Related Research Articles

A cryptocurrency exchange, or a digital currency exchange (DCE), is a business that allows customers to trade cryptocurrencies or digital currencies for other assets, such as conventional fiat money or other digital currencies. Exchanges may accept credit card payments, wire transfers or other forms of payment in exchange for digital currencies or cryptocurrencies. A cryptocurrency exchange can be a market maker that typically takes the bid–ask spreads as a transaction commission for its service or, as a matching platform, simply charges fees.

A cryptocurrency, crypto-currency, or crypto is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it. It is a decentralized system for verifying that the parties to a transaction have the money they claim to have, eliminating the need for traditional intermediaries, such as banks, when funds are being transferred between two entities.

Litecoin is a decentralized peer-to-peer cryptocurrency and open-source software project released under the MIT/X11 license. Inspired by Bitcoin, Litecoin was among the earliest altcoins, starting in October 2011. In technical details, the Litecoin main chain shares a slightly modified Bitcoin codebase. The practical effects of those codebase differences are lower transaction fees, faster transaction confirmations, and faster mining difficulty retargeting. Due to its underlying similarities to Bitcoin, Litecoin has historically been referred to as the "silver to Bitcoin's gold." In 2022, Litecoin added optional privacy features via soft fork through the MWEB upgrade.

Coinbase Global, Inc., branded Coinbase, is an American publicly traded company that operates a cryptocurrency exchange platform. Coinbase is a distributed company; all employees operate via remote work and the company lacks a physical headquarters. It is the largest cryptocurrency exchange in the United States by trading volume. The company was founded in 2012 by Brian Armstrong and Fred Ehrsam. In May 2020, Coinbase announced it would shut its San Francisco, California headquarters and change operations to remote-first, part of a wave of several major tech companies closing headquarters in San Francisco in the wake of the COVID-19 pandemic.

Blockchain.com is a cryptocurrency financial services company. The company began as the first Bitcoin blockchain explorer in 2011 and later created a cryptocurrency wallet that accounted for 28% of bitcoin transactions between 2012 and 2020. It also operates a cryptocurrency exchange and provides institutional markets lending business and data, charts, and analytics.

Circle began as a peer-to-peer payments technology company that now manages stablecoin USDC, a cryptocurrency the value of which is pegged to the U.S. dollar. It was founded by Jeremy Allaire and Sean Neville in October 2013. Circle is headquartered in Boston, Massachusetts. USDC is designed to hold at or near a stable price of $1.

A cryptocurrency tumbler or cryptocurrency mixing service is a service that mixes potentially identifiable or "tainted" cryptocurrency funds with others, so as to obscure the trail back to the fund's original source. This is usually done by pooling together source funds from multiple inputs for a large and random period of time, and then spitting them back out to destination addresses. As all the funds are lumped together and then distributed at random times, it is very difficult to trace exact coins. Tumblers have arisen to improve the anonymity of cryptocurrencies, usually bitcoin, since the digital currencies provide a public ledger of all transactions. Due to its goal of anonymity, tumblers have been used to money launder cryptocurrency.

The BitGive Foundation is an American nonprofit organization that solicits bitcoin donations for use in charitable causes.

BitGo, Inc. is a digital asset trust company and security company, headquartered in Palo Alto, California. It was founded in 2013 by Mike Belshe and Ben Davenport. Galaxy Digital announced its acquisition of BitGo in 2021 for $1.2 billion, although this acquisition was announced to have been canceled in 2022 after the crypto downturn, with BitGo continuing as an independent company.

Quadriga Fintech Solutions was the owner and operator of QuadrigaCX, which was believed to be Canada's largest cryptocurrency exchange. In 2019 the exchange ceased operations and the company filed for bankruptcy with C$215.7 million in liabilities and about C$28 million in assets.

Digital Currency Group (DCG) is a venture capital company focusing on the digital currency market. It is located in Stamford, Connecticut. The company has five subsidiaries: CoinDesk, Foundry, Genesis, Grayscale Investments, and Luno.

Abra is a financial services and technology company that operates a cryptocurrency wallet service including a trading service for buying and selling cryptocurrencies, a service for earning interest on cryptocurrencies and stablecoins, and a lending services for borrowing against cryptocurrency collateral.

