Related Research Articles

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Futures are secured by physical assets. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

Normal backwardation, also sometimes called backwardation, is the market condition wherein the price of a commodities' forward or futures contract is trading below the expected spot price at contract maturity. The resulting futures or forward curve would typically be downward sloping, since contracts for further dates would typically trade at even lower prices. In practice, the expected future spot price is unknown, and the term "backwardation" may refer to "positive basis", which occurs when the current spot price exceeds the price of the future.

Contango is a situation where the futures price of a commodity is higher than the expected spot price of the contract at maturity. In a contango situation, arbitrageurs or speculators are "willing to pay more [now] for a commodity [to be received] at some point in the future than the actual expected price of the commodity [at that future point]. This may be due to people's desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carry costs of buying the commodity today." On the other side of the trade, hedgers are happy to sell futures contracts and accept the higher-than-expected returns. A contango market is also known as a normal market, or carrying-cost market.

Speculation is the purchase of an asset with the hope that it will become more valuable in the near future. In finance, speculation is also the practice of engaging in risky financial transactions in an attempt to profit from short term fluctuations in the market value of a tradable financial instrument—rather than attempting to profit from the underlying financial attributes embodied in the instrument such as value addition, return on investment, or dividends.

In finance, a futures contract is a standardized legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price the parties agree to buy and sell the asset for is known as the forward price. The specified time in the future—which is when delivery and payment occur—is known as the delivery date. Because it is a function of an underlying asset, a futures contract is a derivative product.

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provides physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn commissions and revenue acting as brokers or market makers. For-profit futures exchanges earn most of their revenue from trading and clearing fees.

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts.

A carbon credit is a generic term for any tradable certificate or permit representing the right to emit one tonne of carbon dioxide or the equivalent amount of a different greenhouse gas (tCO2e).

Renewable Energy Certificates (RECs), also known as Green tags, Renewable Energy Credits, Renewable Electricity Certificates, or Tradable Renewable Certificates (TRCs), are tradable, non-tangible energy commodities in the United States that represent proof that 1 megawatt-hour (MWh) of electricity was generated from an eligible renewable energy resource and was fed into the shared system of power lines which transport energy. Solar renewable energy certificates (SRECs) are RECs that are specifically generated by solar energy. The updated Greenhouse Gas Protocol Scope 2 Guidance guarantees of origin, RECs and I-RECs as mainstream instruments for documenting and tracking electricity consumed from renewable sources.

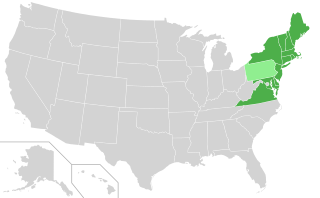

The Regional Greenhouse Gas Initiative (RGGI, pronounced "Reggie") is the first mandatory market based program in the United States to reduce greenhouse gas emissions. RGGI is a cooperative effort among the states of Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, Vermont, and Virginia to cap and reduce carbon dioxide (CO2) emissions from the power sector. RGGI compliance obligations apply to fossil-fueled power plants 25MW and larger within the ten-state region. As of 2020, Pennsylvania is pending RGGI membership with an anticipated start in early 2022.

Financial incentives for photovoltaics are incentives offered to electricity consumers to install and operate solar-electric generating systems, also known as photovoltaics (PV).

Solar power in New Jersey has grown significantly, increasing from less than 50 megawatts (MW) in 2007 to over 2,800 MW in 2018, such that solar power provided 4.17% of the state's electricity consumption. This is aided by a Renewable Portfolio Standard which requires that 22.5% of New Jersey's electricity come from renewable resources by 2021, and by one of the most favorable net metering standards in the country, along with Arizona, allowing unlimited customers of any size array to use net metering, although generation may not exceed annual demand. Best practices recommend limiting net metering only to the size of the customer’s service entrance capacity. As of 2018, New Jersey has the sixth-largest installed solar capacity of all U.S. states and the largest installed solar capacity of the Northeastern States.

Solar Renewable Energy Certificates (SRECs) or Solar Renewable Energy Credits are a form of Renewable Energy Certificate or "Green tag" existing in the United States of America. SRECs exist in states that have Renewable Portfolio Standard (RPS) legislation with specific requirements for solar energy, usually referred to as a "solar carve-out". The additional income received from selling SRECs increases the economic value of a solar investment and assists with the financing of solar technology. In conjunction with state and federal incentives, solar system owners can recover their investment in solar by selling their SRECs through spot market sales or long-term sales, both described below.

