The Financial Times (FT) is a British daily business newspaper printed in broadsheet and also published digitally that focuses on business and economic current affairs. Based in London, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis rather than generalist reporting, drawing both criticism and acclaim. It sponsors an annual book award and publishes a "Person of the Year" feature.

Masayoshi Son is a Japanese billionaire technology entrepreneur, investor and philanthropist. A third-generation Zainichi Korean, he naturalized as a Japanese citizen in 1990. He is the founder, representative director, corporate officer, chairman and CEO of SoftBank Group Corp. (SBG), a strategic technology-focused investment holding company, as well as chairman of UK-based Arm Holdings.

Liberty Global plc is a multinational telecommunications company with headquarters in London, Amsterdam and Denver. Its respective legal names are Liberty Global Plc, Liberty Global B.V. and Liberty Global, Inc., with the first of these being publicly traded. It was formed in 2005 by the merger of the international arm of Liberty Media and UnitedGlobalCom (UGC).

BlackRock, Inc. is an American multinational investment company. It is the world's largest asset manager, with $10 trillion in assets as of December 31, 2023. Headquartered in New York City, Blackrock has 70 offices in 30 countries, and clients in 100 countries. BlackRock is the manager of the iShares group of exchange-traded funds, and along with The Vanguard Group and State Street, it is considered to be one of the Big Three index fund managers. Its Aladdin software keeps track of investment portfolios for many major financial institutions and its BlackRock Solutions division provides financial risk management services. As of 2023, BlackRock was ranked 229th on the Fortune 500 list of the largest United States corporations by revenue.

TheStreet is a financial news and financial literacy website. It is a subsidiary of The Arena Group. The company provides both free content and subscription services such as Action Alerts Plus, a stock recommendation portfolio co-managed by Bob Lang and Chris Versace. TheStreet was founded by Marty Peretz and Jim Cramer, and the site boasts numerous notable former contributors, including Aaron Task, Herb Greenberg, and Brett Arends.

iShares is a collection of exchange-traded funds (ETFs) managed by BlackRock, which acquired the brand and business from Barclays in 2009. The first iShares ETFs were known as World Equity Benchmark Shares (WEBS) but have since been rebranded.

Working Lunch is a television programme which was broadcast on BBC Two covering business, personal finance and consumer news; it was broadcast between 1994 and 2010. The programme was first aired on 19 September 1994. It had a quirky, relaxed style, especially when compared to other BBC business shows such as World Business Report. In April 2010, the BBC announced that the programme was being cancelled at the end of July 2010. GMT with George Alagiah took its place in the schedule at 12:30 on BBC Two.

The Bank of New York Mellon Corporation, commonly known as BNY Mellon, is an American banking and financial services corporation headquartered in New York City. The bank offers investment management, investment services, and wealth management services. BNY Mellon was formed from the merger of The Bank of New York and the Mellon Financial Corporation in 2007. It is the world's largest custodian bank and securities services company, with $1.8 trillion in assets under management and $45.7 trillion in assets under custody as of 2023. It is considered a systemically important bank by the Financial Stability Board.

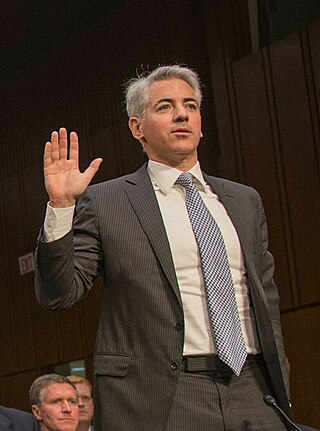

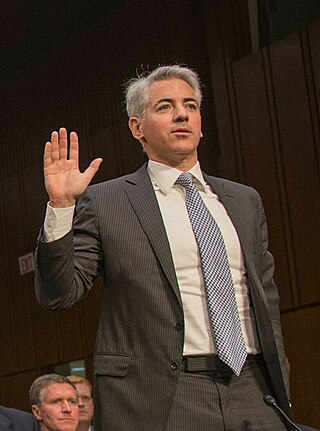

William Albert Ackman is an American hedge fund manager who is the founder and chief executive officer of Pershing Square Capital Management, a hedge fund management company. His investment approach has made him an activist investor. As of January 2024, Ackman's net worth was estimated at $4 billion by Forbes.