An initial coin offering (ICO) or initial currency offering is a type of funding using cryptocurrencies. It is often a form of crowdfunding, although a private ICO which does not seek public investment is also possible. In an ICO, a quantity of cryptocurrency is sold in the form of "tokens" ("coins") to speculators or investors, in exchange for legal tender or other cryptocurrencies such as Bitcoin or Ether. The tokens are promoted as future functional units of currency if or when the ICO's funding goal is met and the project successfully launches.

Bitmain Technologies Ltd., is a privately owned company headquartered in Beijing, China, that designs application-specific integrated circuit (ASIC) chips for bitcoin mining.

Tether is an asset-backed cryptocurrency stablecoin. It was launched by the company Tether Limited Inc. in 2014. Tether Limited is owned by the Hong Kong-based company iFinex Inc., which also owns the Bitfinex cryptocurrency exchange. As of July 2022, Tether Limited has minted the USDT stablecoin on ten protocols and blockchains. Tether is described as a stablecoin because it was originally designed to be valued at USD $1.00. Tether Limited has stated that it maintains USD $1 of asset reserves for each USD₮ 1 issued, but has been fined by regulators for failing to do this and has failed to present audits showing sufficient asset reserves.

Binance Holdings Ltd., branded Binance, is a global company that operates the largest cryptocurrency exchange in terms of daily trading volume of cryptocurrencies.

Cryptocurrency and crime describes notable examples of cybercrime related to theft of cryptocurrencies and some of the methods or security vulnerabilities commonly exploited. Cryptojacking is a form of cybercrime specific to cryptocurrencies that has been used on websites to hijack a victim's resources and use them for hashing and mining cryptocurrencies.

OKX, formerly known as OKEx, is a Seychelles-based cryptocurrency exchange and derivatives exchange. It was founded by Star Xu (徐明星) in 2017. OKX is owned by OK Group, which also owns crypto exchange Okcoin. It is not currently available to US-based investors. The company's CEO is Jay Hao and CMO is Haider Rafique.

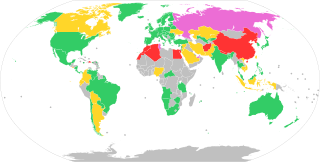

El Salvador became the first country in the world to use Bitcoin as legal tender, after having been adopted as such by the Legislative Assembly of El Salvador in 2021. It has been promoted by Nayib Bukele, the president of El Salvador, who claimed that it would improve the economy by making banking easier for Salvadorans, and that it would encourage foreign investment. The adoption has been criticized both internationally and within El Salvador, due to the volatility of Bitcoin, its environmental impact, and lack of transparency regarding the government's fiscal policy.

Michael Patryn is an internet entrepreneur. He is best known for being the co-founder of Quadriga Fintech Solutions.

References

- 1 2 3 4 5 Andrea Gunn (February 8, 2019). "QuadrigaCX founder left $9.8m in personal property, over a million in Nova Scotia". The Chronicle Herald (Halifax, Nova Scotia).

Not much is known about Robertson outside of what's come out in court documents regarding her relation to the Quadriga case, but it seems she has changed her name at least three times. A Nova Scotia Royal Gazette entry from 2017 shows that she changed her name from Jennifer Griffith to Jennifer Robertson in late 2016. The short entry also says she was born in Halifax in 1988, making her the same age as Cotten. Legal property documents also list her as formerly Jennifer Forgeron, but it's not clear when that name change occurred.

- 1 2 3 Nathaniel Rich (November 22, 2019). "Ponzi Schemes, Private Yachts, and a Missing $250 Million in Crypto: The Strange Tale of Quadriga". Vanity Fair . Retrieved 2020-01-20.

Robertson was also not her birth name; she had gone from her given name, Griffith, to Forgeron and then back, following an earlier marriage and its dissolution, before finally landing on Robertson in 2016.

- 1 2 Doug Alexander (2019-10-08). "Quadriga Founder's Finances Add to Mystery of Missing Millions". Bloomberg News . Retrieved 2019-11-27.

Robertson, who married Cotten in June 2018, agreed yesterday to return about C$12 million of assets to Quadriga as part of a voluntary settlement, which still requires court approval. She'll get to keep about C$90,000 in cash, a C$20,000 retirement savings plan, a 2015 Jeep Cherokee, her wedding band, some personal furnishings and Quadriga shares.

