Related Research Articles

The National Labor Relations Act of 1935, also known as the Wagner Act, is a foundational statute of United States labor law that guarantees the right of private sector employees to organize into trade unions, engage in collective bargaining, and take collective action such as strikes. Central to the act was a ban on company unions. The act was written by Senator Robert F. Wagner, passed by the 74th United States Congress, and signed into law by President Franklin D. Roosevelt.

Employment is a relationship between two parties regulating the provision of paid labour services. Usually based on a contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any other entity, pays the other, the employee, in return for carrying out assigned work. Employees work in return for wages, which can be paid on the basis of an hourly rate, by piecework or an annual salary, depending on the type of work an employee does, the prevailing conditions of the sector and the bargaining power between the parties. Employees in some sectors may receive gratuities, bonus payments or stock options. In some types of employment, employees may receive benefits in addition to payment. Benefits may include health insurance, housing, disability insurance. Employment is typically governed by employment laws, organisation or legal contracts.

Flextime is a flexible hours schedule that allows workers to alter their workday and decide/adjust their start and finish times. In contrast to traditional work arrangements that require employees to work a standard 9 a.m. to 5 p.m. day, flextime typically involves a "core" period of the day during which employees are required to be at work, and a "bandwidth" period within which all required hours must be worked. The working day outside of the "core" period is "flexible time", in which employees can choose when they work, subject to achieving total daily, weekly or monthly hours within the "bandwidth" period set by employers, and subject to the necessary work being done. The total working time required of employees on flextime schedules is the same as that required under traditional work schedules.

The Family and Medical Leave Act of 1993 (FMLA) is a United States labor law requiring covered employers to provide employees with job-protected, unpaid leave for qualified medical and family reasons. The FMLA was a major part of President Bill Clinton's first-term domestic agenda, and he signed it into law on February 5, 1993. The FMLA is administered by the Wage and Hour Division of the United States Department of Labor.

An employment contract or contract of employment is a kind of contract used in labour law to attribute rights and responsibilities between parties to a bargain. The contract is between an "employee" and an "employer". It has arisen out of the old master-servant law, used before the 20th century. Employment contracts relies on the concept of authority, in which the employee agrees to accept the authority of the employer and in exchange, the employer agrees to pay the employee a stated wage.

The rights and duties for employees, labor unions, and employers are set by labor law in the United States. Labor law's basic aim is to remedy the "inequality of bargaining power" between employees and employers, especially employers "organized in the corporate or other forms of ownership association". Over the 20th century, federal law created minimum social and economic rights, and encouraged state laws to go beyond the minimum to favor employees. The Fair Labor Standards Act of 1938 requires a federal minimum wage, currently $7.25 but higher in 29 states and D.C., and discourages working weeks over 40 hours through time-and-a-half overtime pay. There are no federal laws, and few state laws, requiring paid holidays or paid family leave. The Family and Medical Leave Act of 1993 creates a limited right to 12 weeks of unpaid leave in larger employers. There is no automatic right to an occupational pension beyond federally guaranteed Social Security, but the Employee Retirement Income Security Act of 1974 requires standards of prudent management and good governance if employers agree to provide pensions, health plans or other benefits. The Occupational Safety and Health Act of 1970 requires employees have a safe system of work.

The National Labor Relations Board, an agency within the United States government, was created in 1935 as part of the National Labor Relations Act. Among the NLRB's chief responsibilities is the holding of elections to permit employees to vote whether they wish to be represented by a particular labor union. Congress amended the Act in 1947 through the Taft–Hartley Act to give workers the ability to decertify an already recognized or certified union as well. This article describes, in a very summary manner, the procedures that the NLRB uses to hold such elections, as well as the circumstances in which a union may obtain the right to represent a group of employees without an election.

An unfair labor practice (ULP) in United States labor law refers to certain actions taken by employers or unions that violate the National Labor Relations Act of 1935 29 U.S.C. § 151–169 and other legislation. Such acts are investigated by the National Labor Relations Board (NLRB).

Union busting is a range of activities undertaken to disrupt or prevent the formation of trade unions or their attempts to grow their membership in a workplace.

Japanese labour law is the system of labour law operating in Japan.

