This article has multiple issues. Please help improve it or discuss these issues on the talk page . (Learn how and when to remove these template messages)

|

This is a partial list of major banking company mergers in the United States.

This article has multiple issues. Please help improve it or discuss these issues on the talk page . (Learn how and when to remove these template messages)

|

This is a partial list of major banking company mergers in the United States.

This 2012 chart shows some of the mergers noted above. Solid arrows point from the acquiring bank to the acquired one. The lines are labeled with the year of the deal and color-coded from blue (older) to red (newer). Dotted arrows point to the final merged entity.

Washington Mutual, Inc. was an American savings bank holding company based in Seattle. It was the parent company of WaMu Bank, which was the largest savings and loan association in the United States until its collapse in 2008.

Bank One Corporation was an American bank founded in 1968 and at its peak the sixth-largest bank in the United States. It traded on the New York Stock Exchange under the stock symbol ONE. The company merged with JPMorgan Chase & Co. on July 1, 2004, with its CEO Jamie Dimon taking the lead at the combined company. The company had its headquarters in the Bank One Plaza in the Chicago Loop in Chicago, Illinois, now the headquarters of Chase's retail banking division.

The PNC Financial Services Group, Inc. is an American bank holding company and financial services corporation based in Pittsburgh, Pennsylvania. Its banking subsidiary, PNC Bank, operates in 27 states and the District of Columbia, with 2,629 branches and 9,523 ATMs. PNC Bank is on the list of largest banks in the United States by assets and is one of the largest banks by number of branches, deposits, and number of ATMs.

National City Corporation was a regional bank holding company based in Cleveland, Ohio, founded in 1845; it was once one of the ten largest banks in America in terms of deposits, mortgages and home equity lines of credit. Subsidiary National City Mortgage is credited for doing the first mortgage in America. The company operated through an extensive banking network primarily in Ohio, Illinois, Indiana, Kentucky, Michigan, Missouri, Pennsylvania, Florida, and Wisconsin, and also served customers in selected markets nationally. Its core businesses included commercial and retail banking, mortgage financing and servicing, consumer finance, and asset management. The bank reached out to customers primarily through mass advertising and offered comprehensive banking services online. In its last years, the company was commonly known in the media by the abbreviated NatCity, with its investment banking arm even bearing the official name NatCity Investments.

Truist Financial Corporation is an American bank holding company headquartered in Charlotte, North Carolina. The company was formed in December 2019 as the result of the merger of BB&T and SunTrust Banks. Its bank operates 2,781 branches in 15 states and Washington, D.C., offering consumer and commercial banking, securities brokerage, asset management, mortgage, and insurance products and services. It is on the list of largest banks in the United States by assets; as of August 2023, it is the 9th largest bank with $514 billion in assets. As of January 2021, Truist Insurance Holdings is the seventh largest insurance broker in the world, with $2.27 billion in annual revenue.

CoreStates Financial Corporation, previously known as Philadelphia National Bank (PNB), was an American bank holding company in the Philadelphia, Pennsylvania, metropolitan area.

The National Bank of Detroit (NBD), later renamed NBD Bank, was a bank that operated mostly in the Midwestern United States. Following its merger with First National Bank of Chicago, the bank was ultimately acquired and merged into Bank One, at which point the NBD name was discontinued. Today, what was once NBD is owned by JPMorgan Chase & Co.

SouthTrust Corporation was a banking company headquartered in Birmingham, Alabama. In 2004, SouthTrust reached an agreement to merge with Wachovia in a stock-for-stock deal. At the time of the merger with Wachovia was completed, SouthTrust had $53 Billion in assets. SouthTrust was listed on the NASDAQ exchange under the ticker symbol SOTR. The company was headquartered in the SouthTrust Tower, now known as the Shipt Tower. SouthTrust had branches in Alabama, Florida, Georgia, Mississippi, North Carolina, South Carolina, Tennessee, Texas and Virginia. By the end of 2005, all former SouthTrust branches that remained open carried the Wachovia name.

First Union Corporation was a bank holding company that provided commercial and retail banking services in eleven states in the eastern U.S. First Union also provided various other financial services, including mortgage banking, credit card, investment banking, investment advisory, home equity lending, asset-based lending, leasing, insurance, international and securities brokerage services and private equity through First Union Capital Partners, and through other subsidiaries.

