The economy of Singapore is a highly developed free-market economy with dirigiste characteristics. Singapore's economy has been previously ranked as the most open in the world, the joint 4th-least corrupt, and the most pro-business. Singapore has low tax-rates and the second-highest per-capita GDP in the world in terms of purchasing power parity (PPP). The Asia-Pacific Economic Cooperation (APEC) is headquartered in Singapore.

Health insurance or medical insurance is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses. As with other types of insurance, risk is shared among many individuals. By estimating the overall risk of health risk and health system expenses over the risk pool, an insurer can develop a routine finance structure, such as a monthly premium or payroll tax, to provide the money to pay for the health care benefits specified in the insurance agreement. The benefit is administered by a central organization, such as a government agency, private business, or not-for-profit entity.

Chubb Limited is an American company incorporated in Zürich, Switzerland. It is the parent company of Chubb, a global provider of insurance products covering property and casualty, accident and health, reinsurance, and life insurance and the largest publicly traded property and casualty company in the world. Chubb operates in 55 countries and territories and in the Lloyd's insurance market in London. Clients of Chubb consist of multinational corporations and local businesses, individuals, and insurers seeking reinsurance coverage. Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance and life insurance.

Deposit insurance or deposit protection is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due. Deposit insurance systems are one component of a financial system safety net that promotes financial stability.

The Central Provident Fund Board (CPFB), commonly known as the CPF Board or simply the Central Provident Fund (CPF), is a compulsory comprehensive savings and pension plan for working Singaporeans and permanent residents primarily to fund their retirement, healthcare, and housing needs in Singapore.

The National Trades Union Congress (NTUC), also known as the Singapore National Trades Union Congress (SNTUC) internationally, is the sole national trade union centre in Singapore. NTUC is at the heart of the Labour Movement which comprises 59 affiliated trade unions, 5 affiliated trade associations, 10 social enterprises, 6 related organisations as well as a growing ecosystem of U Associates and enterprise partners. Together, it helms May Day celebrations and organises an annual rally in support of workers' solidarity and commitment to tripartite partnership. The NTUC has had a symbiotic relationship with the People's Action Party (PAP) since its inception in 1961.

Lim Boon Heng is a Singaporean former politician. A former member of the governing People's Action Party (PAP), he was a Member of Parliament (MP) between 1980 and 2011, and had served in the Cabinet between 2001 and 2011. He was also the chairman of the party's Central Executive Committee (CEC) between 2004 and 2011.

NTUC FairPrice is the largest supermarket chain in Singapore. The company is a co-operative of the National Trades Union Congress (NTUC). The group has 100 supermarkets across the island, with over 160 outlets of Cheers convenience stores island-wide.

Hri Kumar Nair is a Singaporean lawyer and former politician. He is the Deputy Attorney-General of the Republic of Singapore. From 2006 to 2015, he was a Member of Parliament and a member of the People's Action Party. Nair retired from politics after his wife’s diagnosis of lymphoma in 2012.

GCH Retail (Malaysia) Sdn Bhd is a hypermarket and retailer chain now mainly in Malaysia, Singapore, Brunei and Cambodia, and formerly Indonesia and Vietnam. In 2016, Giant was the largest supermarket chain in Malaysia.

An equalization pool is a fund created to level out differences in financial risk, often across long periods of time, in a process known as risk equalization. Examples include mandatory health insurance and grower co-operatives.

Healthcare in Singapore or the Singapore healthcare system is under the purview of the Ministry of Health of the Government of Singapore. It mainly consists of a government-run publicly funded universal healthcare system as well as a significant private healthcare sector. Financing of healthcare costs is done through a mixture of direct government subsidies, compulsory comprehensive savings, a national healthcare insurance, and cost sharing.

Eastpoint Mall is a shopping mall located in Simei, Singapore beside Simei MRT station. It was formerly known for its wide selection of educational and enrichment centres and its pet shop, which was once the largest in Asia.

Tan Kin Lian is a Singaporean businessman who served as the chief executive officer of NTUC Income between 1997 and 2007, before standing for the 2011 presidential election.

Tan Suee Chieh is a Malaysian-Singaporean businessman and actuary. He was appointed the Group Chief Executive at NTUC Enterprise on 1 October 2013.

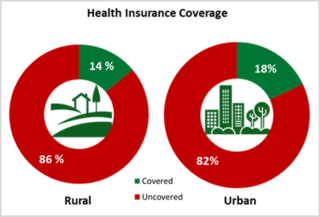

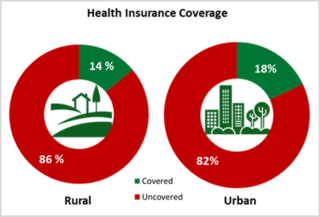

Health insurance in India is a growing segment of India's economy. The Indian healthcare system is one of the largest in the world, with the number of people it concerns: nearly 1.3 billion potential beneficiaries. The healthcare industry in India has rapidly become one of the most important sectors in the country in terms of income and job creation. In 2018, one hundred million Indian households do not benefit from health coverage. In 2011, 3.9% of India's gross domestic product was spent in the health sector. According to the World Health Organization (WHO), this is among the lowest of the BRICS economies. Policies are available that offer both individual and family cover. Out of this 3.9%, health insurance accounts for 5-10% of expenditure, employers account for around 9% while personal expenditure amounts to an astounding 82%. In the year 2016, the NSSO released the report “Key Indicators of Social Consumption in India: Health” based on its 71st round of surveys. The survey carried out in the year 2014 found out that, more than 80% of Indians are not covered under any health insurance plan, and only 18% of the urban population and 14% of the rural population was covered under any form of health insurance.

Seah Kian Peng is a Singaporean politician who served as Deputy Speaker of the Parliament of Singapore between 2011 and 2016. A member of the governing People's Action Party (PAP), he has been the Member of Parliament (MP) representing the Braddell Heights ward of Marine Parade GRC since 2006. He has also been serving as the chief executive officer of NTUC Fairprice since 2010.

FWD Group is a multinational insurance company based in Hong Kong. Founded in 2013 as the insurance arm of Pacific Century Group, FWD Group sells life and medical insurance, general insurance and employee benefits in Asia. The company had USD$50.9 billion in assets under management in 2020 and in 2021 was managing US$63 billion in assets. On February 28, 2022, FWD filed for a HK IPO. FWD currently operates in Hong Kong, Japan, Macau, Singapore, Thailand, Philippines, Indonesia, Vietnam, Malaysia and Cambodia.

The following lists events that happened during 2022 in the Republic of Singapore.