NLRB v. Mackay Radio & Telegraph Co., 304 U.S. 333 (1938), is a United States labor law case of the Supreme Court of the United States which held that workers who strike remain employees for the purposes of the National Labor Relations Act (NLRA). The Court granted the relief sought by the National Labor Relations Board, which sought to have the workers reinstated by the employer. However, the decision is much better known today for its obiter dicta in which the Court said that an employer may hire strikebreakers and is not bound to discharge any of them if or when the strike ends.

The Fair Labor Standards Act of 1938 29 U.S.C. § 203 (FLSA) is a United States labor law that creates the right to a minimum wage, and "time-and-a-half" overtime pay when people work over forty hours a week. It also prohibits employment of minors in "oppressive child labor". It applies to employees engaged in interstate commerce or employed by an enterprise engaged in commerce or in the production of goods for commerce, unless the employer can claim an exemption from coverage. The Act was enacted by the 75th Congress and signed into law by President Franklin D. Roosevelt in 1938.

Managerial prerogatives are also referred to as the functions and rights of management, is considered as the discretion of the employer or manager on how to manage its business, not bound by collective bargaining. It is a term that easily leads to widespread misunderstanding. Different circles have different interpretations of this term. When it is used in the trade unions circles, is perceived as a user's support for unilateral management power and can cause protests.When used by the management circle, It is considered as exclusive right and control right without interference. Managerial prerogatives give employers or managers the power to control the direction in which their businesses are heading. Employees basically do not have this power.

Iranian labor law describes the rules of employment in Iran. As a still developing country, Iran is considerably behind by international standards. It has failed to ratify the two basic Conventions of the International Labour Organization on freedom of association and collective bargaining, and one on abolition of child labor. Countries such as the US and India have also failed to ratify many of these Conventions and a mere 14 other Conventions, only 2 since the Islamic Revolution.

The Wage and Hour Division (WHD) of the United States Department of Labor is the federal office responsible for enforcing federal labor laws. The Division was formed with the enactment of the Fair Labor Standards Act of 1938. The Wage and Hour mission is to promote and achieve compliance with labor standards to protect and enhance the welfare of the Nation's workforce. WHD protects over 144 million workers in more than 9.8 million establishments throughout the United States and its territories. The Wage and Hour Division enforces over 13 laws, most notably the Fair Labor Standards Act and the Family Medical Leave Act. In FY18, WHD recovered $304,000,000 in back wages for over 240,000 workers and followed up FY19, with a record-breaking $322,000,000 for over 300,000 workers.

Work–life balance in the United States is having enough time for work and enough time to have a personal life in the United States. Related, though broader, terms include lifestyle balance and life balance. The most important thing in work and life is the personal ability to demonstrate and meet the needs of work and personal life in order to achieve goals. People should learn to deal with role engagement management, role conflict management and managing life needs to achieve balance. Balance is about how to properly achieve the desired work and life satisfaction and needs in a conflict situation.

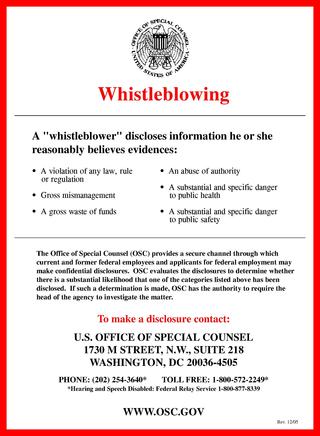

A whistleblower is a person who exposes any kind of information or activity that is deemed illegal, unethical, or not correct within an organization that is either private or public. The Whistleblower Protection Act was made into federal law in the United States in 1989.

The elaws Advisors are a set of interactive, online tools developed by the U.S. Department of Labor to help employers and employees learn more about their rights and responsibilities under numerous Federal employment laws. They address some of the nation's most widely applicable employment laws, offering easy-to-understand information on areas such as:

A public access file is a file that needs to be maintained by any United States employer hiring people in H-1B, H-1B1, or E-3 temporary nonimmigrant worker statuses. It is intended to include more background information related to the attestations made on the Labor Condition Application used for the Form I-129 and/or visa application that was used to acquire the nonimmigrant worker status. The file may be requested by any member of the public through telephone or email inquiries. Any member of the public requesting access to the documents must be allowed to capture the information through such means as transcription, scanning, or taking photographs, for example. It is distinguished from a private access file that contains more sensitive and confidential employee data that must be shared with the U.S. Department of Labor if they choose to investigate. Regulations governing the public access file can be found in the Code of Federal Regulations, Title 20, or more specifically, in 20 CFR 655.760.