KeyBank, the primary subsidiary of KeyCorp, is an American regional bank headquartered in Cleveland, Ohio. Key ranked 449th on the 2022 Fortune 500 list based on its 2021 revenue. It is 25th on the list of largest banks in the United States.

Huntington Bancshares Incorporated is an American bank holding company headquartered in Columbus, Ohio. The company is ranked 466th on the Fortune 500 as of 2024, and is 26th on the list of largest banks in the United States.

This article outlines the history of Wells Fargo & Company from its merger with Norwest Corporation and beyond. The new company chose to retain the name of "Wells Fargo" and so this article is about the history after the merger.

First Niagara Bank was a Federal Deposit Insurance Corporation-insured regional banking corporation headquartered in Buffalo, New York. Its parent company, First Niagara Financial Group, Inc. was the 44th-largest bank in the United States with assets of over $37.1 billion as of June 30, 2013.

First Chicago Bank was a Chicago-based retail and commercial bank tracing its roots to 1863, when it received one of the first charters under the then new National Bank Act. Over the years, the bank operated under several names including The First National Bank of Chicago and First Chicago NBD. In 1998, First Chicago NBD merged with Banc One Corporation to form Bank One Corporation, today a part of Chase.

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo and Company in 2008, Wachovia was the fourth-largest bank holding company in the United States, based on total assets. Wachovia provided a broad range of banking, asset management, wealth management, and corporate and investment banking products and services. At its height, it was one of the largest providers of financial services in the United States, operating financial centers in 21 states and Washington, D.C., with locations from Connecticut to Florida and west to California. Wachovia provided global services through more than 40 offices around the world.

Wachovia Securities was the trade name of Wachovia's retail brokerage and institutional capital markets and investment banking subsidiaries. Following Wachovia's merger with Wells Fargo and Company on December 31, 2008, the retail brokerage became Wells Fargo Advisors on May 1, 2009 and the institutional capital markets and investment banking group became Wells Fargo Securities on July 6, 2009.

The National City acquisition by PNC was the deal by PNC Financial Services to acquire National City Corp. on October 24, 2008 following National City's untenable loan losses during the subprime mortgage crisis. The deal received much controversy due to PNC using TARP funds to buy National City only hours after accepting the funds while National City itself was denied funds, as well as civic pride for the city of Cleveland, Ohio, where National City was based.

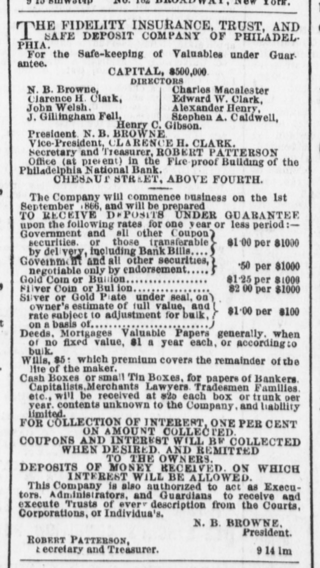

Fidelity Trust Company was a bank in Philadelphia, Pennsylvania. Founded in 1866 as Fidelity Insurance, Trust, & Safe Deposit Company, the bank was later renamed Fidelity Trust Company, Fidelity-Philadelphia Trust Company, The Fidelity Bank, and Fidelity Bank, National Association. It was absorbed in 1988 in the biggest U.S. bank merger up to that point, and is today part of Wells Fargo.

INB Financial Corporation was an Indianapolis-based statewide bank holding company that was the largest Indiana-based financial institution at the time it was acquired by Michigan-based NBD Bancorp in 1992. Its primary subsidiary was the Indianapolis-based INB National Bank, formerly the Indiana National Bank, which can trace its origins to the founding of the Second State Bank of Indiana in 1834.

Star Banc Corporation was a Cincinnati, Ohio-based regional bank holding company that acquired Firstar in 1998 and took the Firstar name; the merged bank acquired U.S. Bancorp in 2001 and took the U.S. Bancorp name. The company can trace its origins back to 1863 when it was first founded as the First National Bank of Cincinnati.