Related Research Articles

Chemical Bank was a bank with headquarters in New York City from 1824 until 1996. At the end of 1995, Chemical was the third-largest bank in the U.S., with about $182.9 billion in assets and more than 39,000 employees around the world.

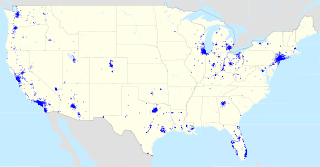

JPMorgan Chase & Co. is an American multinational financial institution headquartered in New York City and incorporated in Delaware. It is the largest bank in the United States and the world's largest bank by market capitalization as of 2023. As the largest of Big Four banks, the firm is considered systemically important by the Financial Stability Board. Its size and scale have often led to enhanced regulatory oversight as well as the maintenance of an internal "Fortress Balance Sheet" of capital reserves. The firm is headquartered at 383 Madison Avenue in Midtown Manhattan and is set to move into the under-construction JPMorgan Chase Building at 270 Park Avenue in 2025.

JPMorgan Chase Bank, N.A., doing business as Chase, is an American national bank headquartered in New York City that constitutes the consumer and commercial banking subsidiary of the U.S. multinational banking and financial services holding company, JPMorgan Chase. The bank was known as Chase Manhattan Bank until it merged with J.P. Morgan & Co. in 2000. Chase Manhattan Bank was formed by the merger of the Chase National Bank and the Manhattan Company in 1955. The bank merged with Chemical Bank New York in 1996 and later merged with Bank One Corporation in 2004 and in 2008 acquired the deposits and most assets of Washington Mutual.

Bankers Trust was a historic American banking organization. The bank merged with Alex. Brown & Sons in 1997 before being acquired by Deutsche Bank in 1999. Deutsche Bank sold the Trust and Custody division of Bankers Trust to State Street Corporation in 2003.

J.P. Morgan & Co. is an American financial institution specialized in investment banking, asset management and private banking founded by financier J. P. Morgan in 1871. Through a series of mergers and acquisitions, the company is now a subsidiary of JPMorgan Chase, one of the largest banking institutions in the world. The company has been historically referred to as the "House of Morgan" or simply Morgan. For 146 years, until 2000, J.P. Morgan specialized in commercial banking, before a merger with Chase Manhattan Bank led to the business line spinning off under the Chase brand.

Manufacturers Hanover Corporation was the bank holding company formed as parent of Manufacturers Hanover Trust Company, a large New York bank formed by a merger in 1961. After 1969, Manufacturers Hanover Trust became a subsidiary of Manufacturers Hanover Corporation. Charles J. Stewart was the company's first president and chairman.

John Pierpont Morgan Jr. was an American banker, finance executive, and philanthropist. He inherited the family fortune and took over the business interests including J.P. Morgan & Co. after his father J. P. Morgan died in 1913.

The Knickerbocker Trust was a bank based in New York City that was, at one time, among the largest banks in the United States. It was a central player in the Panic of 1907.

The Brooklyn Trust Company was a bank in New York City. Chartered in 1866, the Brooklyn Trust Company originally offered trust management and estate management services but also functioned as a commercial bank. The Brooklyn Trust Company acquired over a dozen smaller banks throughout its existence, merging with the Manufacturers Trust Company in 1950.

Douglas 'Sandy' Warner is an American banker who joined Morgan Guaranty Trust Company of New York out of college in 1968 as an officer's assistant and rose through the ranks to become chief executive officer and chairman of the board of J.P. Morgan & Co. Inc. in 1995. Among his many accomplishments, Warner may be best known for spearheading the 2000 sale of J P Morgan & Co. to Chase Manhattan Bank for $30.9 billion.

The New York Trust Company was a large trust and wholesale-banking business that specialized in servicing large industrial accounts. It merged with the Chemical Corn Exchange Bank and eventually the merged entity became Chemical Bank.

The National Reserve Bank of the City of New York was a New York City bank in that was formed from a merger of Consolidated National Bank and Oriental Bank in 1909 and operated until acquired by the Mutual Alliance Trust Company in 1914.

The Mutual Alliance Trust Company was a trust company formed in New York City in 1902, with founders such as Cornelius Vanderbilt III and William Rockefeller.

The Chatham Phenix National Bank and Trust Company was a bank in New York City connected with the Chatham Phenix Corporation. Its predecessor Chatham and Phenix National Bank was formed in 1911 when Chatham National Bank paid $1,880,000 to absorb the asset of the Phenix National Bank. The bank grew significantly as it absorbed smaller banking institutions, such as Mutual Alliance Trust Company and Century Bank in 1915, at which point Chatham and Phenix National Bank became the "first national bank to operate branches in the same city with the main bank."

The Astor Trust Company was a historic American banking organization. The firm merged with Bankers Trust in 1917.

Robert Lenox Kennedy, was an American banker and philanthropist who served as president of the National Bank of Commerce in New York and the Lenox Library.

James Strange Alexander Jr. was an American banker from New York who served as president of the National Bank of Commerce in New York and chairman of the board of the Guaranty Trust Company.

Frederick Sturges was an American businessman, philanthropist and art connoisseur who was, briefly, a brother-in-law of J.P. Morgan.

The Metropolitan Trust Company of the City of New York was a trust company located in New York City that was founded in 1881. The trust company merged with the Chatham and Phenix National Bank in 1925 under the name of the Chatham Phenix National Bank and Trust Company of New York.

Henry Clay Alexander was an American banker who served as president, chairman, and CEO of J.P. Morgan & Co.