The VAT Tribunal case of CGI Group (Europe) Limited v HMRC is a United Kingdom legal case which addressed the VAT treatment of a joint employment arrangement in the context of outsourcing services.

References

- ↑ "Garland's Digest on employment discrimination law". Archived from the original on 2011-04-02.

- ↑ Law.cornell.edu, (2014). 29 CFR 791.2 - Joint employment. | LII / Legal Information Institute. [online] Available at: https://www.law.cornell.edu/cfr/text/29/791.2 [Accessed 30 Oct. 2014].

- ↑ "US Department of Labor announces final rule to rescind March 2020 joint employer rule, ensure more workers minimum wage, overtime protections | U.S. Department of Labor".

- ↑ "Federal Register :: Request Access".

- ↑ "Federal Register :: Request Access".

- ↑ DLA Piper, (2014). Joint employer law: is the NLRB edging closer to the abyss? Takeaways from the Bloomberg webinar | Insights | DLA Piper Global Law Firm. [online] Available at: http://www.dlapiper.com/en/us/insights/publications/2014/10/joint-employer-law-nlrb-edging-abyss/ [Accessed 30 Oct. 2014].

- ↑ The Emplawyerologist, (2014). Has Wal-Mart Helped to Expand the Scope of Joint Employment?. [online] Available at: http://theemplawyerologist.com/2014/10/02/has-wal-mart-helped-to-expand-the-scope-of-joint-employment/#more-1125 [Accessed 30 Oct. 2014].

- ↑ Lawroom.com, (2014). LawRoom: Definition of Joint Employers. [online] Available at: http://www.lawroom.com/Memo_Preview.aspx?txtmemoid=1685#P6_62 [Accessed 30 Oct. 2014].

- ↑ Anonymous IOMA's Payroll Manager's Report, Feb 2012, Vol.16(2), pp.1-3

- ↑ Dol.gov, (2014). U.S. Department of Labor - Wage and Hour Division (WHD) - Fact Sheet. [online] Available at: http://www.dol.gov/whd/regs/compliance/whdfs35.htm [Accessed 30 Oct. 2014].

- ↑ Shibahara, S; Okonogi, T; Yoshida, T; Murai, Y; Kudo, T; Inouye, S; Kondo, S (1990). "A new aminothiazolylcephalosporin having 1-carboxyethoxyimino group, ME1228". The Journal of Antibiotics. 43 (1): 62–9. doi: 10.7164/antibiotics.43.62 . PMID 2407708.

- ↑ Reid, B. (2014). Who is an Employee, Joint Employee, or Independent Contractor?. [online] The Huffington Post. Available at: http://www.huffingtonpost.com/brad-reid/who-is-an-employee-joint_b_5744774.html [Accessed 31 Oct. 2014].

- ↑ aw.cornell.edu, (2014). 29 CFR 825.106 - Joint employer coverage. | LII / Legal Information Institute. [online] Available at: https://www.law.cornell.edu/cfr/text/29/825.106 [Accessed 30 Oct. 2014].

- ↑ Matthew Stoloff, E. (2014). Joint Employer and Overtime Pay | Law Office of Matthew Stoloff. [online] Stoloff-law.com. Available at: http://stoloff-law.com/blog/joint-employer-and-overtime-pay/. [Accessed 30 Oct. 2014].

- ↑ AFL-CIO, The Browning-Ferris NLRB Decision Explained, published 2 September 2015, accessed 6 August 2022

- ↑ Staffing Industry Analysists, NLRB RELEASES JOINT-EMPLOYER FINAL RULE; REVERSES OBAMA-ERA DECISION, published 26 February 2020, accessed 7 August 2022

- ↑ Bma.org.uk, (2014). Joint employment. [online] Available at: http://bma.org.uk/practical-support-at-work/gp-practices/how-to-employ-shared-staff/joint-employment Archived 2014-10-28 at the Wayback Machine [Accessed 30 Oct. 2014].

- ↑ Serota, S. (2001). Employee Benefits Considerations in Joint Ventures. The Tax Lawyer, pp.477--508.