Related Research Articles

The Tariff Act of 1789 was the first major piece of legislation passed in the United States after the ratification of the United States Constitution. It had two purposes: to protect manufacturing industries developing in the nation and to raise revenue for the federal government. It was sponsored by Congressman James Madison, passed by the 1st United States Congress, and signed into law by President George Washington. The act levied a 50¢ per ton duty on goods imported by foreign ships; American-owned vessels were charged 6¢ per ton.

Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods, including animals, transports, personal effects, and hazardous items, into and out of a country. Traditionally, customs has been considered as the fiscal subject that charges customs duties and other taxes on import and export. In recent decades, the views on the functions of customs have considerably expanded and now covers three basic issues: taxation, security, and trade facilitation.

The World Customs Organization (WCO) is an intergovernmental organization headquartered in Brussels, Belgium. The WCO works on customs-related matters including the development of international conventions, instruments, and tools on topics such as commodity classification, valuation, rules of origin, collection of customs revenue, supply chain security, international trade facilitation, customs enforcement activities, combating counterfeiting in support of intellectual property rights (IPR), illegal drug enforcement, combating counterfeiting of medicinal drugs, illegal weapons trading, integrity promotion, and delivering sustainable capacity building to assist with customs reforms and modernization. The WCO maintains the international Harmonized System (HS) goods nomenclature, and administers the technical aspects of the World Trade Organization (WTO) Agreements on Customs Valuation and Rules of Origin.

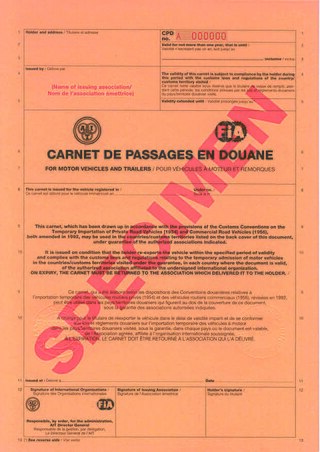

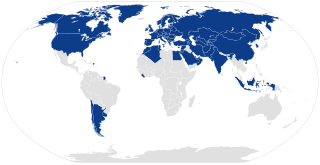

The Carnet de Passages en Douane is a customs document that identifies a traveller's motor vehicle or other valuable equipment or baggage. It is required in order to take a motor vehicle into a significant number of countries around the world. The CPD system is managed by the Federation Internationale de l'automobile, duly mandated by the World customs organization and the United Nations Economic Commission for Europe.

The Convention on International Transport of Goods Under Cover of TIR Carnets is a multilateral treaty that was concluded at Geneva on 14 November 1975 to simplify and harmonise the administrative formalities of international road transport. The 1975 convention replaced the TIR Convention of 1959, which itself replaced the 1949 TIR Agreement between a number of European countries. The conventions were adopted under the auspices of the United Nations Economic Commission for Europe (UNECE). As of December 2020, there are 77 parties to the Convention, including 76 states and the European Union.

A bonded warehouse, or bond, is a building or other secured area in which dutiable goods may be stored, manipulated, or undergo manufacturing operations without payment of duty. It may be managed by the state or by private enterprise. In the latter case a customs bond must be posted with the government. This system is widely used in developed countries throughout the world.

A carnet may refer to:

An import is the receiving country in an export from the sending country. Importation and exportation are the defining financial transactions of international trade.

The ATA Carnet, often referred to as the "Passport for goods", is an international customs document that permits the tax-free and duty-free temporary export and import of nonperishable goods for up to one year. It consists of unified customs declaration forms which are prepared ready to use at every border crossing point. It is a globally accepted guarantee for customs duties and taxes which can replace the security deposit required by each customs authority. It can be used in multiple countries in multiple trips up to its one-year validity. The acronym ATA is a combination of French and English terms "Admission Temporaire/Temporary Admission". The ATA carnet is now the document most widely used by the business community for international operations involving temporary admission of goods.

The United States Council for International Business (USCIB) is an independent business advocacy group that was founded in 1945 to promote free trade and help represent U.S. business in the then-new United Nations. One of its primary goals is expanding market access for U.S. products and services abroad. The organization is strongly in favor of open markets and sensible regulation.

The United States imposes tariffs on imports of goods. The duty is levied at the time of import and is paid by the importer of record. Customs duties vary by country of origin and product. Goods from many countries are exempt from duty under various trade agreements. Certain types of goods are exempt from duty regardless of source. Customs rules differ from other import restrictions. Failure to properly comply with customs rules can result in seizure of goods and criminal penalties against involved parties. The United States Customs and Border Protection (CBP) enforces customs rules.

The Japan-Philippines Economic Partnership Agreement (日本・フィリピン経済連携協定) or in or commonly known as JPEPA is an economic partnership agreement concerning bilateral investment and free trade agreement between Japan and the Philippines. It was signed in Helsinki, Finland on September 9, 2006, by Japanese Prime Minister Junichiro Koizumi and Philippine President Gloria Macapagal Arroyo. It is the first bilateral trade treaty which the Philippines has entered since the Parity Right Agreement of 1946 with the United States. This treaty consists of 16 Chapters and 165 Articles, with 8 Annexes.

The Nepal–Britain Treaty was first discussed in 1921 and the final treaty was signed on 21 December 1923 in Singha Durbar. The treaty was the first formal acknowledgement by the British that Nepal, as an independent nation, had the right to conduct its foreign policy in any way it saw fit and was considered to be “a great achievement of 25 years of Chandra Shumsher’s diplomacy.” The treaty was recorded in 1925 in the League of Nations.

The Customs Convention on the Temporary Importation of Private Road Vehicles is a 1954 United Nations multilateral treaty. In states that adhere to the Convention, it allows individuals that are temporarily visiting a country—such as tourists or individuals on student visas—to import a road vehicle to the country duty-free.

The Customs Convention on Containers is a United Nations and International Maritime Organization treaty whereby states agree to allow intermodal containers to be temporarily brought into their states duty- and tax-free.

The Agreement on the Importation of Educational, Scientific and Cultural Materials is a 1950 UNESCO treaty whereby states agree to not impose customs duties on certain educational, scientific, and cultural materials that are imported.

The Customs Convention on the Temporary Importation for Private Use of Aircraft and Pleasure Boats is a 1956 United Nations multilateral treaty. In states that adhere to the Convention, it allows individuals that are temporarily visiting a country—such as tourists—to import an aircraft or pleasure boat to the country duty free so long as the aircraft or boat will be used exclusively for private use.

The Customs Convention on the Temporary Importation of Commercial Road Vehicles is a 1956 United Nations multilateral treaty. In states that adhere to the Convention, it allows commercial road vehicles—such as taxis, buses, and semi-trailer trucks—to temporarily travel within the country duty free.

The Convention Concerning Customs Facilities for Touring is a 1954 United Nations multilateral treaty. In states that adhere to the Convention, it allows tourists to import personal effects into the country duty free so long as the effects are for the personal use of the tourist and they are carried on the person or in their luggage.

A customs declaration is a form that lists the details of goods that are being imported or exported when a citizen or visitor enters a customs territory. Most countries require travellers to complete a customs declaration form when bringing notified goods across international borders. Posting items via international mail also requires the sending party to complete a customs declaration form.

References

- ↑ "United Nations Treaty Collection".

- ↑ "Notification No. 154/94-Cus., dated 13-7-1994: Exemption to samples, price lists, commercial samples or prototypes imported as baggage or by post. Air or Courier service and prototypes of engineering goods imported as samples for executing or securing export orders". cbec.gov.in. Archived from the original on 29 July 2015.