The Federal Deposit Insurance Corporation (FDIC) is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was created by the Banking Act of 1933, enacted during the Great Depression to restore trust in the American banking system. More than one-third of banks failed in the years before the FDIC's creation, and bank runs were common. The insurance limit was initially US$2,500 per ownership category, and this was increased several times over the years. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to $250,000 per ownership category. FDIC insurance is backed by the full faith and credit of the government of the United States of America, and according to the FDIC, "since its start in 1933 no depositor has ever lost a penny of FDIC-insured funds."

A savings and loan association (S&L), or thrift institution, is a financial institution that specializes in accepting savings deposits and making mortgage and other loans. The terms "S&L" or "thrift" are mainly used in the United States; similar institutions in the United Kingdom, Ireland and some Commonwealth countries include building societies and trustee savings banks. They are often mutually held, meaning that the depositors and borrowers are members with voting rights, and have the ability to direct the financial and managerial goals of the organization like the members of a credit union or the policyholders of a mutual insurance company. While it is possible for an S&L to be a joint-stock company, and even publicly traded, in such instances it is no longer truly a mutual association, and depositors and borrowers no longer have membership rights and managerial control. By law, thrifts can have no more than 20 percent of their lending in commercial loans—their focus on mortgage and consumer loans makes them particularly vulnerable to housing downturns such as the deep one the U.S. experienced in 2007.

The savings and loan crisis of the 1980s and 1990s was the failure of 32% savings and loan associations (S&Ls) in the United States from 1986 to 1995. An S&L or "thrift" is a financial institution that accepts savings deposits and makes mortgage, car and other personal loans to individual members.

The Federal Home Loan Banks are 11 U.S. government-sponsored banks that provide liquidity to the members of financial institutions to support housing finance and community investment.

The Federal Home Loan Bank Board (FHLBB) was a board created in 1932 that governed the Federal Home Loan Banks also created by the act, the Federal Savings and Loan Insurance Corporation (FSLIC) and nationally-chartered thrifts. It was abolished and superseded by the Federal Housing Finance Board and the Office of Thrift Supervision in 1989 due to the savings and loan crisis of the 1980s, as Federal Home Loan Banks gave favorable lending to the thrifts it regulated leading to regulatory capture.

The Resolution Trust Corporation (RTC) was a U.S. government-owned asset management company run by Lewis William Seidman and charged with liquidating assets, primarily real estate-related assets such as mortgage loans, that had been assets of savings and loan associations (S&Ls) declared insolvent by the Office of Thrift Supervision (OTS) as a consequence of the savings and loan crisis of the 1980s. It also took over the insurance functions of the former Federal Home Loan Bank Board (FHLBB).

An industrial loan company (ILC) or industrial bank is a financial institution in the United States that lends money, and may be owned by non-financial institutions. They provide niche financial services nationwide. ILCs offer FDIC-insured deposits and are subject to FDIC and state regulator oversight. All "FDIC-insured entities are subject to Sections 23A and 23B of the Federal Reserve Act, which limits bank transactions with affiliates, including the non-bank parent company." ILCs are permitted to have branches in multiple states. They are regulated and supervised by state-charters and insured by the Federal Deposit Insurance Corporation. They are authorized to make consumer and commercial loans and accept federally insured deposits. Banks may not accept demand deposits if the bank has total assets greater than $100 million. ILCs are exempted from the Bank Holding Company Act.

The Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA), is a United States federal law enacted in the wake of the savings and loan crisis of the 1980s.

The Federal Deposit Insurance Reform Act of 2005, was an act of the United States Congress on banking regulation. It contained a number of changes to the Federal Deposit Insurance Corporation (FDIC).

The early 1980s recession was a severe economic recession that affected much of the world between approximately the start of 1980 and 1983. It is widely considered to have been the most severe recession since World War II. A key event leading to the recession was the 1979 energy crisis, mostly caused by the Iranian Revolution which caused a disruption to the global oil supply, which saw oil prices rising sharply in 1979 and early 1980. The sharp rise in oil prices pushed the already high rates of inflation in several major advanced countries to new double-digit highs, with countries such as the United States, Canada, West Germany, Italy, the United Kingdom and Japan tightening their monetary policies by increasing interest rates in order to control the inflation. These G7 countries each, in fact, had "double-dip" recessions involving short declines in economic output in parts of 1980 followed by a short period of expansion, in turn, followed by a steeper, longer period of economic contraction starting sometime in 1981 and ending in the last half of 1982 or in early 1983. Most of these countries experienced stagflation, a situation of both high inflation rates and high unemployment rates.

