of a student's financial aid package, to which other forms of aid are added. The Federal Pell Grant program is administered by the United States Department of Education, which determines the student's financial need and through it, the student's Pell eligibility. The U.S. Department of Education uses a standard formula to evaluate financial information reported on the Free Application for Federal Student Aid (FAFSA) for determining the student's Expected Family Contribution (EFC).

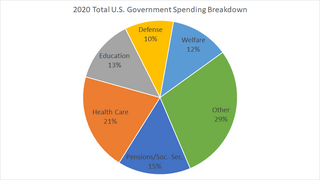

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. It has reported that large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels—from 98 percent of gross domestic product (GDP) in 2020 to 195 percent by 2050.

The United States government provides funding to hospitals that treat indigent patients through the Disproportionate Share Hospital (DSH) programs, under which facilities are able to receive at least partial compensation.

The United States federal budget is divided into three categories: mandatory spending, discretionary spending, and interest on debt. Also known as entitlement spending, in US fiscal policy, mandatory spending is government spending on certain programs that are required by law. Congress established mandatory programs under authorization laws. Congress legislates spending for mandatory programs outside of the annual appropriations bill process. Congress can only reduce the funding for programs by changing the authorization law itself. This normally requires a 60-vote majority in the Senate to pass. Discretionary spending on the other hand will not occur unless Congress acts each year to provide the funding through an appropriations bill.

Act 60, known as "The Equal Educational Opportunity Act", was a Vermont law enacted in June 1997 by the Vermont legislature intended to achieve a fair balance of educational spending across school districts, independent of the degree of prosperity within each district. The law was in response to a Vermont Supreme Court decision in the Brigham vs. State of Vermont case, wherein the court ruled that Vermont’s then existing educational funding system was unconstitutional, because it allowed students in towns with higher total property values to receive a higher level of education funding per pupil than students in towns with lower property values. Act 60 was followed by Acts 68 and 130, which addressed some imbalances caused by Act 60.

The Food, Conservation, and Energy Act of 2008 was a $288 billion, five-year agricultural policy bill that was passed into law by the United States Congress on June 18, 2008. The bill was a continuation of the 2002 Farm Bill. It continues the United States' long history of agricultural subsidies as well as pursuing areas such as energy, conservation, nutrition, and rural development. Some specific initiatives in the bill include increases in Food Stamp benefits, increased support for the production of cellulosic ethanol, and money for the research of pests, diseases and other agricultural problems.

The ability of the United States government to tax and spend in specific regions has large implications to economic activity and performance. Taxes are indexed to wages and profits and therefore areas of high taxation are correlated with areas of higher per capita income and more economic activity.

Income-based repayment or income-driven-repayment (IDR) is a student loan repayment program in the United States that regulates the amount that one needs to pay each month based on one's current income and family size.

The United States federal budget consists of mandatory expenditures, discretionary spending for defense, Cabinet departments and agencies, and interest payments on debt. This is currently over half of U.S. government spending, the remainder coming from state and local governments.

Public schools in the United States of America provide basic education from kindergarten until the twelfth grade. This is provided free of charge for the students and parents, but is paid for by taxes on property owners as well as general taxes collected by the federal government. This education is mandated by the states. With the completion of this basic schooling, one obtains a high school diploma as certification of basic skills for employers.

The Adoption Assistance and Child Welfare Act of 1980 (AACWA) was enacted by the US Government on June 17, 1980. Its purpose is to establish a program of adoption assistance; strengthen the program of foster care assistance for needy and dependent children; and improve the child welfare, social services, and aid to families with dependent children programs. This act amended titles IV-B and XX of the Social Security Act.

The Fourteenth Finance Commission of India was a finance commission constituted on 2 January 2013. The commission's chairman was former Reserve Bank of India governor Y. V. Reddy and its members were Sushma Nath, M. Govinda Rao, Abhijit Sen, Sudipto Mundle, and AN Jha. The recommendations of the commission entered force in April 2015; they take effect for a five-year period from that date.

Government spending in the United States is the spending of the federal government of the United States, and the spending of its state and local governments.

The Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act, is a $2.2 trillion economic stimulus bill passed by the 116th U.S. Congress and signed into law by President Donald Trump on March 27, 2020, in response to the economic fallout of the COVID-19 pandemic in the United States. The spending primarily includes $300 billion in one-time cash payments to individual people who submit a tax return in America, $260 billion in increased unemployment benefits, the creation of the Paycheck Protection Program that provides forgivable loans to small businesses with an initial $350 billion in funding, $500 billion in loans for corporations, and $339.8 billion to state and local governments.

References

- ↑ "Impact Aid, 1950, Federal Education Policy History website" . Retrieved 24 March 2011.

- ↑ "National Association of Federally Impacted Schools, History of Impact Aid Appropriations" . Retrieved 25 August 2011.

- ↑ 20 U.S.C. 7702

- ↑ "About Impact Aid" . Retrieved 21 December 2009.

- ↑ 20 U.S.C. 7703