Keynesian economics are the various macroeconomic theories and models of how aggregate demand strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. It is influenced by a host of factors that sometimes behave erratically and impact production, employment, and inflation.

John Maynard Keynes, 1st Baron Keynes was an English economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in mathematics, he built on and greatly refined earlier work on the causes of business cycles. One of the most influential economists of the 20th century, he produced writings that are the basis for the school of thought known as Keynesian economics, and its various offshoots. His ideas, reformulated as New Keynesianism, are fundamental to mainstream macroeconomics. He is known as the "father of macroeconomics".

In economics and political science, fiscal policy is the use of government revenue collection and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 1930s, when the previous laissez-faire approach to economic management became unworkable. Fiscal policy is based on the theories of the British economist John Maynard Keynes, whose Keynesian economics theorised that government changes in the levels of taxation and government spending influence aggregate demand and the level of economic activity. Fiscal and monetary policy are the key strategies used by a country's government and central bank to advance its economic objectives. The combination of these policies enables these authorities to target inflation and to increase employment. In modern economies, inflation is conventionally considered "healthy" in the range of 2%–3%. Additionally, it is designed to try to keep GDP growth at 2%–3% percent and the unemployment rate near the natural unemployment rate of 4%–5%. This implies that fiscal policy is used to stabilise the economy over the course of the business cycle.

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit: the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. Government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression. It is a central point of controversy in economics, as discussed below.

Underconsumption is a theory in economics that recessions and stagnation arise from an inadequate consumer demand, relative to the amount produced. In other words, there is a problem of overproduction and overinvestment during a demand crisis. The theory formed the basis for the development of Keynesian economics and the theory of aggregate demand after the 1930s.

Economic militarism is the ideology surrounding the use of military expenditure to prop up an economy, or the use of military power to gain control or access to territory or other economic resources. Thus a link between output and military expenditure can be made. The scope of this effect depend on : threat faced, productivity of factors, degree of the military utilisation, finance method of military spending, its externalities and effectiveness of this military spending in countering the treaty. As a consequence, a same amount of military spending in different countries can have wide-ranging effects.

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment. These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product.

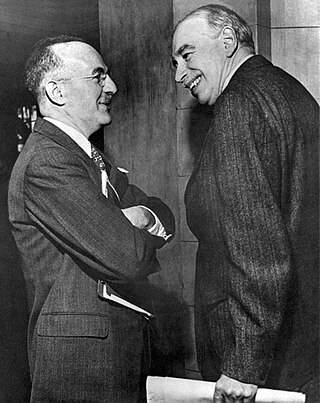

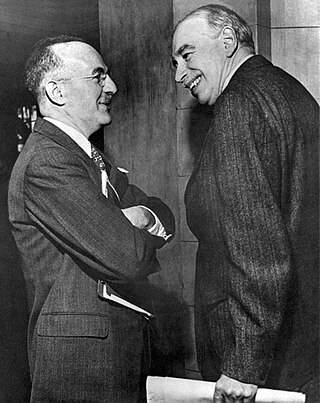

Alvin Harvey Hansen was an American economist who taught at the University of Minnesota and was later a chair professor of economics at Harvard University. Often referred to as "the American Keynes", he was a widely read popular author on economic issues, and an influential advisor to the government on economic policy. Hansen helped create the Council of Economic Advisors and the Social Security system. He is best remembered today for introducing Keynesian economics in the United States in the 1930s and 40s.

The permanent income hypothesis (PIH) is a model in the field of economics to explain the formation of consumption patterns. It suggests consumption patterns are formed from future expectations and consumption smoothing. The theory was developed by Milton Friedman and published in his A Theory of Consumption Function, published in 1957 and subsequently formalized by Robert Hall in a rational expectations model. Originally applied to consumption and income, the process of future expectations is thought to influence other phenomena. In its simplest form, the hypothesis states changes in permanent income, rather than changes in temporary income, are what drive changes in consumption.

