Related Research Articles

In the United Kingdom, taxation may involve payments to at least three different levels of government: central government, devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2014–15, total government revenue was forecast to be £648 billion, or 37.7 per cent of GDP, with net taxes and National Insurance contributions standing at £606 billion.

Irvine Alan Stewart Laidlaw, Baron Laidlaw is a Scottish businessman, and a former member of the House of Lords. In the Sunday Times Rich List 2012 ranking of the wealthiest people in the UK he was placed 105th with an estimated fortune of £745 million. In the 2020 edition, he was ranked the 180th wealthiest person in the UK, with an estimated net worth of £787 million, a decrease of £4 million from the previous year.

Edward Samuel Miliband is a British politician serving as Shadow Secretary of State for Energy Security and Net Zero since 2021. He has been the Member of Parliament (MP) for Doncaster North since 2005. Miliband was Leader of the Labour Party and Leader of the Opposition between 2010 and 2015. Alongside his brother, Foreign Secretary David Miliband, he served in the Cabinet from 2007 to 2010 under Prime Minister Gordon Brown.

Jonathan Harold Esmond Vere Harmsworth, 4th Viscount Rothermere, is a British peer and owner of a newspaper and media empire founded by his great-grandfather Harold Sidney Harmsworth, 1st Viscount Rothermere. He is the chairman and controlling shareholder of the Daily Mail and General Trust, formerly "Associated Newspapers", a media conglomerate which includes the Daily Mail.

Michael Anthony Ashcroft, Baron Ashcroft, is a British-Belizean businessman, pollster and politician. He is a former deputy chairman of the Conservative Party. Ashcroft founded Michael A. Ashcroft Associates in 1972 and was the 132nd richest person in the UK, as ranked by the Sunday Times Rich List 2021, with an estimated fortune of £1.257 billion.

Raj Kumar Bagri, Baron Bagri, was an Indian-born British businessman and a Conservative member of the House of Lords from 1997 to 2010. He was made a life peer in 1997 under the title Baron Bagri, of Regent's Park in the City of Westminster.

Richmond Park is a constituency in Greater London represented in the House of Commons of the UK Parliament. Since 2019, its Member of Parliament (MP) has been Sarah Olney of the Liberal Democrats.

Frank Zacharias Robin Goldsmith, Baron Goldsmith of Richmond Park, is a British politician, life peer and journalist who served as Minister of State for Overseas Territories, Commonwealth, Energy, Climate and Environment from September 2022 to June 2023. A member of the Conservative Party, he was its candidate at the 2016 London mayoral election and was Member of Parliament (MP) for Richmond Park from 2010 to 2016 and 2017 to 2019. Ideologically characterised as having liberal and libertarian views, he is known for his support for environmentalism and localism.

Stephen Keith Green, Baron Green of Hurstpierpoint, is a British politician, former Conservative Minister of State for Trade and Investment, former group chairman of HSBC Holdings plc, and Anglican priest.

Duncan Walker Bannatyne, is a Scottish entrepreneur, philanthropist, and author. His business interests include hotels, health clubs, spas, media, TV, and property. He is most famous for his appearance as a business angel on the BBC programme Dragons' Den. He was appointed an OBE for his contribution to charity. He has written seven books.

The Cash-for-Honours scandal was a political scandal in the United Kingdom in 2006 and 2007 concerning the connection between political donations and the award of life peerages. A loophole in electoral law in the United Kingdom means that although anyone donating even small sums of money to a political party has to declare this as a matter of public record, those loaning money at commercial rates of interest did not have to make a public declaration.

Sir David Eardley Garrard is a retired British property developer.

Ray Edward Harry Collins, Baron Collins of Highbury is a British politician and trade unionist serving as a Member of the House of Lords since 2011. A member of the Labour Party, he served as General Secretary of the Party from 2008 to 2011. Collins has been Shadow Deputy Leader of the House of Lords since 2021.

Stanley Fink, Baron Fink,, is a British hedge fund manager and parliamentarian, who was formerly CEO of Man Group plc.

Peter Andrew Cruddas, Baron Cruddas is an English banker and businessman. He is the founder of online trading company CMC Markets. In the 2007 Sunday Times Rich List, he was named the richest man in the City of London, with an estimated fortune of £860 million. As of March 2012, Forbes estimated his wealth at $1.3 billion, equivalent to £830 million at the time.

Prior to the 2015 general election, various polling organisations conducted opinion polling in specific constituencies. The results of publicised opinion polling for individual constituencies are detailed in this article. However, most opinion polling covers Great Britain, where the results are published in this article here.

