A pension fund, also known as a superannuation fund in some countries, is any program, fund, or scheme which provides retirement income.

War bonds are debt securities issued by a government to finance military operations and other expenditure in times of war without raising taxes to an unpopular level. They are also a means to control inflation by removing money from circulation in a stimulated wartime economy. War bonds are either retail bonds marketed directly to the public or wholesale bonds traded on a stock market. Exhortations to buy war bonds have often been accompanied by appeals to patriotism and conscience. Retail war bonds, like other retail bonds, tend to have a yield which is below that offered by the market and are often made available in a wide range of denominations to make them affordable for all citizens.

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending, in addition to taxation. Since 2012, the U.S. government debt has been managed by the Bureau of the Fiscal Service, succeeding the Bureau of the Public Debt.

Yorkshire Bank is a trading name used by Clydesdale Bank plc for its retail banking operations in England.

The Trustee Savings Bank (TSB) was a British financial institution that operated between 1810 and 1995 when it was merged with Lloyds Bank. Trustee savings banks originated to accept savings deposits from those with moderate means. Their shares were not traded on the stock market but, unlike mutually held building societies, depositors had no voting rights; nor did they have the power to direct the financial and managerial goals of the organisation. Directors were appointed as trustees on a voluntary basis. The first trustee savings bank was established by Rev. Henry Duncan of Ruthwell in Dumfriesshire for his poorest parishioners in 1810, with its sole purpose being to serve the local people in the community. Between 1970 and 1985, the various trustee savings banks in the United Kingdom were amalgamated into a single institution named TSB Group plc, which was floated on the London Stock Exchange. In 1995, the TSB merged with Lloyds Bank to form Lloyds TSB, at that point the largest bank in the UK by market share and the second-largest by market capitalisation.

A liberty bond or liberty loan was a war bond that was sold in the United States to support the Allied cause in World War I. Subscribing to the bonds became a symbol of patriotic duty in the United States and introduced the idea of financial securities to many citizens for the first time.

Islamic Relief Worldwide is a faith-inspired humanitarian and development agency which is working to support and empower the world's most vulnerable people.

The state treasurer of California is a constitutional officer in the executive branch of the government of the U.S. state of California. Thirty-five individuals have held the office of state treasurer since statehood. The incumbent is Fiona Ma, a Democrat. The state treasurer's main office is located in the Jesse M. Unruh State Office Building in Sacramento.

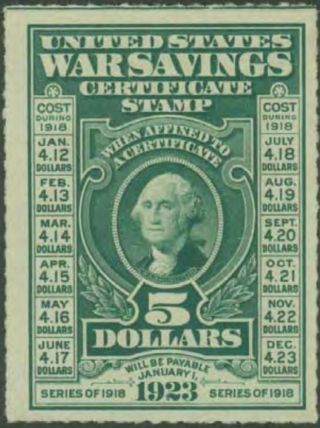

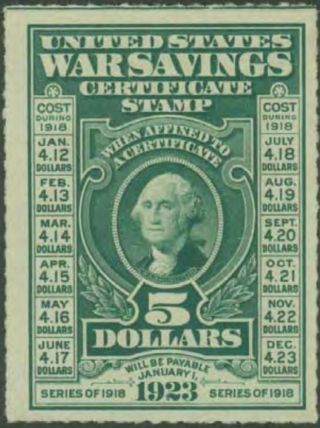

War savings stamps were issued by the United States Treasury Department to help fund participation in World War I and World War II. Although these stamps were distinct from the postal savings stamps issued by the United States Post Office Department, the Post Office nevertheless played a major role in promoting and distributing war savings stamps. In contrast to Liberty Bonds, which were purchased primarily by financial institutions, war savings stamps were principally aimed at common citizens. During World War I, 25-cent Thrift stamps were offered to allow individuals to accumulate enough over time to purchase the standard 5-dollar War Savings Certificate stamp. When the Treasury began issuing war savings stamps during World War II, the lowest denomination was a 10-cent stamp, enabling ordinary citizens to purchase them. In many cases, collections of war savings stamps could be redeemed for Treasury Certificates or War Bonds.