Element Markets, LLC is a limited liability company that provides environmental asset management and compliance services to institutional clients in North America. Its services span the greenhouse gas, emissions, and renewable energy credit markets. Element Markets also develops renewable energy and greenhouse gas emission reduction projects. Element Markets was founded in 2005 and is headquartered in Houston, Texas.

Iran Mercantile Exchange (IME) is a commodities exchange located in Tehran, Iran.

Danske Commodities (DC) is an energy trading house. The company is an international trader of energy-related commodities such as electric power, gas and climate market products with activities in 39 countries.

Solar power in Georgia on rooftops can provide 31% of all electricity used in Georgia.

Solar power in Maryland is supported by the state's legislation regarding the Renewable Portfolio Standard and Solar Renewable Energy Credit (SREC) program. The target for renewable energy as of 2017 is 20% by 2020, including 2% from solar power.

Solar power in Pennsylvania currently provides less than 1% of the state's electricity, but there are many policies in place to regulate and incentivize its use. Pennsylvania mandates the use of solar power through a renewable portfolio standard, which requires a percentage of electricity from each providers to come from solar, and net metering, which compensates small-scale solar generation through net metering. By 2021, Pennsylvania is required to have 0.5% of its electricity from solar. Solar power could theoretically provide over 30% of the state's electricity, but growth in solar generation has slowed due to a reduction in solar grants and the low price of solar energy credits.

Belarusian Universal Commodity Exchange (BUCE) is the only commodity exchange in the Republic of Belarus and one of the largest in Eastern Europe. The BUCE is an open joint-stock company with the controlling stake (98%) owned by the government.

References

- ↑ Gronewold, Nathanial (25 August 2011). "Solar Industry's Boom in N.J. Casts Shadow Over Program That Spurred It". New York Times. Retrieved 15 February 2013.

- ↑ "NFA Case Summary". National Futures Association. Retrieved 21 January 2019.

- ↑ "Flett Exchange". Carbon TradeEx America. Retrieved 15 February 2013.

- ↑ Lori Bird; Jenny Heeter; Claire Kreycik. "Solar Renewable Energy Certificate (SREC) Markets: Status and Trends" (PDF). National Renewable Energy Laboratory. p. 30. Retrieved 15 February 2013.

- ↑ Michel, Fred. "Incentives for PV Electric Systems in Ohio - Solar Renewable Energy Credits (SRECs)" (PDF). The Ohio State University-OARDC. Retrieved 15 February 2013.

- ↑ "How do I sell RECs?". PJM Environmental Information Services. Retrieved 15 February 2013.

- ↑ Marlowe, Craig. "Unleashing Consumer Energy Savings: A Mass-Deployment Strategy for Solar Water Heating in Prince George's County" (PDF). Prince George’s County Solar Water Heating Task Force. p. 42. Retrieved 15 February 2013.

- ↑ "e SREC Based Financing Program - Program Guide" (PDF). NERA Economic Consulting. Retrieved 25 April 2013.

- ↑ "Flett Exchange Public-Auctions". Flett Exchange. Retrieved 15 February 2013.

- ↑ "2012 Executive Municipal Budget" (PDF). The Town of Morristown. p. 42. Retrieved 25 April 2013.

- ↑ "Long-Term SREC Contracts". Flett Exchange. Retrieved 15 February 2013.

- ↑ Bird, Lori. "Green Power Marketing in the United States: A Status Report (2009 Data)" (PDF). National Renewable Energy Laboratory. p. 36. Retrieved 15 February 2013.

- ↑ Williams, Glenn (24 October 2011). "Solar Energy Credits Point to a Slowdown". TheStreet.com. Retrieved 15 February 2013.

- ↑ "Summary Information as of September 17, 2007, on Exempt Commercial Markets That Have Filed a Notification under section 2(h)(3)-(5) of CEA" (PDF). US Commodity Futures Trading Commission. Retrieved 25 April 2013.

- ↑ "President's Budget and Performance Plan FY 2012" (PDF). U.S. Commodity Futures Trading Commission. Retrieved 25 April 2013.

- ↑ "Flett Exchange Launches Regional Greenhouse Gas Initiative (RGGI) Allowance Market". 7 October 2008. Retrieved 25 April 2013.

- ↑ "Regional Greenhouse Gas Initiative (RGGI)". Flett Exchange. Retrieved 25 April 2013.