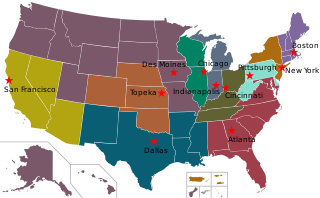

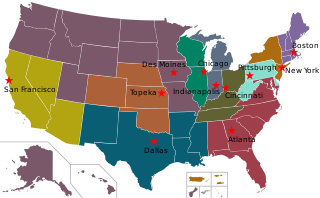

The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

In finance, a high-yield bond is a bond that is rated below investment grade by credit rating agencies. These bonds have a higher risk of default or other adverse credit events, but offer higher yields than investment-grade bonds in order to compensate for the increased risk.

The London Inter-Bank Offered Rate is an interest rate average calculated from estimates submitted by the leading banks in London. Each bank estimates what it would be charged were it to borrow from other banks. It is the primary benchmark, along with the Euribor, for short-term interest rates around the world. Libor was phased out at the end of 2021, and market participants are being encouraged to transition to risk-free interest rates such as SOFR and SARON.

Bloomberg L.P. is a privately held financial, software, data, and media company headquartered in Midtown Manhattan, New York City. It was co-founded by Michael Bloomberg in 1981, with Thomas Secunda, Duncan MacMillan, Charles Zegar, and a 12% ownership investment by Bank of America through their brokerage subsidiary Merrill Lynch.

Credit Suisse Group AG is a global investment bank and financial services firm founded and based in Switzerland. Headquartered in Zürich, it maintains offices in all major financial centers around the world and provides services in investment banking, private banking, asset management, and shared services. It is known for strict bank–client confidentiality and banking secrecy. The Financial Stability Board considers it to be a global systemically important bank. Credit Suisse is also a primary dealer and Forex counterparty of the Federal Reserve in the United States.

The Federal Home Loan Banks are 11 U.S. government-sponsored banks that provide liquidity to financial institutions to support housing finance and community investment.

Henry Kaufman is president of Henry Kaufman & Company, Inc., a firm established in April 1988, specializing in economic and financial consulting, and is known by the nickname "Dr. Doom."

Jefferies Group LLC is an American multinational independent investment bank and financial services company that is headquartered in New York City. The firm provides clients with capital markets and financial advisory services, institutional brokerage, securities research, and asset management. This includes mergers and acquisitions, restructuring, and other financial advisory services. The Capital Markets segment also includes its securities trading and investment banking activities.

Peter Richard Orszag is the Chief Executive Officer of Lazard.

Quantitative easing (QE) is a monetary policy action where a central bank purchases predetermined amounts of government bonds or other financial assets in order to stimulate economic activity. Quantitative easing is a novel form of monetary policy that came into wide application after the financial crisis of 2007–2008. It is used to mitigate an economic recession when inflation is very low or negative, making standard monetary policy ineffective. Quantitative tightening (QT) does the opposite, where for monetary policy reasons, a central bank sells off some portion of its holdings of government bonds or other financial assets.

The Greenspan put was a monetary policy response to financial crises that Alan Greenspan, former chair of the Federal Reserve, exercised beginning with the crash of 1987. Successful in addressing various crises, it became controversial as it led to periods of extreme speculation led by Wall Street investment banks overusing the put's repurchase agreements and creating successive asset price bubbles. The banks so overused Greenspan's tools that their compromised solvency in the global financial crisis of 2007–2008 required Fed chair Ben Bernanke to use direct quantitative easing. The term Yellen put was used to refer to Fed chair Janet Yellen's policy of perpetual monetary looseness.

First Republic Bank was a commercial bank and provider of wealth management services headquartered in San Francisco, California. It catered to high-net-worth individuals and operated 93 offices in 11 states, primarily in New York, California, Massachusetts, and Florida. On May 1, 2023, as part of the 2023 banking crisis, the FDIC announced that First Republic had been closed and sold to JPMorgan Chase.

Elvira Sakhipzadovna Nabiullina is a Russian economist and current head of the Central Bank of Russia. She was president Vladimir Putin's economic adviser from May 2012 to June 2013 after serving as the minister of economic development from September 2007 to May 2012. As of 2019, she was listed as the 53rd most powerful woman in the world by Forbes. She has the federal state civilian service rank of 1st class Active State Councillor of the Russian Federation.

Betsy Duke is an American bank executive who served as a member of the Federal Reserve Board of Governors from 2008 to 2013. Duke was confirmed by the Senate to fill an unexpired term ending January 31, 2012. She was the seventh woman to be appointed to the board. In July 2013, she announced her resignation from the board.

Promontory Financial Group, a wholly owned subsidiary of IBM, is a global consulting firm that advises clients on a variety of financial services matters, including regulatory issues, compliance, risk management, liquidity, restructuring, acquisitions, due diligence, internal investigations and cyber security.

Blythe Masters is a British Private Equity executive and former financial services and fintech executive. She is a former executive at JPMorgan Chase, where she was widely credited for developing the credit default swap as a financial instrument. She is founding partner of FinTech private equity firm, Motive Partners, CEO of Motive Capital Corp, an Advisory Board Member of the US Chamber of Digital Commerce, a Board Member of GCM Grosvenor, Forge Global, CAIS Group, and Credit Suisse Group.

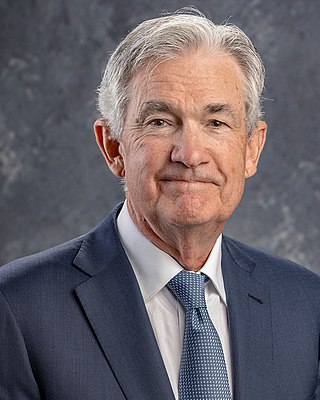

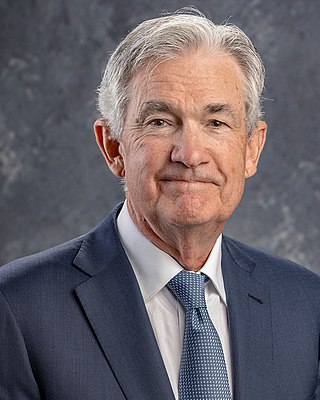

Jerome Hayden "Jay" Powell is an American attorney and investment banker who has served since 2018 as the 16th chair of the Federal Reserve.

Signature Bank was an American full-service commercial bank headquartered in New York City and with 40 private client offices in the states of New York, Connecticut, California, Nevada, and North Carolina. In addition to banking products, specialty national businesses provided services specific to industries such as commercial real estate, private equity, mortgage servicing, and venture banking; subsidiaries of the bank provided equipment financing and investment services. At the end of 2022, the bank had total assets of US$110.4 billion and deposits of $82.6 billion; as of 2021, it had loans of $65.25 billion.

Dawn Fitzpatrick is an American investment banker and financial officer based in New York City. She is known for her work as a hedge fund manager and as the Chief Executive Officer (CEO) & Chief Investment Officer (CIO) at Soros Fund Management.

Ilan Goldfajn is a Brazilian economist, former governor of the Central Bank of Brazil and former director of the International Monetary Fund's Western Hemisphere Department. In December 2022, he became president of the Inter-American Development Bank.