The automotive industry inmainland China has been the largest in the world measured by automobile unit production since 2008. As of 2024, mainland China is also the world's largest automobile market both in terms of sales and ownership.

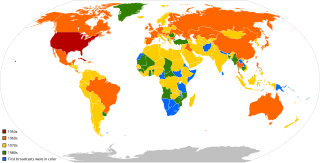

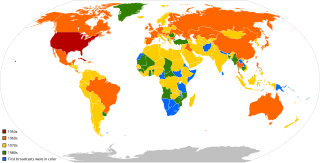

This is a list of when the first color television broadcasts were transmitted to the general public. Non-public field tests, closed-circuit demonstrations and broadcasts available from other countries are not included, while including dates when the last black-and-white stations in the country switched to color or shutdown all black-and white television sets, which has been highlighted in red.

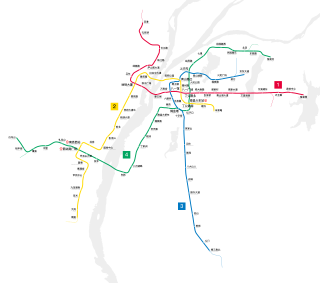

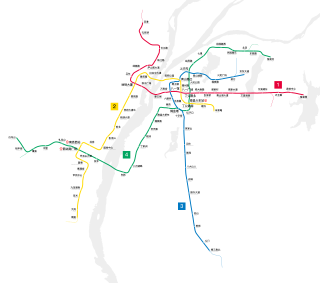

Line 1 of the Guangzhou Metro runs from Xilang to Guangzhou East Railway Station. Apart from Kengkou and Xilang, all stations in Line 1 are underground. The first section, from Xilang to Huangsha, opened on 28 June 1997, making Guangzhou the fourth city in mainland China to have a metro system. Construction took a total of 66 months. The total investment is 12.2616 billion yuan with an average cost per kilometer of 662.9 million yuan. The full line started operation on 28 June 1999. Line 1 is coloured yellow.

Nanchang Metro, officially Nanchang Rail Transit, is a rapid transit system in Nanchang, Jiangxi, China. As of 2021, four lines are operational. The Metro opened for commercial operation in December 2015. The network is currently 128.3 km (79.7 mi) in length with 4 lines. A total length of 163 km (101.3 mi) of network is planned, with Line 5 which is currently under planning.

Futures markets in mainland China, initially deployed in 1990, have quickly established rapid growth as a result of transition to a market economy.

The BYD Qin is a compact sedan produced by BYD Auto since 2012. The Qin started out as the plug-in hybrid version of the BYD Surui, and was introduced in the Chinese market in August 2012. Currently, the Qin is available as battery electric vehicle, as a plug-in hybrid and previously as an internal combustion engine vehicle.

HTX is a Seychelles-based cryptocurrency exchange. Founded in China as Huobi, the company now has offices in Hong Kong, South Korea, Japan and the United States. In August 2018 it became a publicly listed Hong Kong company.

The Jereh Group known as Yantai Jereh Oilfield Services Group Co., Ltd. and formerly Jereh Oilfield Services or Yantai Jereh is a Chinese oil field services company and manufacturer of oilfield equipment.

The Shanghai–Chongqing–Chengdu high-speed railway is a high-speed rail line under construction in China. The Chinese name of the railway line, Huyurong, is a combination of the abbreviations for Shanghai, Chongqing, and Chengdu. It will run in an east-west direction largely parallel to the Yangtze River, connecting the cities of Shanghai, Nanjing, Hefei, Wuhan, Chongqing and Chengdu.

Zeng Jingsheng is a Chinese oil painter. He was born in Huizhou, Guangdong. He is a member of the China Artists Association. He has been vice chairman of the Shenzhen Artists Association.

Jiang Xiaojuan is a Chinese economist and politician. She is a Professor and Dean of the School of Public Policy and Management of Tsinghua University, and a research professor at the Chinese Academy of Social Sciences (CASS). She is a Standing Committee Member of the National People's Congress (NPC) and Vice Chairperson of the NPC Social Construction Committee, taking charge of lawmaking, revision, enforcement, and supervision of social insurance, sports, protection of women's and children's rights and others. She was elected President of the Chinese Public Administration Society in 2019.

The XPeng P7 is a battery-powered executive sedan made by the Chinese electric car company XPeng, which started deliveries in the Chinese market on 29 June 2020.

The Qing dynasty developed a complicated system of ranks and titles. Princess's consort was granted a title of efu, meaning "imperial charioter". However, the title was not granted to the spouses of clanswoman. An efu retained his title and privileges as long as the princess remained his primary spouse – even after her death. However, if an efu remarried or promoted another consort to be his primary spouse, he lost all rights obtained from his marriage to the princess.

The Hongqi E-QM5 is a purpose-built electric compact executive sedan made by Hongqi for online car-hailing.

The Wey Macchiato is a compact luxury crossover SUV produced by Great Wall Motor under the premium brand, Wey.

Ganfeng Lithium Co., Ltd. is a company that produces lithium, lithium products, other metals, and batteries in mainland China and globally. It was founded by Li Liangbin in 2000 and is headquartered in Xinyu, Jiangxi. It is the largest lithium salt producer in China and the third largest in the world, as well as the second largest lithium processor in the world. It is traded on both the Shenzhen Stock Exchange and the Hong Kong Stock Exchange and has a market capitalization of US$26 billion.

The Yichang–Xingshan high-speed railway, also referred to in Chinese under the acronym Yichang-Zhengwan high-speed railway connection line, is a high-speed railway under construction between Yichang on the Wuhan–Yichang railway and Xingshan on the Zhengzhou–Wanzhou high-speed railway in Hubei province, China. It will form part of the Shanghai–Chongqing–Chengdu high-speed railway. The total length of the line is 109.38 km (67.97 mi), and there are 3 stations on the whole line. It is a line connecting the Wuhan–Yichang railway and the Zhengzhou–Wanzhou high-speed railway. The line will run from Yichang East station via the Changgangling area and Xiabaoping station to Xingshan station. In addition, this line is also planned to be connected with Yichang North railway station and the Wuhan–Yichang high speed railway, also currently under construction. The estimated total investment of the project is 18.15 billion yuan, the construction period is 5.5 years, the design speed is 350 km/h (220 mph), and 94.37% of the main line will run on bridge or through tunnel. It is expected to be officially completed and opened to traffic in 2024. After the completion of the line, combined with the Zhengzhou-Wanzhou HSR to form a new east–west high-speed railway route in the Sichuan-Chongqing area, the Wuhan–Chongqing route will be shortened from the current fastest service of 5 hours and 54 minutes to about 3 hours, and Wuhan–Chengdu services will take only 5 hours. At the same time, journeys between Yichang and Beijing will be shortened from the current 8 hours to about 4.5 hours.

GMY Lighting Technology Co., LTD, is a large manufacturer of light source components and products, located in Heshan, Guangdong, China.

Hangzhou Silan Microelectronics is a partially state-owned publicly listed Chinese semiconductor company headquartered in Hangzhou.

Fengtang is a town in south China, under the jurisdiction of Chao'an District, Chaozhou City, Guangdong Province. It has an area of 38.58 square kilometers and a population of 91,234 persons.