Econometrics is an application of statistical methods to economic data in order to give empirical content to economic relationships. More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference". An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships". Jan Tinbergen is one of the two founding fathers of econometrics. The other, Ragnar Frisch, also coined the term in the sense in which it is used today.

Economic statistics is a topic in applied statistics and applied economics that concerns the collection, processing, compilation, dissemination, and analysis of economic data. It is closely related to business statistics and econometrics. It is also common to call the data themselves "economic statistics", but for this usage, "economic data" is the more common term.

Sir Clive William John Granger was a British econometrician known for his contributions to nonlinear time series analysis. He taught in Britain, at the University of Nottingham and in the United States, at the University of California, San Diego. Granger was awarded the Nobel Memorial Prize in Economic Sciences in 2003 in recognition of the contributions that he and his co-winner, Robert F. Engle, had made to the analysis of time series data. This work fundamentally changed the way in which economists analyse financial and macroeconomic data.

gretl is an open-source statistical package, mainly for econometrics. The name is an acronym for GnuRegression, Econometrics and Time-seriesLibrary.

Computational Economics is an interdisciplinary research discipline that involves computer science, economics, and management science. This subject encompasses computational modeling of economic systems. Some of these areas are unique, while others established areas of economics by allowing robust data analytics and solutions of problems that would be arduous to research without computers and associated numerical methods.

Cointegration is a statistical property of a collection (X1, X2, ..., Xk) of time series variables. First, all of the series must be integrated of order d (see Order of integration). Next, if a linear combination of this collection is integrated of order less than d, then the collection is said to be co-integrated. Formally, if (X,Y,Z) are each integrated of order d, and there exist coefficients a,b,c such that aX + bY + cZ is integrated of order less than d, then X, Y, and Z are cointegrated. Cointegration has become an important property in contemporary time series analysis. Time series often have trends—either deterministic or stochastic. In an influential paper , Charles Nelson and Charles Plosser (1982) provided statistical evidence that many US macroeconomic time series (like GNP, wages, employment, etc.) have stochastic trends.

Nonparametric regression is a category of regression analysis in which the predictor does not take a predetermined form but is constructed according to information derived from the data. That is, no parametric form is assumed for the relationship between predictors and dependent variable. Nonparametric regression requires larger sample sizes than regression based on parametric models because the data must supply the model structure as well as the model estimates.

The Journal of Business & Economic Statistics is a quarterly peer-reviewed academic journal published by the American Statistical Association. The journal covers a broad range of applied problems in business and economic statistics, including forecasting, seasonal adjustment, applied demand and cost analysis, applied econometric modeling, empirical finance, analysis of survey and longitudinal data related to business and economic problems, the impact of discrimination on wages and productivity, the returns to education and training, the effects of unionization, and applications of stochastic control theory to business and economic problems.

Applied economics is the study as regards the application of economic theory and econometrics in specific settings. As one of the two sets of fields of economics, it is typically characterized by the application of the core, i.e. economic theory and econometrics to address practical issues in a range of fields including demographic economics, labour economics, business economics, industrial organization, agricultural economics, development economics, education economics, engineering economics, financial economics, health economics, monetary economics, public economics, and economic history. From the perspective of economic development, the purpose of applied economics is to enhance the quality of business practices and national policy making.

The following tables compare general and technical information for a number of statistical analysis packages.

Economics education or economic education is a field within economics that focuses on two main themes:

Eric Ghysels is a Belgian-American economist with interest in finance and time series econometrics, and in particular the fields of financial econometrics and financial technology. He is the Edward M. Bernstein Distinguished Professor of Economics at the University of North Carolina and a Professor of Finance at the Kenan-Flagler Business School. He is also the Faculty Research Director of the Rethinc.Labs at the Frank Hawkins Kenan Institute of Private Enterprise.

The Journal of Econometrics is a scholarly journal in econometrics. It was first published in 1973. Its current managing editors are Serena Ng, Elie Tamer, Torben Andersen, and Xiaohong Chen serve as editors.

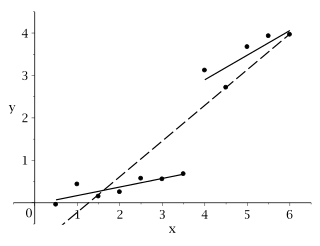

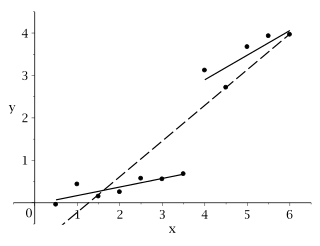

In econometrics and statistics, a structural break is an unexpected change over time in the parameters of regression models, which can lead to huge forecasting errors and unreliability of the model in general. This issue was popularised by David Hendry, who argued that lack of stability of coefficients frequently caused forecast failure, and therefore we must routinely test for structural stability. Structural stability − i.e., the time-invariance of regression coefficients − is a central issue in all applications of linear regression models.

Jianqing Fan is a statistician, financial econometrician, and data scientist. He is currently the Frederick L. Moore '18 Professor of Finance, Professor of Operations Research and Financial Engineering, Professor of Statistics, and a former Chairman of Department of Operations Research and Financial Engineering (2012–2015) and a former director of Committee of Statistical Studies (2005–2017) at Princeton University, where he directs both statistics lab and financial econometrics lab since 2008.

LIMDEP is an econometric and statistical software package with a variety of estimation tools. In addition to the core econometric tools for analysis of cross sections and time series, LIMDEP supports methods for panel data analysis, frontier and efficiency estimation and discrete choice modeling. The package also provides a programming language to allow the user to specify, estimate and analyze models that are not contained in the built in menus of model forms.

Philippus Henricus Benedictus Franciscus "Philip Hans" Franses is a Dutch economist and Professor of Applied Econometrics and Marketing Research at the Erasmus University Rotterdam, and dean of the Erasmus School of Economics, especially known for his 1998 work on "Nonlinear Time Series Models in Empirical Finance."

Microfit is a statistics package developed by Bahram Pesaran and M. Hashem Pesaran, and published by Oxford University Press. It is designed for econometric modelling with time series data.

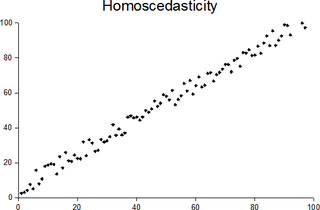

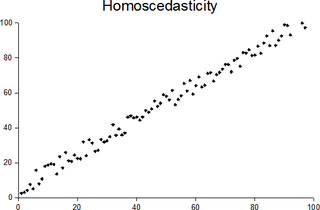

In statistics, a sequence of random variables is homoscedastic if all its random variables have the same finite variance; this is also known as homogeneity of variance. The complementary notion is called heteroscedasticity, also known as heterogeneity of variance. The spellings homoskedasticity and heteroskedasticity are also frequently used. Assuming a variable is homoscedastic when in reality it is heteroscedastic results in unbiased but inefficient point estimates and in biased estimates of standard errors, and may result in overestimating the goodness of fit as measured by the Pearson coefficient.