- 1 2 Rohan Abraham (2019-04-10). "A crypto millionaire, loose ends & a dead end: A consignment of teddy bears before Gerald Cotten died". India Times . Archived from the original on 2019-05-19. Retrieved 2019-05-22.

Pastor Cherukupalli Rama Rao has been waiting for four months for a dozen odd beady-eyed teddy bears to reach the six children under his charge at the Angel House India home in Venkatapuram village, Mudigona, Telangana.

- ↑ "Lawyers want cryptocurrency Quadriga founder exhumed". BBC News . 2019-12-13. Retrieved 2019-12-16.

- ↑ Rafael Augusto (2019-03-17). "QuadrigaCX Founder's Widow Inherits Millions in Real Estate". 71 Republic. Archived from the original on 2019-09-27. Retrieved 2019-09-26.

Jennifer, also known as the QuadrigaCX widow, has roughly 7.5 million Canadian dollars in real estate property. Yes, you heard that right.

- ↑ Andrea Gunn (2019-02-14). "QuadrigaCX CEO's wife questioned over access to bitcoins". Halifax Chronicle-Herald . Archived from the original on 2019-09-11. Retrieved 2019-09-26.

- ↑ Andrea Gunn (2019-02-19). "Two law firms appointed to represent QuadrigaCX users through crypotcurrency recovery". Halifax Chronicle-Herald . Archived from the original on 2019-09-27. Retrieved 2019-09-26.

- 1 2 Michael MacDonald (2019-08-29). "RCMP, FBI two of four agencies investigating former crypto exchange Quadriga". Global News . Archived from the original on 2019-09-26. Retrieved 2019-09-26.

Earlier this year, the court issued a so-called asset preservation order to prevent Robertson from selling about $12 million in assets belonging to her or Cotten's estate. Those assets include properties in Nova Scotia and British Columbia, a small aircraft, "luxury vehicles," a sailboat, investments, cash and gold and silver coins.

- ↑ "Case of defunct QuadrigaCX cryptocurrency exchange could shift to Toronto court". Red Deer Advocate . 2019-08-29. Archived from the original on 2019-10-06. Retrieved 2019-10-08.

Meanwhile, Ernst and Young confirmed it is talking to lawyers representing Cotten's widow, Jennifer Robertson, regarding the sale of personal assets that were purchased with Quadriga funds.

- 1 2 Jennifer Robertson (2019-10-04). "Jennifer Robertson Statement - October, 2019 4131-5813-7374 v.2" . Retrieved 2019-10-08.

As a result of the Monitor's investigation, I have agreed to return to QCX assets that I had previously thought were purchased with Gerry's legitimately earned profits, salary and dividends. I was upset and disappointed with Gerry's activities as uncovered by the investigation when I first learned of them, and continue to be as we conclude this settlement.

- 1 2 3 Doug Alexander (2019-10-08). "Quadriga CEO's widow to return $12M of estate assets". Bloomberg News . Archived from the original on 2019-10-08. Retrieved 2019-10-08.

"I have now entered into a voluntary settlement agreement where the vast majority of my assets and all of the estate's assets are being returned to QCX to benefit the affected users," she said. "These assets originally came from QCX at the direction of Gerry."

- ↑ Jack Julian (2019-11-08). "Settlement allows QuadrigaCX founder's widow to keep $90K in cash, wedding ring, Jeep". CBC News . Retrieved 2019-11-27.

Jennifer Robertson, the widow of QuadrigaCX founder Gerald (Gerry) Cotten, will be allowed to keep more than $90,000 cash and a Jeep Cherokee in a settlement agreement with the company's bankruptcy trustee.

- ↑ "Quadriga CEO's widow speaks out over his death and the missing crypto millions". Cbc.ca. Retrieved 18 January 2022.

- ↑ Castaldo, Joe; Posadzki, Alexandra (15 January 2022). "Widow of Quadriga crypto founder Gerald Cotten says she had no idea about the $215-million scam". Theglobeandmail.com. Retrieved 18 January 2022.

- ↑ "The bestselling books in Canada for the week ending Jan. 26, 2022". Toronto Star. 26 January 2022.

- ↑ "The bestselling books in Canada for the week ending Feb. 16, 2022". Toronto Star. 16 February 2022.

- ↑ "The Globe and Mail Bestsellers for the week of Jan. 29, 2022". The Globe and Mail. 28 January 2022. Archived from the original on 31 January 2022.