Related Research Articles

A fuel tax is an excise tax imposed on the sale of fuel. In most countries the fuel tax is imposed on fuels which are intended for transportation. Fuel tax receipts are often dedicated or hypothecated to transportation projects, in which case the fuel tax can be considered a user fee. In other countries, the fuel tax is a source of general revenue. Sometimes, a fuel tax is used as an ecotax, to promote ecological sustainability. Fuel taxes are often considered by government agencies such as the Internal Revenue Service as regressive taxes.

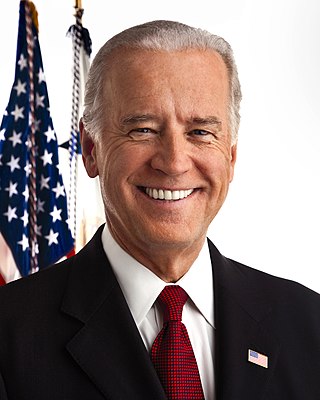

The 2008 United States presidential election was the 56th quadrennial presidential election, held on November 4, 2008. The Democratic ticket of Barack Obama, the junior senator from Illinois, and Joe Biden, the senior senator from Delaware, defeated the Republican ticket of John McCain, the senior senator from Arizona, and Sarah Palin, the governor of Alaska. Obama became the first African American to be elected to the presidency, as well as being only the third sitting United States senator elected president, joining Warren G. Harding and John F. Kennedy. Meanwhile, this was only the second successful all-senator ticket since the 1960 election and is the only election where both major party nominees were sitting senators. This was the first election since 1952 in which neither the incumbent president nor vice president was on the ballot.

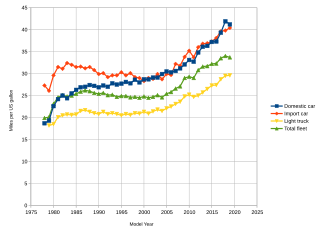

Corporate average fuel economy (CAFE) standards are regulations in the United States, first enacted by the United States Congress in 1975, after the 1973–74 Arab Oil Embargo, to improve the average fuel economy of cars and light trucks produced for sale in the United States. More recently, efficiency standards were developed and implemented for heavy-duty pickup trucks and commercial medium-duty and heavy-duty vehicles.

The 2008 Democratic National Convention was a quadrennial presidential nominating convention of the Democratic Party where it adopted its national platform and officially nominated its candidates for president and vice president. The convention was held in Denver, Colorado, from August 25 to 28, 2008, at the Pepsi Center. Senator Barack Obama from Illinois gave his acceptance speech on August 28 at Invesco Field in what the party called an "Open Convention". Denver last hosted the Democratic National Convention in 1908. Obama became the party's first nonwhite nominee, and nominee of African descent, for president. Senator Joe Biden from Delaware was nominated for vice president.

The Energy Policy Act of 2005 is a federal law signed by President George W. Bush on August 8, 2005, at Sandia National Laboratories in Albuquerque, New Mexico. The act, described by proponents as an attempt to combat growing energy problems, changed US energy policy by providing tax incentives and loan guarantees for energy production of various types. The most consequential aspect of the law was to greatly increase ethanol production to be blended with gasoline. The law also repealed the Public Utility Holding Company Act of 1935, effective February 2006.

The question of whether to drill for oil in the Arctic National Wildlife Refuge (ANWR) has been an ongoing political controversy in the United States since 1977. As of 2017, Republicans have attempted to allow drilling in ANWR almost fifty times, finally being successful with the passage of the Tax Cuts and Jobs Act of 2017.

The following is a timeline of major events leading up to and immediately following the United States presidential election of 2008. The election was the 56th quadrennial United States presidential election. It was held on November 4, 2008, but its significant events and background date back to about 2002. The Democratic Party nominee, Senator Barack Obama of Illinois, defeated the Republican Party's nominee, Senator John McCain of Arizona.

