Related Research Articles

Railway Mania was an instance of a stock market bubble in the United Kingdom of Great Britain and Ireland in the 1840s. It followed a common pattern: as the price of railway shares increased, speculators invested more money, which further increased the price of railway shares, until the share price collapsed. The mania reached its zenith in 1846, when 263 Acts of Parliament setting up new railway companies were passed, with the proposed routes totalling 9,500 miles (15,300 km). About a third of the railways authorised were never built—the companies either collapsed due to poor financial planning, were bought out by larger competitors before they could build their line, or turned out to be fraudulent enterprises to channel investors' money into other businesses.

The Carlyle Group is an American multinational private equity, alternative asset management and financial services corporation. It specializes in private equity, real assets, and private credit. In 2015, Carlyle was the world's largest private equity firm by capital raised over the previous five years, according to the PEI 300 index, though by 2020 it had slipped into second place.

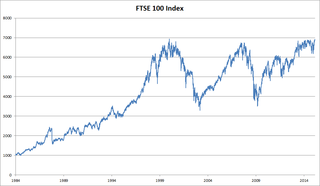

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie", is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalisation. The index is maintained by the FTSE Group, a subsidiary of the London Stock Exchange Group.

Bendigo and Adelaide Bank is an Australian financial institution, operating primarily in retail banking. The company was formed by the merger of Bendigo Bank and Adelaide Bank in November 2007.

HIH Insurance was Australia's second-largest insurance company before it was placed into provisional liquidation on 15 March 2001. The demise of HIH is considered to be the largest corporate collapse in Australia's history, with liquidators estimating that HIH's losses totalled up to A$5.3 billion. Investigations into the cause of the collapse have led to conviction and imprisonment of a handful of members of HIH management on various charges relating to fraud.

Blackstone Inc. is an American alternative investment management company based in New York City. In 2019, Blackstone converted from a publicly traded partnership into a C-type corporation. Blackstone's private equity business has been one of the largest investors in leveraged buyouts in the last three decades, while its real estate business has actively acquired commercial real estate. As of 2021, the company's total assets under management were approximately US$880 billion.

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The company's main business areas before its failure were capital markets, investment banking, wealth management, and global clearing services, and it was heavily involved in the subprime mortgage crisis.

МММ was a Russian company that perpetrated one of the world's largest Ponzi schemes of all time, in the 1990s. By different estimates from 5 to 10 million people lost their savings. According to contemporary Western press reports, most investors were aware of the fraudulent nature of the scheme, but still hoped to profit from it by withdrawing money before it collapsed.

An institutional investor is an entity which pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked companies, insurers, pension funds, sovereign wealth funds, charities, hedge funds, REITs, investment advisors, endowments, and mutual funds. Operating companies which invest excess capital in these types of assets may also be included in the term. Activist institutional investors may also influence corporate governance by exercising voting rights in their investments. In 2019, the world's top 500 asset managers collectively managed $104.4 trillion in Assets under Management (AuM).

The Motley Fool is a private financial and investing advice company based in Alexandria, Virginia. It was founded in July 1993 by co-chairmen and brothers David Gardner and Tom Gardner, and Erik Rydholm, who has since left the company. The company employs over 300 people worldwide.

Moody's Investors Service, often referred to as Moody's, is the bond credit rating business of Moody's Corporation, representing the company's traditional line of business and its historical name. Moody's Investors Service provides international financial research on bonds issued by commercial and government entities. Moody's, along with Standard & Poor's and Fitch Group, is considered one of the Big Three credit rating agencies. It is also included in the Fortune 500 list of 2021.

Bain Capital is an American private investment firm based in Boston, Massachusetts. It specializes in private equity, venture capital, credit, public equity, impact investing, life sciences, and real estate. Bain Capital invests across a range of industry sectors and geographic regions. As of 2022, the firm managed more than $155 billion of investor capital. The firm was founded in 1984 by partners from the consulting firm Bain & Company. The company is headquartered at 200 Clarendon Street in Boston, Massachusetts, with 22 offices in North America, Europe, Asia, and Australia.

Carillion plc was a British multinational construction and facilities management services company headquartered in Wolverhampton in the United Kingdom, prior to its liquidation – officially, "the largest ever trading liquidation in the UK" – which began in January 2018.

Rosauers Supermarkets, Inc. is a regional chain of supermarkets in the Western United States, based in Spokane, Washington. Founded in 1934 by J. Merton Rosauer, Rosauers was sold in 1984 to Spokane-based URM Stores, and it eventually grew to 22 stores under the Huckleberry's Natural Market, Rosauers, and Super 1 Foods brands. Its stores are located in Washington, Idaho, Montana, and Oregon.

Thomas Cook Group plc was a global travel group, headquartered in the United Kingdom and listed on the London Stock Exchange from its formation on 19 June 2007 by the merger of Thomas Cook AG — successor to Thomas Cook & Son — and MyTravel Group until 23 September 2019 when it went into compulsory liquidation. The group operated as a tour operator and airline, and also operated travel agencies in Europe. At the time of the group's collapse, approximately 21,000 worldwide employees were left without jobs and 600,000 customers were left abroad, triggering the UK's largest peacetime repatriation.

Apollo Global Management, Inc. is an American global alternative investment management firm. It invests in credit, private equity, and real assets. As of December 31, 2020, the company had $455.5 billion of assets under management, including $328.6 billion invested in credit, including mezzanine capital, hedge funds, non-performing loans and collateralized loan obligations, $80.7 billion invested in private equity, and $46.2 billion invested in real assets, which includes real estate and infrastructure. The company invests money on behalf of pension funds, financial endowments and sovereign wealth funds, as well as other institutional and individual investors. Since inception in 1990, private equity funds managed by Apollo have produced a 24% internal rate of return (IRR) to investors, net of fees.

Storm Financial Limited was a financial advice company, based in Townsville, Queensland, Australia. The company was founded by Emmanuel Cassimatis and his wife Julie Cassimatis as a private company initially with the name Cassimatis Securities Pty Ltd on 23 May 1994. As part of the company's expansion outside of Townsville the company changed its name from a personality based name to ozdaq Securities Pty Ltd on 10 April 2000. This name remained intact until 1 February 2004 when it was relinquished consequent to trademark objections from the NASDAQ stock exchange in the United States. The company then traded as Storm Financial Pty Ltd from 2 February 2004 until 14 June 2007 at which time the company became an unlisted public company and continued trading as Storm Financial Ltd from 15 June 2007 in preparation for making an initial public offering (IPO) in December 2007. This IPO was subject to a Storm Financial Prospectus which was dated 14 November 2007 and lodged with the Australian Securities & Investments Commission (ASIC) on the same date. Storm Financial Ltd continued to trade until external administrator Worrells Solvency and Forensic Accountants were appointed on 9 January 2009. The main creditor Commonwealth Bank appointed receivers and manager KordaMentha on 15 January 2009.

Michael James Burry is an American investor, hedge fund manager, and physician. He founded the hedge fund Scion Capital, which he ran from 2000 until 2008, before closing it to focus on his personal investments. He is best known for being amongst the first investors to predict and profit from the subprime mortgage crisis that occurred between 2007 and 2010.

Dawnus was a British construction company. Established in 2001 the company grew rapidly in the early 2000s but collapsed into administration in 2019. The company had operations in the United Kingdom and West Africa.

References

- ↑ Gosnell, Peter (26 December 2007). "Corporate collapses burn investors". Perth Now. Retrieved 8 March 2019.

- ↑ "Investors launch class action on Fincorp collapse". ABC News. 3 December 2008. Retrieved 8 March 2019.