Valora is a Swiss retail and food service holding company. The company was acquired on 7 October 2022 by FEMSA.

Emmi AG is a Swiss milk processor and dairy products company headquartered in Lucerne. The company employs a total of around 8,900 people in Europe, North America, South America and North Africa (Tunisia). Emmi AG is listed on the SWX Swiss Exchange. The company generates about 42.5 percent of its sales locally and the other 57.5 percent abroad. Numerous production companies in Switzerland belong to the Emmi Group. Outside of Switzerland, Emmi has production facilities, in Chile, Germany, Italy, the Netherlands, Austria, Spain, Tunisia, Brazil, Canada and the USA. Emmi is one of the 500 largest companies in Switzerland.

Implenia is a Swiss real estate and construction services company with activities in development and civil engineering in Switzerland and Germany. Implenia is also active in tunneling and related infrastructure construction in Austria, France, Sweden, Norway and Italy. The Group was formed at the beginning of 2006 from the merger of Basel-based Batigroup Holding AG with Geneva-based Zschokke Holding SA. The headquarters are located in Glattpark (Opfikon) in the canton of Zurich. Implenia is one of the 500 largest companies in Switzerland.

Helvetia is an international insurance group that exists since 1858. The group of companies has been organised in a holding structure since 1996. The head office of Helvetia Group is located in St. Gallen, Switzerland.

Werner F.M. De Bondt is one of the founders in the field of behavioral finance. He is also the founding director of Richard H. Driehaus Center for Behavioral Finance at DePaul University in Chicago. Previously, he was the Frank Graner Professor of Investment Management at the University of Wisconsin-Madison, and the Thomas F. Gleed Chair of Business Administration at Albers School of Business and Economics at the Seattle University.

Reichmuth & Co is a Swiss private bank that was founded in Luzern, Switzerland, in 1988. It was the first private bank created in Switzerland in 80 years. Its general partners are Karl Reichmuth, Christof Reichmuth, and Juerg Staub. As of 2012, it was one of 12 unlimited liability bank members listed by the Swiss Private Bankers Association. It is a prominent major player among Swiss hedge funds.

Michael Pieper is a Swiss billionaire businessman, the owner of the kitchen appliance manufacturer Franke, through his Artemis Group holding company. As of October 2021, his net worth was estimated at US$4.8 billion.

Digitec Galaxus AG is the biggest online retailer in Switzerland. It operates the digitec and Galaxus online shops as well as ten stores in the German and French speaking parts of Switzerland.

Swiss Prime Site AG is one of the largest listed real estate companies in Europe. The fair value of the real estate under management is around CHF 20 billion. The portfolio of the company's own real estate has a value of around CHF 13 billion and consists primarily of commercial and retail properties in the most important Swiss metropolitan regions of the Central Plateau. In addition to the real estate investments, the Group companies Swiss Prime Site Solutions and Jelmoli make up the Services segment.

Ernst Tanner is a Swiss manager and entrepreneur. He is Chairman of the Board of the chocolate manufacturer Lindt & Sprüngli.

Leonteq AG is a Swiss company founded in 2007 and headquartered in Zürich. It is specialized in structured financial products and in insurance products in the sector of finance and technology. It is an issuer of its own products, as well as a partner of other finance companies.

Dadvan Ismat Yousuf Yousuf is an Iraqi cryptocurrency investor and businessman whose early bitcoin investments made him the youngest self-made billionaire in Switzerland. Yousuf and his companies have been involved in a number of allegations.

Daniel Grieder is a Swiss entrepreneur and business executive. Between 2014 and 2020 he was CEO of Tommy Hilfiger Global, as well as CEO of PVH Europe and Calvin Klein Europe. Since 2021 he has been CEO of Hugo Boss.

Rainer Emil Gut was a Swiss bank manager.

Benjamin Giezendanner is a Swiss businessman and politician who currently serves as a member of the National Council (Switzerland) for the Swiss People's Party (SVP) since 2019. He previously served on the Grand Council of Aargau being elected as the youngest member only aged 18 in 2001. In the 2023 Swiss federal election he was a candidate for Council of States (Switzerland), but lost election against Marianne Binder-Keller. Giezendanner is the youngest son of former National Councillor Ulrich Giezendanner and brother of incumbent Grand Councillor Stefan Giezendanner.

Franz Josef Grüter is a Swiss businessman and politician. He currently serves as a member of the National Council (Switzerland) for the Swiss People's Party since 30 November 2015. Grüter is also known for founding green.ch group which he ultimately sold to the Altice concern for 214 million Swiss Francs. Grüter belongs among the richest politicians in the Swiss legislative according to Handelszeitung.

Thomas Matter is a Swiss businessman, banker, philanthropist and politician. He currently serves as a member of the National Council (Switzerland) for the Swiss People's Party since 2014. Matter is estimated to be the second richest politician in the Swiss legislature with an estimated net worth of 150 million Swiss Francs (2017) by Handelszeitung.

Hans Jakob Vontobel was a Swiss private banker and philanthropist. He was the former president of Vontobel between 1984 and 1994 and honorary president until his death. He held approximately 20% of controlling shares of the private bank. He was the patriarch of the Vontobel banking family.

Bellevue Group AG, headquartered in Küsnacht, is a listed investment management corporation from Switzerland. Bellevue Group consists of the subsidiaries Bellevue Asset Management, Bellevue Private Markets and StarCapital. It has 9,6 billion Swiss francs Assets Under Management Around 80% of clients assets are in healthcare investments. Bellevue Group is also active in alternative investments and private equity, including co-investments in private domestic small and medium-sized enterprises. In this business area, client assets under management were 1.0 billion francs as of mid-2021.

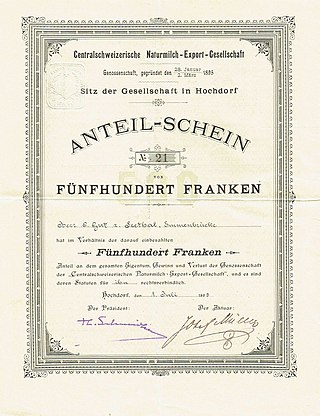

Hochdorf Holding, often referred to as the Hochdorf Group, is a Swiss food company based in Hochdorf and the third largest dairy company in Switzerland. As of 31 December 2021, the group of companies employed 387 people and generated a consolidated net sales of 303.5 million Swiss francs. Hochdorf Holding is one of the 500 largest companies in Switzerland. Its shares have been listed on the SIX Swiss Exchange since 17. May 2011.