The Fifteenth Amendment to the United States Constitution prohibits the federal government and each state from denying or abridging a citizen's right to vote "on account of race, color, or previous condition of servitude." It was ratified on February 3, 1870, as the third and last of the Reconstruction Amendments.

The Voting Rights Act of 1965 is a landmark piece of federal legislation in the United States that prohibits racial discrimination in voting. It was signed into law by President Lyndon B. Johnson during the height of the civil rights movement on August 6, 1965, and Congress later amended the Act five times to expand its protections. Designed to enforce the voting rights guaranteed by the Fourteenth and Fifteenth Amendments to the United States Constitution, the Act sought to secure the right to vote for racial minorities throughout the country, especially in the South. According to the U.S. Department of Justice, the Act is considered to be the most effective piece of federal civil rights legislation ever enacted in the country. It is also "one of the most far-reaching pieces of civil rights legislation in U.S. history."

The Twenty-fourth Amendment of the United States Constitution prohibits both Congress and the states from conditioning the right to vote in federal elections on payment of a poll tax or other types of tax. The amendment was proposed by Congress to the states on August 27, 1962, and was ratified by the states on January 23, 1964.

A grandfather clause, also known as grandfather policy, grandfathering, or grandfathered in, is a provision in which an old rule continues to apply to some existing situations while a new rule will apply to all future cases. Those exempt from the new rule are said to have grandfather rights or acquired rights, or to have been grandfathered in. Frequently, the exemption is limited, as it may extend for a set time, or it may be lost under certain circumstances; for example, a grandfathered power plant might be exempt from new, more restrictive pollution laws, but the exception may be revoked and the new rules would apply if the plant were expanded. Often, such a provision is used as a compromise or out of practicality, to allow new rules to be enacted without upsetting a well-established logistical or political situation. This extends the idea of a rule not being retroactively applied.

Voting rights in the United States, specifically the enfranchisement and disenfranchisement of different groups, has been a moral and political issue throughout United States history.

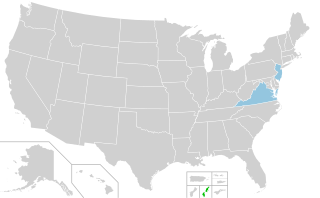

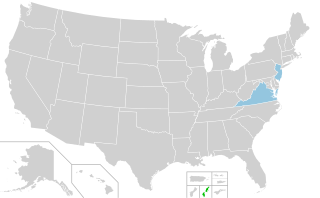

Harper v. Virginia State Board of Elections, 383 U.S. 663 (1966), was a case in which the U.S. Supreme Court found that Virginia's poll tax was unconstitutional under the equal protection clause of the 14th Amendment. In the late 19th and early 20th centuries, eleven southern states established poll taxes as part of their disenfranchisement of most blacks and many poor whites. The Twenty-fourth Amendment to the United States Constitution (1964) prohibited poll taxes in federal elections; five states continued to require poll taxes for voters in state elections. By this ruling, the Supreme Court banned the use of poll taxes in state elections.

The 2005 United States elections were held on Tuesday, November 8. During this off-year election, the only seats up for election in the United States Congress were special elections held throughout the year. None of these congressional seats changed party hands. There were also two gubernatorial races, state legislative elections in two states, numerous citizen initiatives, mayoral races in several major cities, and a variety of local offices on the ballot.

The Reconstruction Amendments, or the Civil War Amendments, are the Thirteenth, Fourteenth, and Fifteenth amendments to the United States Constitution, adopted between 1865 and 1870. The amendments were a part of the implementation of the Reconstruction of the American South which occurred after the war.

Nixon v. Herndon, 273 U.S. 536 (1927), was a United States Supreme Court decision which struck down a 1923 Texas law forbidding blacks from voting in the Texas Democratic Party primary. Due to the limited amount of Republican Party activity in Texas at the time following the suppression of black voting through poll taxes, the Democratic Party primary was essentially the only competitive process and chance to choose candidates for the Senate, House of Representatives and state offices.