Mohamed Aly El-Erian is an Egyptian-American economist and businessman. He is President of Queens' College, Cambridge, and chief economic adviser at Allianz, the corporate parent of PIMCO where he was CEO and co-chief investment officer (2007–14). He was chair of President Obama's Global Development Council (2012–17), and is a columnist for Bloomberg View, and a contributing editor to the Financial Times.

Chuka Harrison Umunna is a British businessman and former politician who served as Member of Parliament (MP) for Streatham from 2010 until 2019. A former member of the Labour Party, he was part of the Shadow Cabinet from 2011 to 2015. He left Labour in February 2019, when he resigned to form The Independent Group, later Change UK, along with six other MPs. Later in 2019, he left Change UK and, after a short time as an independent MP, joined the Liberal Democrats. In the 2019 general election, he was unsuccessful in being re-elected as an MP and did not return to the House of Commons.

Canaccord Genuity Group Inc. is a global, full-service investment banking and financial services company that specializes in wealth management and brokerage in capital markets. It is the largest independent investment dealer in Canada. The firm focuses on growth companies, with operations in 10 countries worldwide and the ability to list companies on 10 stock exchanges. Canaccord Genuity, the international capital markets division, is based in Canada, with offices in the US, the UK, France, Germany, Ireland, Hong Kong, China, Singapore, Dubai, Australia, and Barbados.

The Qatar Investment Authority is Qatar's sovereign wealth fund. The QIA was founded by the State of Qatar in 2005 to strengthen the country's economy by diversifying into new asset classes. In October 2023, the QIA has an estimated $475 billion of assets under management.

The bankruptcy of Lehman Brothers on September 15, 2008, was the climax of the subprime mortgage crisis. After the financial services firm was notified of a pending credit downgrade due to its heavy position in subprime mortgages, the Federal Reserve summoned several banks to negotiate financing for its reorganization. These discussions failed, and Lehman filed a Chapter 11 petition that remains the largest bankruptcy filing in U.S. history, involving more than US$600 billion in assets.

Wake Up to Money is an early morning financial radio programme on BBC Radio 5 Live. It is broadcast from 05:00 to 06:00 each weekday.

Hugh E. "Skip" McGee III is an American investment banker who was formerly a senior executive at Lehman Brothers and Barclays. He is presently co-founder and chief executive officer of Intrepid Financial Partners, a power and energy focused merchant bank.

James Edward "Jes" Staley is an American banker, and the former group chief executive of Barclays. He stepped down as CEO on November 1, 2021, and was succeeded by C. S. Venkatakrishnan. Staley has nearly four decades of experience in banking and financial services. He spent 34 years at J.P. Morgan's investment bank, ultimately becoming CEO. In 2013, he moved to BlueMountain Capital, and in December 2015, became CEO of Barclays. In November 2021, Staley resigned amid a regulatory probe into whether he mischaracterized his relationship with the financier, human trafficker, and sex offender Jeffrey Epstein.

Barclays plc is a British multinational universal bank, headquartered in London, England. Barclays operates as two divisions, Barclays UK and Barclays International, supported by a service company, Barclays Execution Services.

Terence Smith is the founder and chief executive of Fundsmith and a notable British fund manager. He was formerly the chief executive of Tullett Prebon and Collins Stewart. He is a bestselling author and a regular media commentator on investment issues.

Matt Singh is an election and opinion polling analyst and was founder of the website and polling company Number Cruncher Politics, based in London. Singh rose to prominence in mid-2015 for his analysis which correctly predicted the opinion polling failure and Conservative victory at the 2015 UK general election.