A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

In finance, a futures contract is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the forward price. The specified time in the future when delivery and payment occur is known as the delivery date. Because it derives its value from the value of the underlying asset, a futures contract is a derivative product.

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn commissions and revenue acting as brokers or market makers. For-profit futures exchanges earn most of their revenue from trading and clearing fees.

The Chicago Mercantile Exchange (CME) is a global derivatives marketplace based in Chicago and located at 20 S. Wacker Drive. The CME was founded in 1898 as the Chicago Butter and Egg Board, an agricultural commodities exchange. Originally, the exchange was a non-profit organization. The Merc demutualized in November 2000, went public in December 2002, and merged with the Chicago Board of Trade in July 2007 to become a designated contract market of the CME Group Inc., which operates both markets. The chairman and chief executive officer of CME Group is Terrence A. Duffy, Bryan Durkin is president. On August 18, 2008, shareholders approved a merger with the New York Mercantile Exchange (NYMEX) and COMEX. CME, CBOT, NYMEX, and COMEX are now markets owned by CME Group. After the merger, the value of the CME quadrupled in a two-year span, with a market cap of over $25 billion.

The Chicago Board of Trade (CBOT), established on April 3, 1848, is one of the world's oldest futures and options exchanges. On July 12, 2007, the CBOT merged with the Chicago Mercantile Exchange (CME) to form CME Group. CBOT and three other exchanges now operate as designated contract markets (DCM) of the CME Group.

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Group of Chicago. NYMEX is located at One North End Avenue in Brookfield Place in the Battery Park City section of Manhattan, New York City.

A currency future, also known as an FX future or a foreign exchange future, is a futures contract to exchange one currency for another at a specified date in the future at a price that is fixed on the purchase date; see Foreign exchange derivative. Typically, one of the currencies is the US dollar. The price of a future is then in terms of US dollars per unit of other currency. This can be different from the standard way of quoting in the spot foreign exchange markets. The trade unit of each contract is then a certain amount of other currency, for instance €125,000. Most contracts have physical delivery, so for those held at the end of the last trading day, actual payments are made in each currency. However, most contracts are closed out before that. Investors can close out the contract at any time prior to the contract's delivery date.

An interest rate future is a financial derivative with an interest-bearing instrument as the underlying asset. It is a particular type of interest rate derivative.

E-mini S&P, often abbreviated to "E-mini" and designated by the commodity ticker symbol ES, is a stock market index futures contract traded on the Chicago Mercantile Exchange's Globex electronic trading platform. The notional value of one contract is 50 times the value of the S&P 500 stock index; thus, for example, on June 20, 2018, the S&P 500 cash index closed at 2,767.32, making each E-mini contract a $138,366 bet.

The Chicago Butter and Egg Board, founded in 1898, was a spin-off entity of the Chicago Produce Exchange. In the year 1919, it was re-organized as the Chicago Mercantile Exchange (CME). Roots of the Chicago Butter and Egg Board are traceable to the 19th century.

The Kansas City Board of Trade (KCBT), was an American commodity futures and options exchange regulated by the Commodity Futures Trading Commission. Specializing in the hard-red winter wheat contract, it was located at 4800 Main Street in Kansas City, Missouri.

CME Group Inc. is an American global markets company. It is the world's largest financial derivatives exchange, and trades in asset classes that include agricultural products, currencies, energy, interest rates, metals, stock indexes and cryptocurrencies futures. The company offers futures contracts and options on futures using its CME Globex trading platforms, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates a central counterparty clearing provider, CME Clearing. With a range of pre- and post-trade products and services underpinning the entire lifecycle of a trade, CME Group also offers optimization and reconciliation services through TriOptima, and trade processing services through Traiana.

Lean Hog is a type of hog (pork) futures contract that can be used to hedge and to speculate on pork prices.

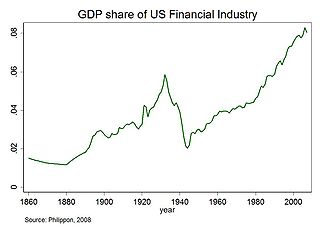

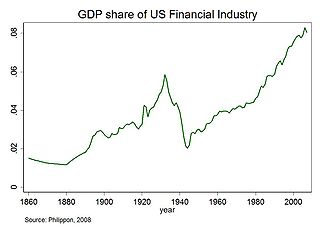

Financialization is a term sometimes used to describe the development of financial capitalism during the period from 1980 to present, in which debt-to-equity ratios increased and financial services accounted for an increasing share of national income relative to other sectors.

VietJet Aviation Joint Stock Company, trading as VietJet Air or Vietjet, is an international low-cost airline from Vietnam. It was the first privately owned new-age airline to be established in Vietnam, being granted its initial approval to operate by the Vietnamese Minister of Finance in November 2007. As of its launch in December 2011, it became the second private airline to offer domestic service in Vietnam, as well as the fifth airline overall to offer civil domestic flights. VietJet Air is owned by Sovico Holdings, HDBank, other organisational investors, and individual stakeholders.

ViettelGroup is a Vietnamese multinational telecommunications company headquartered in Hanoi, Vietnam. Viettel is the largest telecommunications service provider in Vietnam. It is a state-owned enterprise and operated by the Ministry of Defence.

OneChicago was a US-based all-electronic futures exchange with headquarters in Chicago, Illinois. The exchange offered approximately 12,509 single-stock futures (SSF) products with names such as IBM, Apple and Google. All trading was cleared through Options Clearing Corporation (OCC). The OneChicago exchange closed in September 2020.

Vietinbank is a state-owned Vietnamese bank. It has strategic partnerships with the International Finance Corporation and Mitsubishi UFJ Financial Group. It has a market capitalisation of VND 53.22 trillion as of late 2012, making it one of Vietnam's largest listed companies. According to the VNR500 ranking, Vietinbank is Vietnam's 13th largest company.

The 2021 Southeast Asian Games, officially known as the 31st Southeast Asian Games or 31st SEA Games and also known as Vietnam 2021, is a biennial regional multi-sport event currently held from 12 to 23 May 2022 in Hanoi, Vietnam. Originally scheduled to take place from 21 November to 2 December 2021, it was rescheduled as a result of the COVID-19 pandemic in Vietnam. The competition features 40 sports, mainly those played at the Olympic Games. This is the second time that Vietnam has hosted the Southeast Asian Games, having previously hosted the 2003 edition.