References

- Notes

- ↑ Before the merger, the Bank of Commerce directors were J. Pierpont Morgan, John Claflin, George G. Haven, Joseph C. Hendrix, James N. Jarvie, Augustus D. Juilliard, John Stewart Kennedy, Woodbury Langdon, Charles D. Lanier, Alexander E. Orr, Charles H. Russell, and Frederick Sturges. The directors of the National Union Bank of New York were Samuel D. Babcock, John D. Crimmins, Frederic Cromwell, George G. Haven, R. Somers Hayes, Joseph C. Hendrix, Augustus D. Juilliard, Daniel S. Lamont, Richard A. McCurdy, F. P. Olcott, Henry H. Rogers, Hamilton McKown Twombly, and William C. Whitney. [3]

- Sources

- 1 2 3 4 "GUARANTY TRUST MARKS CENTENARY; Merged Bank of Commerce Was Founded on Jan. 1, 1839, With $5,000,000 Capital". The New York Times . January 2, 1939. Retrieved 23 June 2021.

- ↑ "IN AND ABOUT THE CITY; ROBERT LENOX KENNEDY DEAD DYING ON THE STEAMSHIP ON HIS WAY HOME". The New York Times . September 17, 1887. Retrieved 23 June 2021.

- 1 2 3 "CONSOLIDATION OF BANKS; The Bank of Commerce and Union Directorates Take Action. TALK OF GREATER COALITION J. Pierpont Morgan and the Mutual Life Interested -- National City Bank Mentioned". The New York Times . January 11, 1900. p. 4. Retrieved 24 June 2021.

- ↑ "NEW BANKS AUTHORIZED". The New York Times . March 16, 1900. Retrieved 24 June 2021.

- ↑ "PLAN TO MERGE BIG BANKS NOW ASSURED; National Bank of Commerce and Western to Combine. Consolidated Institution to be Managed by a Committee of Three -- Mutual Life, Equitable Life, Morgan, Gould, and Morton Trust Interests". The New York Times . May 10, 1903. Retrieved 24 June 2021.

- ↑ "BANK MERGER DETAILS; Western National to be Absorbed by the Bank of Commerce. New Institution Will Have $25,000,000 Capital -- Valentine P. Snyder May Be President". The New York Times . June 18, 1903. Retrieved 24 June 2021.

- ↑ Times, Special to The New York (February 21, 1903). "BOSTON STOCK MARKET.; Western National Bank. Bank to Increase Its Stock". The New York Times . Retrieved 24 June 2021.

- ↑ "TWO BANKS MERGED.; Western and United States Shareholders Vote Approval". The New York Times . January 14, 1903. p. 6. Retrieved 24 June 2021.

- 1 2 3 "BIG INTERESTS MERGED IN BANK OF COMMERCE; Effect of the Absorption of the Western National. Closer Bond Between Equitable Life and Mutual Life Companies -- Executive Officers in Consolidation". The New York Times . October 7, 1903. p. 16. Retrieved 24 June 2021.

- 1 2 "NEW COMMERCE BANK HEAD.; James S. Alexander Promoted to Presidency to Succeed V.P. Snyder". The New York Times . September 7, 1911. Retrieved 24 June 2021.

- ↑ "NEW POST CREATED FOR J.S. ALEXANDER; He Is Made Chairman of the Board of the National Bank of Commerce". The New York Times . June 1, 1923. Retrieved 24 June 2021.

- ↑ Alexander, James Strange (1925). National Bank of Commerce in New York: Address by James S. Alexander, at Annual Meeting of the Shareholders January 13, 1925. National Bank of Commerce in New York. Retrieved 24 June 2021.

- ↑ TIMES, Special to THE NEW YORK (June 17, 1950). "EX-BANKER ENDS LIFE IN BRONXVILLE HOME". The New York Times . Retrieved 24 June 2021.

- 1 2 "BANK OF COMMERCE TO GIVE UP ITS TITLE; $2,000,000,000 Institution to Result From Merger Will Be Called Guaranty Trust Co". The New York Times . March 5, 1929. Retrieved 24 June 2021.

- ↑ "$2,000,000,000 BANK, LARGEST IN COUNTRY, FORMED BY MERGER; Guaranty Trust and National Bank of Commerce Near End of Huge Transaction. NATIONAL CITY OUTRANKED Myron Taylor, Steel Executive, Is Credited With Being the Dominant Figure in Deal. STATEMENT READY MONDAY Skyscraper on Present Sites to House Both Is Reported Planned-- Share-for-share Exchange Seen. Resources of the Banks. Merger Regarded as Logical. Gained Prominence in Steel. Grew Largely Without Mergers. Alexander Power in Expansion". The New York Times . February 22, 1929. Retrieved 24 June 2021.

- ↑ "ACTS ON BANK MERGER.; Guaranty Trusts Board Approves Union With Bank of Commerce". The New York Times . April 9, 1929. Retrieved 24 June 2021.

- ↑ "BANK MERGER IN EFFECT.; Guaranty Trust Begins Business United With Bank of Commerce". The New York Times . May 7, 1929. Retrieved 24 June 2021.

- ↑ "J.S. ALEXANDER QUITS GUARANTY TRUST; Ex-Head of Bank of Commerce to Retire as Chairman of Merged Institutions Jan. 1. HAD DISTINGUISHED CAREER Active in Financial Circles for 30 Years, He Was Cited by Three Nations for War Services". The New York Times . December 19, 1929. p. 42. Retrieved 24 June 2021.

- ↑ "BANKS' DIRECTORS APPROVE MERGER; Boards of Guaranty Trust and Morgan Schedule Stockholder Votes BANKS' DIRECTORS APPROVE MERGER". The New York Times . February 9, 1959. Retrieved 24 June 2021.

- ↑ McGeehan, Patrick (December 15, 2000). "Chase and Morgan Say Earnings Will Fall Short". The New York Times . Retrieved 24 June 2021.