A credit union, a type of financial institution similar to a commercial bank, is a member-owned nonprofit financial cooperative. Credit unions generally provide services to members similar to retail banks, including deposit accounts, provision of credit, and other financial services. In several African countries, credit unions are commonly referred to as SACCOs.

Tides Foundation is an American public charity and fiscal sponsor working to advance progressive causes and policy initiatives in areas such as the environment, health care, labor issues, immigrant rights, LGBTQ+ rights, women's rights and human rights. It was founded in San Francisco in 1976. Through donor advised funds, Tides distributes money from anonymous donors to other organizations, which are often politically progressive. It manages two centers in San Francisco and New York that offer collaborative spaces for social ventures and other nonprofits.

The Federal Insurance Contributions Act is a United States federal payroll contribution directed towards both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers.

A charitable organization or charity is an organization whose primary objectives are philanthropy and social well-being.

A 501(c) organization is a nonprofit organization in the federal law of the United States according to Internal Revenue Code and is one of over 29 types of nonprofit organizations exempt from some federal income taxes. Sections 503 through 505 set out the requirements for obtaining such exemptions. Many states refer to Section 501(c) for definitions of organizations exempt from state taxation as well. 501(c) organizations can receive unlimited contributions from individuals, corporations, and unions.

The Marvelwood School is a college preparatory private boarding school located in Kent, Connecticut, United States.

Laws regulating nonprofit organizations, nonprofit corporations, non-governmental organizations, and voluntary associations vary in different jurisdictions.

Blue Shield of California is a mutual benefit corporation and health plan founded in 1939 by the California Medical Association. It is based in Oakland, California, and serves 4.5 million health plan members and more than 65,000 physicians across the state. Blue Shield of California was founded as a not-for-profit organization. As of 2014, it is no longer tax-exempt in California and has been paying federal taxes for several years before that.

A 501(c)(3) organization is a United States corporation, trust, unincorporated association or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the US.

The Orton-Gillingham approach is a multisensory phonics technique for remedial reading instruction developed in the early-20th century. It is practiced as a direct, explicit, cognitive, cumulative, and multi-sensory approach. While it is most commonly associated with teaching individuals with dyslexia, it is highly effective for all individuals learning to read, spell, and write. In the US, it is promoted by more than 15 commercial programs as well as several private schools for students with dyslexia and related learning disabilities.

Fraser Academy, located in Vancouver, British Columbia, Canada, is a private, non-profit, co-educational, non-faith, non-residential school that serves children from grades 1 to 12 with language-based learning disabilities such as dyslexia. Its teaching methods are based on those found at the Kildonan School in New York, using the Orton-Gillingham approach. Besides daily individual tutoring for language, students take the same courses as other students in the province, in which courses a multisensory approach is also used.

The Polish American Association (PAA) is a non-profit human services agency that serves the diverse needs of the Chicago Polish immigrant community.

Anna Gillingham (1878–1963) was an educator and psychologist, known for her contributions to the Orton-Gillingham method for teaching children with dyslexia how to read.

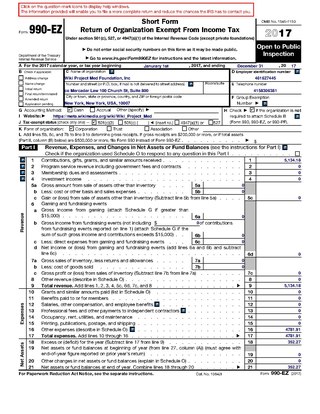

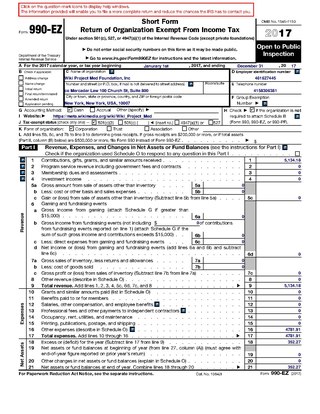

Form 990 is a United States Internal Revenue Service form that provides the public with financial information about a nonprofit organization. It is often the only source of such information. It is also used by government agencies to prevent organizations from abusing their tax-exempt status. Certain nonprofits have more comprehensive reporting requirements, such as hospitals and other health care organizations.

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act.

Sally Burwell Childs was a language training specialist, with an emphasis on furthering the research on dyslexia and educating dyslexic students. Childs, along with several colleagues, opened an organization to help create dyslexia awareness called The Orton Society, in 1949, and she held the position as vice-president from 1959 to 1965. She published several educational books for dyslexia and was recognized for her accomplishments in 1973 with the Samuel T. Orton Award.

The IBON Foundation is a non-profit research, education and information-development institution with programs in research, education and advocacy based in the Philippines. It provides socioeconomic research and analysis on people's issues to various sectors. It aims to contribute to people's empowerment through education and advocacy support. The foundation is also engaged in international solidarity work.

The Kildonan School was a private coeducational boarding and day school in Amenia, New York, for students with dyslexia and language-based learning disabilities. It offered daily one-to-one Orton-Gillingham language remediation and a college preparatory curriculum for students in grades 2-12 and PG (post-graduate).

Margaret Byrd Rawson was an American educator, researcher and writer. She was an early leader in the field of dyslexia, conducting one of the longest-running studies of language disorders ever undertaken and publishing nine books on dyslexia.

Taxation in Armenia is regulated by the State Revenue Committee, which is the tax authority of the Armenian government. Meanwhile, the Armenian Tax Service is responsible for the collection of taxes, providing revenue services, preventing tax fraud and tax evasion, and implementing various tax reform programs in conjunction with the State Revenue Committee.