The usage and pricing of gasoline results from factors such as crude oil prices, processing and distribution costs, local demand, the strength of local currencies, local taxation, and the availability of local sources of gasoline (supply). Since fuels are traded worldwide, the trade prices are similar. The price paid by consumers largely reflects national pricing policy. Most countries impose taxes on gasoline (petrol), which causes air pollution and climate change; whereas a few, such as Venezuela, subsidize the cost. Some country's taxes do not cover all the negative externalities, that is they do not make the polluter pay the full cost. Western countries have among the highest usage rates per person. The largest consumer is the United States.

The Energy Independence and Security Act of 2007, originally named the Clean Energy Act of 2007, is an Act of Congress concerning the energy policy of the United States. As part of the Democratic Party's 100-Hour Plan during the 110th Congress, it was introduced in the United States House of Representatives by Representative Nick Rahall of West Virginia, along with 198 cosponsors. Even though Rahall was 1 of only 4 Democrats to oppose the final bill, it passed in the House without amendment in January 2007. When the Act was introduced in the Senate in June 2007, it was combined with Senate Bill S. 1419: Renewable Fuels, Consumer Protection, and Energy Efficiency Act of 2007. This amended version passed the Senate on June 21, 2007. After further amendments and negotiation between the House and Senate, a revised bill passed both houses on December 18, 2007 and President Bush, a Republican, signed it into law on December 19, 2007, in response to his "Twenty in Ten" challenge to reduce gasoline consumption by 20% in 10 years.

The Highway Trust Fund is a transportation fund in the United States which receives money from a federal fuel tax of 18.4 cents per gallon on gasoline and 24.4 cents per gallon of diesel fuel and related excise taxes. It currently has two accounts, the Highway Account funding road construction and other surface transportation projects, and a smaller Mass Transit Account supporting mass transit. Separate from the Highway Trust Fund is the Leaking Underground Storage Tank Trust Fund, which receives an additional 0.1 cents per gallon on gasoline and diesel, making the total amount of tax collected 18.5 cents per gallon on gasoline and 24.5 cents per gallon on diesel fuel. The Highway Trust Fund was established in 1956 to finance the United States Interstate Highway System and certain other roads. The Mass Transit Account was created in 1982. The federal tax on motor fuels yielded $28.2 billion in 2006.

Joe Biden, a longtime U.S. senator from Delaware, began his 2008 presidential campaign when he announced his candidacy for President of the United States on the January 7, 2007, edition of Meet the Press. He officially became a candidate on January 31, 2007, after filing papers with the Federal Election Commission.

This article lists potential candidates for the Democratic nomination for Vice President of the United States in the 2008 presidential election. After Illinois Senator Barack Obama became the Democratic Party's presumptive presidential nominee on June 3, 2008, Obama formed a small committee, made up of James A. Johnson, Eric Holder and Caroline Kennedy, to help him select a running mate. Veteran Democratic lawyer and advisor James "Jim" Hamilton, of the firm Morgan, Lewis & Bockius, later replaced Johnson in vetting candidates.

The United States federal excise tax on gasoline is 18.4 cents per gallon and 24.4 cents per gallon for diesel fuel. Proceeds from the tax partly support the Highway Trust Fund. The federal tax was last raised on October 1, 1993, and is not indexed to inflation, which increased 93% from 1993 until 2022. On average, as of April 2019, state and local taxes and fees add 34.24 cents to gasoline and 35.89 cents to diesel, for a total US volume-weighted average fuel tax of 52.64 cents per gallon for gas and 60.29 cents per gallon for diesel.

Barack Obama, then junior United States senator from Illinois, announced his candidacy for President of the United States on February 10, 2007, in Springfield, Illinois. After winning a majority of delegates in the Democratic primaries of 2008, on August 23, leading up to the convention, the campaign announced that Senator Joe Biden of Delaware would be the vice presidential nominee. At the 2008 Democratic National Convention on August 27, Barack Obama was formally selected as the Democratic Party nominee for President of the United States in 2008. He was the first African American in history to be nominated on a major party ticket.