The history of economic thought is the study of the philosophies of the different thinkers and theories in the subjects that later became political economy and economics, from the ancient world to the present day.

The neoclassical synthesis (NCS), neoclassical–Keynesian synthesis, or just neo-Keynesianism was a neoclassical economics academic movement and paradigm in economics that worked towards reconciling the macroeconomic thought of John Maynard Keynes in his book The General Theory of Employment, Interest and Money (1936). It was formulated most notably by John Hicks (1937), Franco Modigliani (1944), and Paul Samuelson (1948), who dominated economics in the post-war period and formed the mainstream of macroeconomic thought in the 1950s, 60s, and 70s.

Paul Davidson is an American macroeconomist who has been one of the leading spokesmen of the American branch of the post-Keynesian school in economics. He has actively intervened in important debates on economic policy from a position critical of mainstream economics.

The Keynesian cross diagram is a formulation of the central ideas in Keynes' General Theory of Employment, Interest and Money. It first appeared as a central component of macroeconomic theory as it was taught by Paul Samuelson in his textbook, Economics: An Introductory Analysis. The Keynesian cross plots aggregate income and planned total spending or aggregate expenditure.

Following the global 2007–2008 financial crisis, there was a worldwide resurgence of interest in Keynesian economics among prominent economists and policy makers. This included discussions and implementation of economic policies in accordance with the recommendations made by John Maynard Keynes in response to the Great Depression of the 1930s, most especially fiscal stimulus and expansionary monetary policy.

The Keynesian Revolution was a fundamental reworking of economic theory concerning the factors determining employment levels in the overall economy. The revolution was set against the then orthodox economic framework, namely neoclassical economics.

The post-war displacement of Keynesianism was a series of events which from mostly unobserved beginnings in the late 1940s, had by the early 1980s led to the replacement of Keynesian economics as the leading theoretical influence on economic life in the developed world. Similarly, the allied discipline known as development economics was largely displaced as the guiding influence on economic policies adopted by developing nations.

The Return of Depression Economics and the Crisis of 2008 is a non-fiction book by American economist and Nobel Prize winner Paul Krugman, written in response to growing socio-political discourse on the return of economic conditions similar to The Great Depression. The book was first published in 1999 and later updated in 2008 following his Nobel Prize of Economics. The Return of Depression Economics uses Keynesian analysis of past economics crisis, drawing parallels between the 2008 financial crisis and the Great Depression. Krugman challenges orthodox economic notions of restricted government spending, deregulation of markets and the efficient market hypothesis. Krugman offers policy recommendations for the prevention of future financial crises and suggests that policymakers "relearn the lessons our grandfathers were taught by the Great Depression" and prop up spending and enable broader access to credit.

Demand-side economics is a term used to describe the position that economic growth and full employment are most effectively created by high demand for products and services. According to demand-side economics, output is determined by effective demand. High consumer spending leads to business expansion, resulting in greater employment opportunities. Higher levels of employment create a multiplier effect that further stimulates aggregate demand, leading to greater economic growth.

The economics of defense or defense economics is a subfield of economics, an application of the economic theory to the issues of military defense. It is a relatively new field. An early specialized work in the field is the RAND Corporation report The Economics of Defense in the Nuclear Age by Charles J. Hitch and Roland McKean . It is an economic field that studies the management of government budget and its expenditure during mainly war times, but also during peace times, and its consequences on economic growth. It thus uses macroeconomic and microeconomic tools such as game theory, comparative statistics, growth theory and econometrics. It has strong ties to other subfields of economics such as public finance, economics of industrial organization, international economics, labour economics and growth economics.

Crowding-in occurs when government spending leads to more private investment. It occurs because public investment makes the private sector more productive, as well as because government spending may have a stimulative effect on the economy. It is contrasted with crowding out, which occurs when government spending leads to less private investment.