Related Research Articles

Rabobank is a Dutch multinational banking and financial services company headquartered in Utrecht, Netherlands. The group comprises 89 local Dutch Rabobanks (2019), a central organisation, and many specialised international offices and subsidiaries. Food and agribusiness constitute the primary international focus of the Rabobank Group. Rabobank is the second-largest bank in the Netherlands in terms of total assets.

BNP Paribas is an French multinational universal bank and financial services holding company. It was founded in 2000 from the merger of Banque Nationale de Paris and Paribas, formerly known as the Banque de Paris et des Pays-Bas. With 190,000 employees, the bank is organized into three major business areas: Commercial, Personal Banking & Services (CPBS), Investment & Protection Services (IPS) and Corporate & Institutional Banking (CIB).

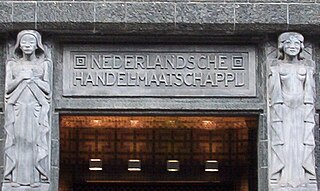

The Netherlands Trading Society was a Dutch trading and financial company, established in 1824, in The Hague by King William I to promote and develop trade, shipping and agriculture. For the next 140 years the NHM developed a large international branch network and increasingly engaged in banking operations. In 1964, it merged with Twentsche Bank to form Algemene Bank Nederland, itself a predecessor of ABN AMRO.

Artesia is the historical Latin and Spanish name of Artois in northern France. The name ultimately derived from the Belgic tribe the Atrebates. The county gave its name to Artesian wells, which were drilled there since the 12th century.

Fortis, formally Fortis N.V./S.A., was a Benelux-centered global financial services group active in insurance, banking and investment management, initially formed in 1990 by a three-way Belgian-Dutch merger and headquartered in Brussels. It grew rapidly through multiple acquisitions, and in 2007 was the 20th largest financial services business in the world by revenue. It was listed on the Euronext Brussels, Euronext Amsterdam, and Luxembourg stock exchanges.

BNP Paribas Fortis is an international bank based in Belgium and is a subsidiary of BNP Paribas. It was formerly, together with Fortis Bank Nederland, the banking arm of the financial institution Fortis. After the ultimately unsuccessful ABN-AMRO takeover, the subprime crisis and management mistakes led to the sale of the Dutch and Luxembourg parts of the banking branch to the Dutch and Luxembourg governments. Fortis Bank itself was first partly bought by the Belgian government, then fully purchased by the government and sold to BNP Paribas.

Erasmus University Rotterdam is a public research university located in Rotterdam, Netherlands. The university is named after Desiderius Erasmus Roterodamus, a 15th-century humanist and theologian.

GE Commercial Finance was a unit of GE Capital,. Headquartered in Norwalk, Connecticut, United States, it plays a role in over 35 countries and had assets of over US$335 billion at year end 2007.

S. G. Warburg & Co. was a London-based investment bank. It was listed on the London Stock Exchange and was once a constituent of the FTSE 100 Index. The firm was acquired by the Swiss Bank Corporation in 1995 and ultimately became a part of UBS.

BMCI is a bank based in Morocco. It is a majority-owned subsidiary of the French financial group BNP Paribas.

The Banque de Paris et des Pays-Bas, generally referred to from 1982 as Paribas, was a French investment bank based in Paris. In May 2000, it merged with the Banque Nationale de Paris to form BNP Paribas.

Nedlloyd was a Dutch shipping company, formed in 1970 as the result of a merger of several shipping lines:

The AMsterdamsche en ROtterdamsche Bank was a major Dutch bank that was created in 1964 by the merger of the Amsterdamsche Bank and the Rotterdamsche Bank. In 1991, it merged with Algemene Bank Nederland (ABN) to form ABN AMRO.

Belfius Bank and Insurance, known as Dexia Bank Belgium up until 1 March 2012, is a for-profit PLC founded to meet local authority needs. Belfius emerged from the dismantling of the Dexia group, of which it was part until 10 October 2011, when it was purchased by the Belgian State for 4 billion euros. The company's headquarters are in Brussels.

The Comptoir national d'escompte de Paris (CNEP), from 1854 to 1889 Comptoir d'escompte de Paris (CEP), was a major French bank active from 1848 to 1966.

The Banque nationale pour le commerce et l'industrie was a major French bank, active from 1932 to 1966 when it merged with Comptoir national d'escompte de Paris to form Banque Nationale de Paris (BNP). It was itself the successor of the Comptoir d'Escompte de Mulhouse, a bank founded in 1848 under the Second French Republic that had become German following the Franco-Prussian War, and its French subsidiary formed in 1913, the Banque Nationale de Crédit.

The Banque de l'Union Parisienne (BUP) was a French investment bank, created in 1904 and merged into Crédit du Nord in 1973.

The Banque Worms was a merchant bank founded by Hypolite Worms in 1928 as a division of Worms & Cie. The banking services division provided financing services to other branches of Worms & Cie, which were involved in ship building, shipping and the coal trade. During World War II (1939–45), Worms & Cie was placed under German supervision, and was subject to intense scrutiny after the war on suspicions of collaboration. The banking services division was spun off as the independent Banque Worms et Cie in 1964. The bank was nationalized in 1982 by the socialist government of François Mitterrand. The bank engaged in risky real estate investments, and lost most of its value. After being re-privatized, it was owned in turn by two insurance groups, then was acquired by Deutsche Bank. The bank was wound down in 2004.

References

- ↑ "Bloomberg Business Week article". Investing.businessweek.com. 2001-07-03. Archived from the original on October 12, 2012. Retrieved 2012-12-18.

- ↑ Finance. "Telegraph newspaper article on GE acquisition of Artesia". Telegraph.co.uk. Retrieved 2012-12-18.

- ↑ Fd. "Handelsbank GE Artesia stopt ermee". fd.nl. Retrieved 2015-03-04.