The Policy Analysis Market (PAM), part of the FutureMAP project, was a proposed futures exchange developed, beginning in May 2001, by the Information Awareness Office (IAO) of the United States Defense Advanced Research Projects Agency (DARPA), and based on an idea first proposed by Net Exchange, a San Diego, California, research firm specializing in the development of online prediction markets. PAM was shut down in August 2003 after multiple US senators condemned it as an assassination and terrorism market, a characterization criticized in turn by futures-exchange expert Robin Hanson of George Mason University, and several journalists. Since PAM's closure, several private-sector variations on the idea have been launched.

Prediction markets, also known as betting markets, information markets, decision markets, idea futures or event derivatives, are open markets that enable the prediction of specific outcomes using financial incentives. They are exchange-traded markets established for trading bets in the outcome of various events. The market prices can indicate what the crowd thinks the probability of the event is. A prediction market contract trades between 0 and 100%. The most common form of a prediction market is a binary option market, which will expire at the price of 0 or 100%. Prediction markets can be thought of as belonging to the more general concept of crowdsourcing which is specially designed to aggregate information on particular topics of interest. The main purposes of prediction markets are eliciting aggregating beliefs over an unknown future outcome. Traders with different beliefs trade on contracts whose payoffs are related to the unknown future outcome and the market prices of the contracts are considered as the aggregated belief.

Robin Dale Hanson is an associate professor of economics at George Mason University and a research associate at the Future of Humanity Institute of Oxford University. He is known for his work on idea futures and markets, and he was involved in the creation of the Foresight Institute's Foresight Exchange and DARPA's FutureMAP project. He invented market scoring rules like LMSR used by prediction markets such as Consensus Point, and has conducted research on signalling.

James Michael Surowiecki is an American journalist. He was a staff writer at The New Yorker, where he wrote a regular column on business and finance called "The Financial Page".

Herd mentality describes how people can be influenced by the majority.

Jean-Jacques Servan-Schreiber, often referred to as JJSS, was a French journalist and politician. He co-founded L'Express in 1953 with Françoise Giroud, and then went on to become president of the Radical Party in 1971. He oversaw its transition to the center-right, the party being thereafter known as Parti radical valoisien. He tried to found in 1972 the Reforming Movement with Christian Democrat Jean Lecanuet, with whom he supported Valéry Giscard d'Estaing's conservative candidature to the 1974 presidential election.

The Wisdom of Crowds: Why the Many Are Smarter Than the Few and How Collective Wisdom Shapes Business, Economies, Societies and Nations, published in 2004, is a book written by James Surowiecki about the aggregation of information in groups, resulting in decisions that, he argues, are often better than could have been made by any single member of the group. The book presents numerous case studies and anecdotes to illustrate its argument, and touches on several fields, primarily economics and psychology.

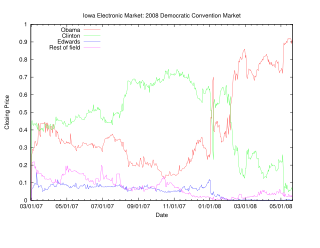

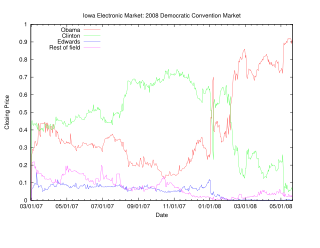

The Iowa Electronic Markets (IEM) are a group of real-money prediction markets/futures markets operated by the University of Iowa Tippie College of Business. Unlike normal futures markets, the IEM is not-for-profit; the markets are run for educational and research purposes.

We Are Smarter Than Me is a collaborative-writing project using wiki software, whose initial goal was producing a book about decision making processes that use large numbers of people. The first book was published as a printed book, late in 2007, by the publishing conglomerate Pearson Education. Along with Pearson, the project's four core sponsors include research institutes of the MIT Sloan School of Management and the Wharton School of the University of Pennsylvania.

Collective wisdom, also called group wisdom and co-intelligence, is shared knowledge arrived at by individuals and groups.