The Federal Deposit Insurance Corporation Improvement Act of 1991, passed during the savings and loan crisis in the United States, strengthened the power of the Federal Deposit Insurance Corporation.

All regulated financial institutions in the United States are required to file periodic financial and other information with their respective regulators and other parties. For banks in the U.S., one of the key reports required to be filed is the quarterly Consolidated Report of Condition and Income, generally referred to as the call report or RC report. Specifically, every National Bank, State Member Bank and insured Nonmember Bank is required by the Federal Financial Institutions Examination Council (FFIEC) to file a call report as of the close of business on the last day of each calendar quarter, i.e. the report date. The specific reporting requirements depend upon the size of the bank and whether or not it has any foreign offices. Call reports are due no later than 30 days after the end of each calendar quarter. Revisions may be made without prejudice up to 30 days after the initial filing period. Form FFIEC 031 is used for banks with both domestic (U.S.) and foreign (non-U.S.) offices; Forms FFIEC 041 and 051 is for banks with domestic (U.S.) offices only.

The Korea Deposit Insurance Corporation (KDIC) is a deposit insurance corporation, established in 1996 in South Korea to protect depositors and maintain the stability of the financial system. The main functions of KDIC are insurance management, risk surveillance, resolution, recovery, and investigation.

The Federal Housing Finance Board (FHFB) was an independent agency of the United States government established in 1989 in the aftermath of the savings and loan crisis to take over management of the Federal Home Loan Banks from the Federal Home Loan Bank Board (FHLBB), and was superseded by the Federal Housing Finance Agency (FHFA) in 2008.

A bank failure occurs when a bank is unable to meet its obligations to its depositors or other creditors because it has become insolvent or too illiquid to meet its liabilities. A bank usually fails economically when the market value of its assets declines to a value that is less than the market value of its liabilities. The insolvent bank either borrows from other solvent banks or sells its assets at a lower price than its market value to generate liquid money to pay its depositors on demand. The inability of the solvent banks to lend liquid money to the insolvent bank creates a bank panic among the depositors as more depositors try to take out cash deposits from the bank. As such, the bank is unable to fulfill the demands of all of its depositors on time. A bank may be taken over by the regulating government agency if its shareholders' equity are below the regulatory minimum.

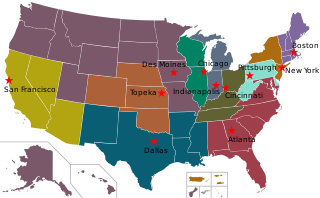

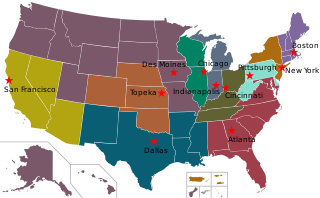

Bank regulation in the United States is highly fragmented compared with other G10 countries, where most countries have only one bank regulator. In the U.S., banking is regulated at both the federal and state level. Depending on the type of charter a banking organization has and on its organizational structure, it may be subject to numerous federal and state banking regulations. Apart from the bank regulatory agencies the U.S. maintains separate securities, commodities, and insurance regulatory agencies at the federal and state level, unlike Japan and the United Kingdom. Bank examiners are generally employed to supervise banks and to ensure compliance with regulations.

Benj. Franklin Savings and Loan was a thrift based in Portland, in the U.S. state of Oregon. Founded in 1925, the company was seized by the United States Government in 1990. In 1996 the United States Supreme Court found that this and similar seizures were based on an unconstitutional provision of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA). Shareholders of the thrift sued the federal government for damages caused by the seizure, with the shareholders winning several rounds in the courts. In 2013, $9.5 million was allocated for disbursement to shareholders.

The New York State Banking Department was created by the New York Legislature on April 15, 1851, with a chief officer to be known as the Superintendent. The New York State Banking Department was the oldest bank regulatory agency in the United States.

This article details the history of banking in the United States. Banking in the United States is regulated by both the federal and state governments.

The Financing Corporation (FICO) was a federally established mixed-ownership corporation that assumed all the assets and liabilities of the insolvent Federal Savings and Loan Insurance Corporation (FSLIC) and operated as a financing vehicle for the FSLIC Resolution Fund after the former was abolished by the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA).