Nasdaq Helsinki, formerly known as the Helsinki Stock Exchange, is a stock exchange located in Helsinki, Finland. Since 3 September 2003, it has been part of Nasdaq Nordic. After the OMX merger, it was referred to as OMX Helsinki (OMXH), then after NASDAQ's acquisition of OMX in February 2008, NASDAQ OMX Helsinki, and currently Nasdaq Helsinki.

Nasdaq Nordic is the common name for the subsidiaries of Nasdaq, Inc. that provide financial services and operate marketplaces for securities in the Nordic and Baltic regions of Europe.

The electricity sector in Norway relies predominantly on hydroelectricity. A significant share of the total electrical production is consumed by national industry.

Singapore Exchange Limited is a Singapore-based exchange conglomerate, operating equity, fixed income, currency and commodity markets. It provides a range of listing, trading, clearing, settlement, depository and data services. SGX Group is also a member of the World Federation of Exchanges and the Asian and Oceanian Stock Exchanges Federation. it is ASEAN's second largest market capitalization after Indonesia Stock Exchange at US$609.653 billion as of September 2023.

Nasdaq, Inc. is an American multinational financial services corporation that owns and operates three stock exchanges in the United States: the namesake Nasdaq stock exchange, the Philadelphia Stock Exchange, and the Boston Stock Exchange, and seven European stock exchanges: Nasdaq Copenhagen, Nasdaq Helsinki, Nasdaq Iceland, Nasdaq Riga, Nasdaq Stockholm, Nasdaq Tallinn, and Nasdaq Vilnius. It is headquartered in New York City, and its president and chief executive officer is Adena Friedman.

The European Climate Exchange (ECX) managed the product development and marketing for ECX Carbon Financial Instruments, listed and admitted for trading on the ICE Futures Europe electronic platform. For a time it was a subsidiary of the Chicago Climate Exchange, but eventually became a sister company. Both companies as well as IFEX were owned by Climate Exchange Plc, a holding company listed on the London Stock Exchange's Alternative Investment Market, founded by Richard Sandor. A chief executive was Patrick Birley, son of archaeologist Robin Birley. While products were listed on the London Stock Exchange, the sales and marketing team was initially based in Amsterdam, the Netherlands, under its first CEO, Peter Koster, before moving to London in 2007. Climate Exchange Plc was bought in April 2010 by Intercontinental Exchange.

European Energy Exchange (EEX) AG is a central European electric power and related commodities exchange located in Leipzig, Germany. It develops, operates and connects secure, liquid and transparent markets for energy and related products, including power derivative contracts, emission allowances, agricultural and freight products.

The Nasdaq Copenhagen, formerly known as the Copenhagen Stock Exchange, is an international marketplace for Danish securities, including shares, bonds, treasury bills and notes, and financial futures and options.

Gasum Oy is a Finnish state-owned energy company operating in the Nordics. Gasum owns 17 biogas refineries in Finland and Sweden, and is the largest processor of biodegradable waste in the Nordic countries. In addition, Gasum sells wind power and provides various energy market services. It is in the process of building a gas filling station network that will also serve heavy-duty vehicles.

Statnett is a Norwegian state owned enterprise responsible for owning, operating and constructing the stem power grid in Norway. The company has its headquarters in Oslo, Norway.

Intercontinental Exchange, Inc. (ICE) is an American multinational financial services company formed in 2000 that operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services. Listed on the Fortune 500, S&P 500, and Russell 1000, the company owns exchanges for financial and commodity markets, and operates 12 regulated exchanges and marketplaces. This includes ICE futures exchanges in the United States, Canada, and Europe; the Liffe futures exchanges in Europe; the New York Stock Exchange; equity options exchanges; and OTC energy, credit, and equity markets.

NordLink is a subsea 1,400 megawatt (MW) HVDC power cable between Norway and Germany, opened in May 2021. The over 500 kilometres (310 mi) long cable operates at a voltage of 500 kV DC.

Nordic electricity market is a common market for electricity in the Nordic countries. It is one of the first free electric-energy markets in Europe and is traded in NASDAQ OMX Commodities Europe and Nord Pool Spot. In 2003, the largest market shares were as follows: Vattenfall 17%, Fortum 14.1%, Statkraft 8.9%, E.on 7.5%, Elsam 5%, Pohjolan Voima 5%. Other producers had 42.5% market share.

The European Multilateral Clearing Facility (EMCF) was a clearing house based in the Netherlands for equity trades done on stock exchanges or multilateral trading facility throughout Europe.

LCH is a financial market infrastructure company headquartered in London that provides clearing services to major international exchanges and to a range of OTC markets. The LCH Group includes two main entities: LCH Limited based in London and LCH SA based in Paris.

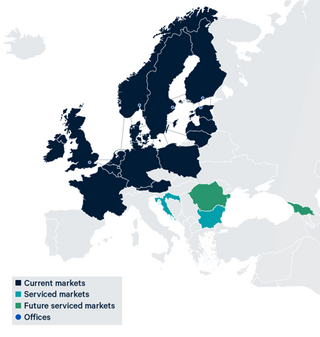

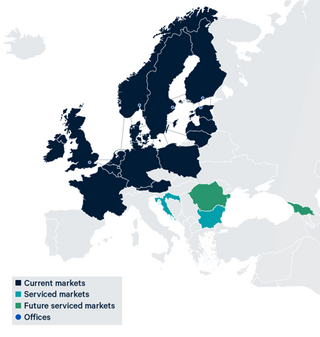

Nord Pool AS is a pan-European power exchange. Nord Pool has a main office in Oslo and further offices in Stockholm, Helsinki, Tallinn and London. The company is owned by the European exchange operator Euronext as well as TSO Holding, which represents the continental Nordic and Baltic countries' transmission system operators. Nord Pool has two subsidiaries, Nord Pool AB and Nord Pool Finland Oy.

BlueNext was a European environmental trading exchange, considered the largest CO2 permit spot market, with headquarters in Paris, France. On October 26, 2012, BlueNext announced that it would close permanently its spot and derivatives trading operations as of December 5, 2012.

European Commodity Clearing (ECC) is the leading clearing house for energy and commodity products in Europe and the central clearing house for the Global Commodity Exchange, EEX Group. ECC assumes the counterparty risk and guarantees the physical and financial settlement of transactions, providing security and cross-margining benefits for its customers. As part of EEX Group, ECC provides clearing services for EEX, EEX Asia and EPEX SPOT with additional services provided to Power Exchange Central Europe (PXE). In addition, ECC also provides clearing services for the partner exchanges HUPX, HUDEX, NOREXECO, SEEPEX and SEMOpx.

Nordic Mining ASA is an Anglo-Norwegian mining company based in Norway. Focussing on exploration and production of industrial minerals and metals, the company is primarily involved in rutile, quartz, and lithium. The company's shares are listed on Oslo Axess.