Disfranchisement after the Reconstruction era in the United States, especially in the Southern United States, was based on a series of laws, new constitutions, and practices in the South that were deliberately used to prevent black citizens from registering to vote and voting. These measures were enacted by the former Confederate states at the turn of the 20th century. Efforts were made in Maryland, Kentucky, and Oklahoma. Their actions were designed to thwart the objective of the Fifteenth Amendment to the United States Constitution, ratified in 1870, which prohibited states from depriving voters of their voting rights on the basis of race. The laws were frequently written in ways to be ostensibly non-racial on paper, but were implemented in ways that purposely suppressed black voters. Beginning in the 1870s, white racists used violence by domestic terrorism groups, as well as fraud, to suppress black voters. After regaining control of the state legislatures, Southern Democrats were alarmed by a late 19th-century alliance between Republicans and Populists that cost them some elections. After achieving control of state legislatures, white bigots added to previous efforts and achieved widespread disfranchisement by law: from 1890 to 1908, Southern state legislatures passed new constitutions, constitutional amendments, and laws that made voter registration and voting more difficult, especially when administered by white staff in a discriminatory way. They succeeded in disenfranchising most of the black citizens, as well as many poor whites in the South, and voter rolls dropped dramatically in each state. The Republican Party was nearly eliminated in the region for decades, and the Southern Democrats established one-party control throughout the Southern United States.

The Virginia State Board of Elections (SBE) was created in 1946 as a nonpolitical agency responsible for ensuring uniformity, fairness, accuracy and purity in all elections in the Commonwealth of Virginia. The SBE promotes the proper administration of election laws, campaign finance disclosure compliance, and voter registration processes in the state by promulgating rules, regulations, issuing instructions, and providing information to local electoral boards and general registrars. In addition, the SBE maintains a centralized database of statewide voter registration and election related data.

United States v. Reese, 92 U.S. 214 (1876), was a voting rights case in which the United States Supreme Court narrowly construed the 15th Amendment to the United States Constitution, which provide that suffrage for citizens can not be restricted due to race, color or the individual having previously been a slave.

A poll tax is a tax of a fixed sum on every liable individual, without reference to income or resources. Although often associated with states of the former Confederate States of America, poll taxes were also in place in some northern and western states, including California, Connecticut, Maine, Massachusetts, Minnesota, New Hampshire, Ohio, Pennsylvania, Vermont and Wisconsin. Poll taxes had been a major source of government funding among the colonies which formed the United States. Poll taxes made up from one-third to one-half of the tax revenue of colonial Massachusetts. Various privileges of citizenship, including voter registration or issuance of driving licenses and resident hunting and fishing licenses, were conditioned on payment of poll taxes to encourage the collection of this tax revenue. Property taxes assumed a larger share of tax revenues as land values rose when population increases encouraged settlement of the American West. Some western states found no need for poll tax requirements; but poll taxes and payment incentives remained in eastern states, and some links to voter registration were modified following the American Civil War until court action following ratification of the 24th Amendment in 1964.

The 2012 Virginia State Elections took place on Election Day, November 6, 2012, the same day as the Presidential, U.S. Senate and U.S. House elections in the state. The only statewide elections on the ballot were two constitutional referendums to amend the Virginia State Constitution. Because Virginia state elections are held on off-years, no statewide officers or state legislative elections were held. Both referendums were referred to the voters by the Virginia General Assembly.

Breedlove v. Suttles, 302 U.S. 277 (1937), is an overturned United States Supreme Court decision which upheld the constitutionality of requiring the payment of a poll tax in order to vote in state elections.

The 2006 Virginia State Elections took place on Election Day, November 7, 2006, the same day as the U.S. House and the U.S. Senate elections in the state. The only statewide elections on the ballot were three constitutional referendums to amend the Virginia State Constitution. Because Virginia state elections are held on off-years, no statewide officers or state legislative elections were held. All referendums were referred to the voters by the Virginia General Assembly.

This is a timeline of voting rights in the United States. The timeline highlights milestones when groups of people in the United States gained voting rights, and also documents aspects of disenfranchisement in the country.

The history of black suffrage in the United States, or the right of African Americans to vote in elections, has had many advances and setbacks. Prior to the Civil War and the Reconstruction Amendments to the U.S. Constitution, some Black people in the United States had the right to vote, but this right was often abridged or taken away. After 1870, Black people were theoretically equal before the law, but in the period between the end of Reconstruction era and the passage of the Civil Rights Act of 1964 this was frequently infringed in practice.

Virginia state elections in 2020 was held on Tuesday, November 3, 2020. With the exception of its Democratic Party presidential primary election held on March 3, 2020, its primary elections were held on June 23 of that year.

The women's poll tax repeal movement was a movement in the United States predominantly led by women that attempted to secure the abolition of poll taxes as a prerequisite for voting in the Southern states. The movement began shortly after the ratification in 1920 of the Nineteenth Amendment to the United States Constitution, which granted suffrage to women. Before obtaining the right to vote, women were not obliged to pay the tax, but shortly after the Nineteenth Amendment became law, Southern states began examining how poll tax statutes could be applied to women. For example, North and South Carolina exempted women from payment of the tax, while Georgia did not require women to pay it unless they registered to vote. In other Southern states, the tax was due cumulatively for each year someone had been eligible to vote.