The wisdom of the crowd is the collective opinion of a diverse independent group of individuals rather than that of a single expert. This process, while not new to the Information Age, has been pushed into the mainstream spotlight by social information sites such as Quora, Reddit, Stack Exchange, Wikipedia, Yahoo! Answers, and other web resources which rely on collective human knowledge. An explanation for this phenomenon is that there is idiosyncratic noise associated with each individual judgment, and taking the average over a large number of responses will go some way toward canceling the effect of this noise.

Intrade.com was a web-based trading exchange whose members "traded" contracts between each other on the probabilities of various events occurring. After having been forced to exclude US traders in 2012, on 10 March 2013 Intrade suspended all trading, citing possible "financial irregularities". For a time after the suspension, the intrade.com website stated that they were working on a relaunch of the site, called "Intrade 2.0", but as of August 2014 it states that "It appears very unlikely now that Intrade will resume trading services in the way it had operated previously", and announced plans to close all accounts and refund monies by 31 December 2014.

Decentralized decision-making is any process where the decision-making authority is distributed throughout a larger group. It also connotes a higher authority given to lower level functionaries, executives, and workers. This can be in any organization of any size, from a governmental authority to a corporation. However, the context in which the term is used is generally that of larger organizations. This distribution of power, in effect, has far-reaching implications for the fields of management, organizational behavior, and government.

The dumb agent theory (DAT) states that many people making individual buying and selling decisions will better reflect true value than any one individual can. In finance this theory is predicated on the efficient-market hypothesis (EMH). One of the first instances of the dumb agent theory in action was with the Policy Analysis Market (PAM); a futures exchange developed by DARPA. While this project was quickly abandoned by the Pentagon, its idea is now implemented in futures exchanges and prediction markets such as Intrade, Newsfutures and Predictify. The DAT is technically a hypothesis, not a theory.

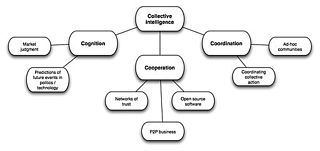

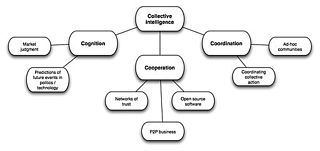

Collective intelligence (CI) is shared or group intelligence (GI) that emerges from the collaboration, collective efforts, and competition of many individuals and appears in consensus decision making. The term appears in sociobiology, political science and in context of mass peer review and crowdsourcing applications. It may involve consensus, social capital and formalisms such as voting systems, social media and other means of quantifying mass activity. Collective IQ is a measure of collective intelligence, although it is often used interchangeably with the term collective intelligence. Collective intelligence has also been attributed to bacteria and animals.

In finance, box office futures is a type of futures contract in which investors speculate on upcoming movies based on their predicted performance.

Bet2Give.com was an online prediction market company started in 2007 by Émile Servan-Schreiber and Maurice Balick, as an offshoot to their NewsFutures. Bet2Give's premise was that having the winnings going automatically to a charity of the winner's choice wouldn't seriously interfere with the efficacy of the prediction market. Servan-Schreiber had conducted research a few years earlier into whether betting with "play money" reduced prediction market accuracy, with encouraging results.

The Good Judgment Project (GJP) is an organization dedicated to "harnessing the wisdom of the crowd to forecast world events". It was co-created by Philip E. Tetlock, decision scientist Barbara Mellers, and Don Moore, all professors at the University of Pennsylvania.

PredictIt is a New Zealand-based online prediction market that offers exchanges on political and financial events. PredictIt is owned and operated by Victoria University of Wellington with support from Aristotle, Inc. The company's office is located in Washington, D.C.

Augur is a decentralized prediction market platform built on the Ethereum blockchain. Augur is developed by Forecast Foundation, which was founded in 2014 by Jack Peterson, Joey Krug, and Jeremy Gardner. Forecast Foundation is advised by Ron Bernstein, founder of now-defunct company Intrade, and Ethereum founder Vitalik Buterin.