Council Tax is a local taxation system used in England, Scotland and Wales. It is a tax on domestic property, which was introduced in 1993 by the Local Government Finance Act 1992, replacing the short-lived Community Charge, which in turn replaced the domestic rates. Each property is assigned one of eight bands in England and Scotland, or nine bands in Wales, based on property value, and the tax is set as a fixed amount for each band. The higher the band, the higher the tax. Some property is exempt from the tax, and some people are exempt from the tax, while some get a discount.

Child benefit or children's allowance is a social security payment which is distributed to the parents or guardians of children, teenagers and in some cases, young adults. A number of countries operate different versions of the program. In most countries, child benefit is means-tested and the amount of child benefit paid is usually dependent on the number of children one has.

In the United Kingdom, taxation may involve payments to at least three different levels of government: central government, devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2014–15, total government revenue was forecast to be £648 billion, or 37.7 per cent of GDP, with net taxes and National Insurance contributions standing at £606 billion.

The economy of Scotland is an open mixed economy which, in 2023, had an estimated nominal gross domestic product (GDP) of £211.7 billion including oil and gas extraction in Scottish waters. Since the Acts of Union 1707, Scotland's economy has been closely aligned with the economy of the rest of the United Kingdom (UK), and England has historically been its main trading partner. Scotland still conducts the majority of its trade within the UK: in 2017, Scotland's exports totalled £81.4 billion, of which £48.9 billion (60%) was with the countries of the United Kingdom, £14.9 billion with the European Union (EU), and £17.6 billion with other parts of the world. Scotland’s imports meanwhile totalled £94.4 billion including intra-UK trade leaving Scotland with a trade deficit of £10.4 billion in 2017.

In the UK tax system, personal allowance is the threshold above which income tax is levied on an individual's income. A person who receives less than their own personal allowance in taxable income in a given tax year does not pay income tax; otherwise, tax must be paid according to how much is earned above this level. Certain residents are entitled to a larger personal allowance than others. Such groups include: the over-65s, blind people, and married couples where at least one person in the marriage was born before 6 April 1935. People earning over £100,000 a year have a smaller personal allowance. For every £2 earned above £100,000, £1 of the personal allowance is lost; meaning that incomes high enough will not have a personal allowance.

Air Passenger Duty (APD) is an excise duty which is charged on the carriage of passengers flying from a United Kingdom or Isle of Man airport on an aircraft that has an authorised take-off weight of more than 5.7 tonnes or more than twenty seats for passengers. The duty is not payable by inbound international passengers who are booked to continue their journey within 24 hours of their scheduled time of arrival in the UK. If a passenger "stops-over" for more than 24 hours, duty is payable in full.

This is a list of the maximum potential tax rates around Europe for certain income brackets. It is focused on three types of taxes: corporate, individual, and value added taxes (VAT). It is not intended to represent the true tax burden to either the corporation or the individual in the listed country.

The starting rate of income tax, known as the 10p rate, was a special rate of personal income taxation in the United Kingdom that existed from 1999 to 2008.

The 2009 United Kingdom Budget, officially known as Budget 2009: Building Britain's Future, was formally delivered by Alistair Darling in the House of Commons on 22 April 2009. It introduced new tax, spending and debt rises in a financial environment of rising unemployment and recession.

The June 2010 United Kingdom Budget, officially also known as Responsibility, freedom, fairness: a five-year plan to re-build the economy, was delivered by George Osborne, Chancellor of the Exchequer, to the House of Commons in his budget speech that commenced at 12.33pm on Tuesday, 22 June 2010. It was the first budget of the Conservative-Liberal Democrat coalition formed after the general election of May 2010. The government dubbed it an "emergency budget", and stated that its purpose was to reduce the national debt accumulated under the Labour government.

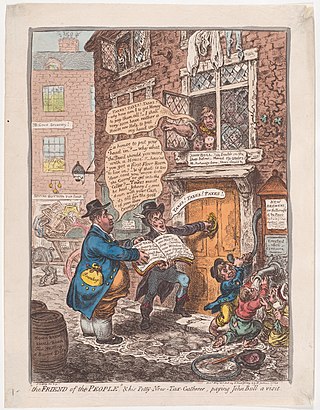

The history of taxation in the United Kingdom includes the history of all collections by governments under law, in money or in kind, including collections by monarchs and lesser feudal lords, levied on persons or property subject to the government, with the primary purpose of raising revenue.

The 2012 United Kingdom budget was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on Wednesday 21 March 2012.

The Welfare Reform Act 2012 is an Act of Parliament in the United Kingdom which makes changes to the rules concerning a number of benefits offered within the British social security system. It was enacted by the Parliament of the United Kingdom on 8 March 2012.

Child benefits in the United Kingdom are a series of welfare payments and tax credits made to parents with children in the UK, a major part of the welfare state.

The Scotland Act 2016 is an act of the Parliament of the United Kingdom. It sets out amendments to the Scotland Act 1998 and devolves further powers to Scotland. The legislation is based on recommendations given by the report of the Smith Commission, which was established on 19 September 2014 in the wake of the Scottish independence referendum.

Taxation in Scotland today involves payments that are required to be made to three different levels of government: to the UK government, to the Scottish Government and to local government. Currently 32.4% of taxation collected in Scotland is in the form of taxes under the control of the Scottish parliament and 67.6% of all taxation collected in Scotland is reserved to the UK Parliament.

Social Security Scotland is an executive agency of the Scottish Government with responsibility for social security provision.

Welsh Rates of Income Tax (WRIT) is part of the UK income tax system and from 6 April 2019 a proportion of income tax paid by taxpayers living in Wales is transferred straight to the Welsh Government to fund Welsh public services. It is administered by HM Revenue and Customs (HMRC), but it is not a devolved tax comparable to Scottish income tax.

Capital gains tax in the United Kingdom is a tax levied on capital gains, the profit realised on the sale of a non-inventory asset by an individual or trust in the United Kingdom. The most common capital gains are realised from the sale of shares, bonds, precious metals, real estate, and property, so the tax principally targets business owners, investors and employee share scheme participants.

The November 1993 United Kingdom budget was delivered by Kenneth Clarke, the Chancellor of the Exchequer, to the House of Commons on 30 November 1993. It was the second budget to be presented in 1993, and the first to be presented by Clarke following his appointment as Chancellor by Prime Minister John Major earlier that year. The November 1993 budget was also the first in the modern era to be held in the autumn, the government having decided to move the date of the budget so it could outline its tax and spending plans at the same time.