National Savings and Investments (NS&I), formerly called the Post Office Savings Bank and National Savings, is a state-owned savings bank in the United Kingdom. It is both a non-ministerial government department and an executive agency of HM Treasury. The aim of NS&I has been to attract funds from individual savers in the UK for the purpose of funding the government's deficit. NS&I attracts savers through offering savings products with tax-free elements on some products, and a 100% guarantee from HM Treasury on all deposits. As of 2017, approximately 9% of the government's debt is met by funds raised through NS&I, around half of which is from the Premium Bond offering.

Interpal is the working name for Palestinian Relief and Development Fund, a British charity founded in 1994 that describes itself as a non-political charity to alleviate problems faced by Palestinians, and focused solely on the provision of relief and development aid to the poor and needy Palestinians the world over, but primarily in the Palestinian territories, Lebanon and Jordan.

Sir William Wedderburn, 4th Baronet, JP DL was a British civil servant and politician who was a Liberal Party member of Parliament (MP). Wedderburn was one of the founding members of the Indian National Congress. He was also the president of Congress in 1889 and 1910, for the Allahabad session.

The Freedman's Saving and Trust Company, known as the Freedman's Savings Bank, was a private savings bank chartered by the U.S. Congress on March 3, 1865, to collect deposits from the newly emancipated communities. The bank opened 37 branches across 17 states and Washington DC within 7 years and collected funds from over 67,000 depositors. At the height of its success, the Freedman's Savings Bank held assets worth more than $3.7 million in 1872 dollars, which translates to approximately $80 million in 2021.

The Campaign for Nuclear Disarmament (CND) is an organisation that advocates unilateral nuclear disarmament by the United Kingdom, international nuclear disarmament and tighter international arms regulation through agreements such as the Nuclear Non-Proliferation Treaty. It opposes military action that may result in the use of nuclear, chemical or biological weapons, and the building of nuclear power stations in the UK.

Wesleyan Assurance Society is a financial services mutual that provides advice and products to select professional groups – notably GPs, hospital doctors, dentists and teachers.

Donald's Decision is a four-minute educational short animated film made by the Walt Disney Studios, for the National Film Board of Canada. The film was released theatrically on January 11, 1942 as part of a series of four films directed at the Canadian public to buy war bonds during the Second World War.

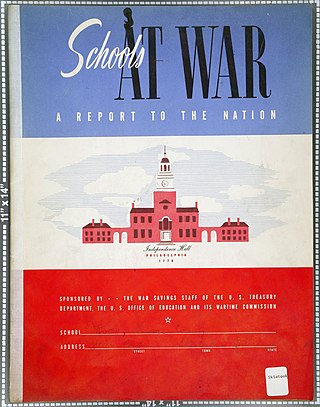

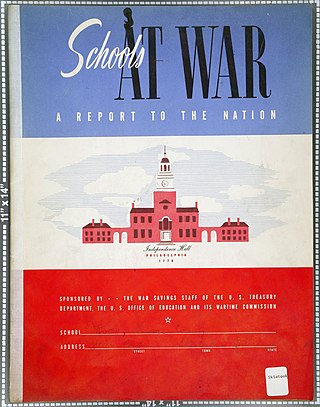

The American Schools at War program was a program during World War II run by the U.S. Treasury Department, in which schoolchildren set goals to sell stamps and bonds to help the war effort. The program was also administered by the U.S. Office of Education, the Federal government agency that interfaced with the nation's school systems and its thirty-two million students. The Office, however, allowed the Treasury to work with the schools directly as the main objective of the program was raising money.

The Aberdeen Savings Bank was a Scottish savings bank. It was formed in 1815 and reconstituted in 1845 under the 1835 Savings Act. It remained a small bank until the interwar period when a series of acquisitions made it grow to fifth in size in 1944. It became one of Scotland's four regional savings banks in 1975. In 1983, it became a part of TSB Scotland.

St Martin’s Place Bank was founded in London in 1816 and for much of the nineteenth century was the leading savings bank in the country. However, it went into decline in the latter part of the century and, in 1896, declined to accept the recommendations of the independent Inspection Committee. The Bank closed its doors and transferred the depositors’ funds to the Post Office.

The London Savings Bank was a product of a 1916 merger between the London Provident Institution (1816), the Bloomsbury Savings Bank (1817) and the Lambeth Savings Bank (1818). In 1942 the Finsbury and City of London Savings Bank amalgamated with the London Savings Bank. In 1971, the London Savings Bank became part of the London and South Eastern TSB, which in turn became part of TSB South East.