New Energy for America was a plan led by Barack Obama and Joe Biden beginning in 2008 to invest in renewable energy sources, reduce reliance on foreign oil, address global warming issues, and create jobs for Americans. The main objective of the New Energy for America plan was to implement clean energy sources in the United States to switch from nonrenewable resources to renewable resources. The plan led by the Obama Administration aimed to implement short-term solutions to provide immediate relief from pain at the pump, and mid- to- long-term solutions to provide a New Energy for America plan. The goals of the clean energy plan hoped to: invest in renewable technologies that will boost domestic manufacturing and increase homegrown energy, invest in training for workers of clean technologies, strengthen the middle class, and help the economy.

The Oklahoma state elections were held on November 4, 2008. Votes for the Presidential Primary were cast on February 5. The primary election for statewide offices was held on July 29, and the runoff primary election was held August 26.

The No Oil Producing and Exporting Cartels Act (NOPEC) was a U.S. Congressional bill, never enacted, known as H.R. 2264 (in 2007) and then as part of H.R. 6074 (in 2008). NOPEC was designed to remove the state immunity shield and to allow the international oil cartel, OPEC, and its national oil companies to be sued under U.S. antitrust law for anti-competitive attempts to limit the world's supply of petroleum and the consequent impact on oil prices. Despite popular sentiment against OPEC, legislative proposals to limit the organization's sovereign immunity have so far been unsuccessful. "Varied forms of a NOPEC bill have been introduced some 16 times since 2000, only to be vehemently resisted by the oil industry and its allied oil interests like the American Petroleum Institute and their legion of 'K' Street Lobbyists."

A worldwide surge in inflation began in mid-2021, with many countries seeing their highest inflation rates in decades. It has been attributed to various causes, including COVID-19 pandemic-related economic dislocation, supply chain disruptions, the fiscal and monetary stimuli provided in 2020 and 2021 by governments and central banks around the world in response to the pandemic, and price gouging. Recovery in demand from the COVID-19 recession had by 2020 led to significant supply shortages across many business and consumer economic sectors. The inflation rate in the United States and the eurozone peaked in the second half of 2022 and sharply declined into 2023.

I Did That! is a phrase found on stickers typically picturing U.S. President Joe Biden pointing at the price of gasoline on fuel pumps in gas stations around the United States as a way to claim that he increased gas prices. The stickers have also been placed on empty store shelves.

The Inflation Reduction Act of 2022 (IRA) is a landmark United States federal law which aims to curb inflation by possibly reducing the federal government budget deficit, lowering prescription drug prices, and investing into domestic energy production while promoting clean energy. It was passed by the 117th United States Congress and signed into law by President Joe Biden on August 16, 2022.

References

- 1 2 3 Broder, John M. (April 29, 2008). "Democrats Divided Over Gas Tax Break". The New York Times. Washington.

- 1 2 "Homepage" (PDF). Joseph Doyle. Archived from the original on June 24, 2008.

- 1 2 Bull, Alister (April 30, 2008). "Clinton-McCain gas tax holiday slammed as bad idea". Reuters. Washington.

- ↑ Goldman, David (March 18, 2008). "Inflation is Americans' top economic concern". CNN Money . New York.

- ↑ Stein, Sam (May 25, 2011) [2008-04-30]. "Expert Support For Gas Tax Holiday Appears Nonexistent". The Huffington Post .

- ↑ "An Open Statement Opposing Proposals for a Gas Tax Holiday". Politico . Archived from the original on May 9, 2008.

- ↑ Williams, Paul (January 11, 2022). "DeSantis Pushes $1B Fla. Gas Tax Holiday Amid Inflation". Law360 . Retrieved July 8, 2022.

- ↑ Stofan, Jake (June 13, 2022). "October-only gas tax holiday plan arose earlier than initially thought". WJAX-TV . Jacksonville, Florida . Retrieved July 8, 2022.

- 1 2 LeBlanc, Paul (June 22, 2022). "President Biden wants a gas tax holiday. Here's why Congress isn't on board". CNN . WCVB5 . Retrieved July 8, 2022.

- ↑ Montague, Zach (June 20, 2022). "Biden Says He Is Considering Seeking a Gas Tax Holiday". The New York Times . Rehoboth Beach. Retrieved July 8, 2022.