The 2015 United Kingdom general election was held on Thursday 7 May 2015 to elect 650 Members of Parliament to the House of Commons. It was the only general election held under the rules of the Fixed-term Parliaments Act 2011 and was the last general election to be held before the United Kingdom would vote to end its membership of the European Union (EU). Local elections took place in most areas of England on the same day.

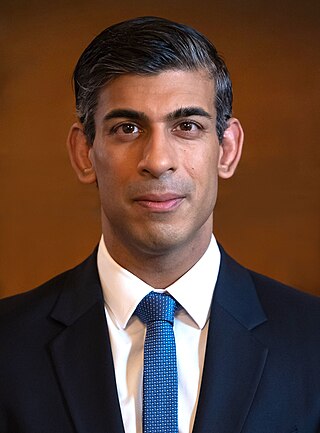

Rishi Sunak is a British politician who has served as Prime Minister of the United Kingdom and Leader of the Conservative Party since 2022. The first British Asian prime minister, he previously held two cabinet positions under Boris Johnson, latterly as Chancellor of the Exchequer from 2020 to 2022. Sunak has been Member of Parliament (MP) for Richmond (Yorks) since 2015.

Isabel Oakeshott is a British right-wing political journalist.

Akshata Narayana Murty is an Indian heiress, businesswoman, fashion designer, and venture capitalist. She is married to Rishi Sunak, the Prime Minister of the United Kingdom and leader of the Conservative Party. According to the Sunday Times Rich List, Murty and Sunak hold the 275th rank for the richest people in Britain as of 2023, with a combined wealth of £529 million.

References

- ↑ "Tax on foreign income". Gov.uk. Retrieved 26 February 2017.

- ↑ Ball, James (7 April 2015). "Non-dom status: living and working in the UK, without paying all your tax in the UK". The Guardian. Retrieved 8 April 2015.

- 1 2 3 4 5 Morris, Nigel (7 April 2015). "General Election 2015: British residents who do not pay tax on overseas earnings will be stripped of 'non-dom' status, says Miliband". The Independent. Archived from the original on 10 April 2015. Retrieved 8 April 2015.

- 1 2 3 "Four non-dom peers quit Lords - Westminster". Politics.co.uk. 6 July 2010. Retrieved 8 April 2015.

- 1 2 3 4 5 Savage, Rachel (8 April 2015). "Ditching non-doms may lose the UK money - but it's the right thing to do". Management Today. Retrieved 9 April 2015.

- 1 2 3 4 5 6 7 8 9 "Non-dom donors: who has given money to which parties?". The Guardian. 8 April 2015. Retrieved 8 April 2015.

- 1 2 3 Donnellan, Aimee. "Labour non-dom threat hits RBS, Barclays, Lloyds — and Carney". The Sunday Times. Archived from the original on 12 April 2015. Retrieved 12 April 2015.

- 1 2 3 4 "Scrapping non-dom tax status would hit bank chiefs". The Daily Telegraph. 12 April 2015. Retrieved 14 April 2015.

- 1 2 3 4 Garside, Juliette (8 April 2015). "Miliband's abolition: Many have tried to close non-dom loophole – all have failed". The Guardian. Retrieved 9 April 2015.

- ↑ Isaac, Anna (6 April 2022). "Revealed: Rishi Sunak's millionaire wife avoids tax through non-dom status". The Independent.

- ↑ Will Woodward and Jason Rodrigues. "The major non-dom donors for the Conservatives and Labour. As a spreadsheet | News". Guardian.co.uk. Retrieved 8 April 2015.

- ↑ "Brown forced to close tax loophole after 'Mittalgate'". The Independent. independent.co.uk. 9 February 2017. Retrieved 9 February 2017.

- 1 2 3 Leigh, David (11 February 2015). "HSBC files reveal how UK's non-dom tax concession is being exploited". The Guardian. Retrieved 8 April 2015.

- ↑ Sheffield, Hazel (8 April 2015). "Non-doms: who they are and why Labour wants to scrap their tax privileges". The Independent. Retrieved 8 April 2015.

- ↑ "Tory donor Lord Ashcroft gives up non-dom tax status". BBC. 7 July 2010. Retrieved 15 February 2017.

- ↑ "Ministers and monarchy pass buck on 'non-doms'". The Independent. independent.co.uk. 9 February 2017. Retrieved 9 February 2017. For Lord retirement lists see also "Tory donor Lord Ashcroft gives up non-dom tax status". BBC News. 7 July 2010.

- ↑ Pickard, Jim (31 March 2015). "Lord Ashcroft retires from House of Lords" . Financial Times.