Related Research Articles

In economics, Kondratiev waves are hypothesized cycle-like phenomena in the modern world economy. The phenomenon is closely connected with the technology life cycle.

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0%. Inflation reduces the value of currency over time, but sudden deflation increases it. This allows more goods and services to be bought than before with the same amount of currency. Deflation is distinct from disinflation, a slow-down in the inflation rate, i.e. when inflation declines to a lower rate but is still positive.

An economic bubble is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be caused by overly optimistic projections about the scale and sustainability of growth, and/or by the belief that intrinsic valuation is no longer relevant when making an investment. They have appeared in most asset classes, including equities, commodities, real estate, and even esoteric assets. Bubbles usually form as a result of either excess liquidity in markets, and/or changed investor psychology. Large multi-asset bubbles, are attributed to central banking liquidity.

Business cycles are intervals of expansion followed by recession in economic activity. A recession is defined as 2 quarters of negative GDP growth. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examining trends in a broad economic indicator such as Real Gross Domestic Production.

The Elliott Wave Principle, or Elliott wave theory, is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology and price levels, such as highs and lows, by looking for patterns in prices.

The causes of the Great Depression in the early 20th century in the United States have been extensively discussed by economists and remain a matter of active debate. They are part of the larger debate about economic crises and recessions. The specific economic events that took place during the Great Depression are well established.

The Long Depression was a worldwide price and economic recession, beginning in 1873 and running either through March 1879, or 1896, depending on the metrics used. It was most severe in Europe and the United States, which had been experiencing strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War. The episode was labeled the "Great Depression" at the time, and it held that designation until the Great Depression of the 1930s. Though a period of general deflation and a general contraction, it did not have the severe economic retrogression of the Great Depression.

Ralph Nelson Elliott was an American accountant and author, whose study of stock market data led him to develop the Wave Principle, a description of the cyclical nature of trader psychology and a form of technical analysis. It identifies trends and reversals in financial markets. These cyclical patterns in price movements are known among practitioners of the method as Elliott waves.

The 2000s United States housing bubble was a real-estate bubble affecting over half of the U.S. states. It was the impetus for the subprime mortgage crisis. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2011. On December 30, 2008, the Case–Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is an important cause of the Great Recession in the United States.

Economic collapse, also called economic meltdown, is any of a broad range of bad economic conditions, ranging from a severe, prolonged depression with high bankruptcy rates and high unemployment, to a breakdown in normal commerce caused by hyperinflation, or even an economically caused sharp rise in the death rate and perhaps even a decline in population. Often economic collapse is accompanied by social chaos, civil unrest and a breakdown of law and order.

The Elliott Wave Theorist is a monthly newsletter published by Elliott Wave International. The first issue of the Theorist was published in April 1976 and has been continuously in print on a subscription basis since May 1979. The publication includes Elliott wave analysis of the financial markets and cultural trends, plus commentary on topics that include technical analysis, behavioral finance, physics, pattern recognition, and socionomics. Robert Prechter is the publication's editor and main contributor.

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy.

The Great Crash, 1929 is a book written by John Kenneth Galbraith and published in 1955. It is an economic history of the lead-up to the Wall Street Crash of 1929. The book argues that the 1929 stock market crash was precipitated by rampant speculation in the stock market, that the common denominator of all speculative episodes is the belief of participants that they can become rich without work and that the tendency towards recurrent speculative orgy serves no useful purpose, but rather is deeply damaging to an economy. It was Galbraith's belief that a good knowledge of what happened in 1929 was the best safeguard against its recurrence.

Robert R. Prechter Jr. is an American financial author, and stock market analyst, known for his financial forecasts using the Elliott Wave Principle. Prechter is an author and co-author of 14 books, and editor of 2 books, and his book Conquer the Crash was a New York Times bestseller in 2002. He also has published monthly financial commentary in the newsletter The Elliott Wave Theorist since 1979, and is the founder of Elliott Wave International and New Classics Library. Prechter served on the board of the CMT Association for nine years, and as its president in 1990–1991. He has been a member of Mensa and Intertel. In recent years Prechter has supported the study of socionomics, a theory about human social behavior.

Debt deflation is a theory that recessions and depressions are due to the overall level of debt rising in real value because of deflation, causing people to default on their consumer loans and mortgages. Bank assets fall because of the defaults and because the value of their collateral falls, leading to a surge in bank insolvencies, a reduction in lending and by extension, a reduction in spending.

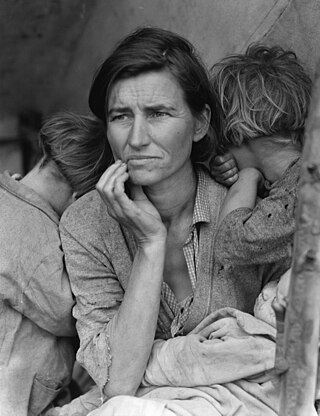

The Great Depression (1929–1939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagion began around September and led to the Wall Street stock market crash of October 24. It was the longest, deepest, and most widespread depression of the 20th century.

The Depression of 1920–1921 was a sharp deflationary recession in the United States, United Kingdom and other countries, beginning 14 months after the end of World War I. It lasted from January 1920 to July 1921. The extent of the deflation was not only large, but large relative to the accompanying decline in real product.

Paper wealth means wealth as measured by monetary value, as reflected in price of assets – how much money one's assets could be sold for. Paper wealth is contrasted with real wealth, which refers to one's actual physical assets.

BCA Research Inc. is an independent provider of global investment research and investment strategy advice. BCA was founded by A. Hamilton Bolton in 1949 in Montreal, Quebec, Canada. The firm is also known by the title of its first publication, The Bank Credit Analyst.

References

- The Great Wave: Price Revolutions and the Rhythm of History (2000) ISBN 0-19-505377-X

- Korotayev, Andrey V., & Tsirel, Sergey V.(2010). A Spectral Analysis of World GDP Dynamics: Kondratieff Waves, Kuznets Swings, Juglar and Kitchin Cycles in Global Economic Development, and the 2008–2009 Economic Crisis. Structure and Dynamics. Vol.4. #1. P.3-57.