The economy of Denmark is a modern high-income and mixed economy.

Unemployment benefits, also called unemployment insurance, unemployment payment, unemployment compensation, or simply unemployment, are payments made by authorized bodies to unemployed people. In the United States, benefits are funded by a compulsory governmental insurance system, not taxes on individual citizens. Depending on the jurisdiction and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary.

In macroeconomics and finance, a transfer payment is a redistribution of income and wealth by means of the government making a payment, without goods or services being received in return. These payments are considered to be non-exhaustive because they do not directly absorb resources or create output. Examples of transfer payments include welfare, financial aid, social security, and government subsidies for certain businesses.

The Hartz concept, also known as Hartz reforms or the Hartz plan, is a set of recommendations submitted by a committee on reforms to the German labour market in 2002. Named after the head of the committee, Peter Hartz, these recommendations went on to become part of the German government's Agenda 2010 series of reforms, known as Hartz I – Hartz IV. The committee devised thirteen "innovation modules", which recommended changes to the German labour market system. These were then gradually put into practice: The measures of Hartz I – III were undertaken between 1 January 2003, and 2004, while Hartz IV was implemented on 1 January 2005.

Unemployment benefits in Sweden are payments made by the state or other authorized bodies to unemployed people. They can be divided into a voluntary scheme with income-related compensation up to a certain level, or a comprehensive scheme that provides a lower level of basic support.

The Italian welfare state is based partly upon the corporatist-conservative model and partly upon the universal welfare model.

The Royal Norwegian Ministry of Labour and Social Inclusion is a Norwegian ministry established in 1846. It is responsible for the labour market, the working environment, pensions, welfare, social security, integration, immigration, asylum, minorities and the Sami. Since 2022 the ministry has been led by Marte Mjøs Persen of the Labour Party).

Taxation in Denmark consists of a comprehensive system of direct and indirect taxes. Ever since the income tax was introduced in Denmark via a fundamental tax reform in 1903, it has been a fundamental pillar in the Danish tax system. Today various personal and corporate income taxes yield around two thirds of the total Danish tax revenues, indirect taxes being responsible for the last third. The state personal income tax is a progressive tax while the municipal income tax is a proportional tax above a certain income level.

In 2017, Norway's immigrant population consisted of 883,751 people, making up 16.8% of the country's total population. Of this number, 724,987 are foreign-born, while 158,764 are Norwegian-born with foreign-born parents. The ten most common countries of origin of immigrants residing in Norway are Poland (97,197), Lithuania (37,638), Sweden (36,315), Somalia (28,696), Germany (24,601), Iraq (22,493), Syria (20,823), Philippines (20,537), Pakistan (19,973) and Eritrea (19,957). The immigrant population comprises people from a total of 221 countries and autonomous regions, but 25% of the immigrants are from one of four migrant groups: Polish, Lithuanians, Swedes and Somalis.

Kjersti Toppe is a Norwegian doctor and politician representing the Centre Party. She has served as minister of children and families since 2021, and an MP from Hordaland since 2009.

Aetat was a Norwegian government agency responsible for battling unemployment.

The National Insurance Service was a Norwegian government agency responsible for social security.

Taxation in Norway is levied by the central government, the county municipality and the municipality. In 2012 the total tax revenue was 42.2% of the gross domestic product (GDP). Many direct and indirect taxes exist. The most important taxes – in terms of revenue – are VAT, income tax in the petroleum sector, employers' social security contributions and tax on "ordinary income" for persons. Most direct taxes are collected by the Norwegian Tax Administration and most indirect taxes are collected by the Norwegian Customs and Excise Authorities.

The Labour and Welfare Director is an office (embete) in Norway, created in 2006. The Labour and Welfare Director is the head of the Labour and Welfare Service as well as the Labour and Welfare Administration (NAV), which comprises both the state Labour and Welfare Service and the municipal labour and welfare offices. The Labour and Welfare Director is appointed by the King-in-Council, effectively by the government. The Director is responsible for one third of the state budget of Norway and 19,000 employees. It is the only office in Norway to be responsible for both state and municipal services. The incumbent Labour and Welfare Director is Joakim Lystad.

The Labour and Welfare Service is a government agency of Norway. Together with municipal welfare agencies, it makes up the Norwegian Labour and Welfare Administration (NAV). The Labour and Welfare Service is led by Labour and Welfare Directorate, a government directorate located in Oslo. Its head is the Labour and Welfare Director, currently Joakim Lystad. The Labour and Welfare Service has 14,000 employees, whereas the Norwegian Labour and Welfare Administration as a whole has 19,000 employees. The service is subordinate to the Ministry of Labour and Social Inclusion.

Syrians in Denmark are citizens and residents of Denmark who are of Syrian descent.

Lebanese people of Denmark are people from Lebanon or those of Lebanese descent who live in the country of Denmark. The majority of Lebanese people came to Denmark in the 1970s and 1980s, either escaping the Lebanese Civil War or for economic reasons. Per 1 October 2016, 26,404 persons in Denmark were of Lebanese origin.

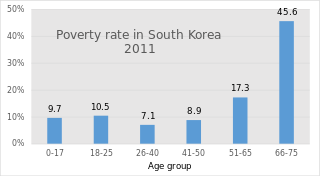

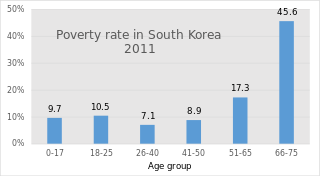

South Korea's pension scheme was introduced relatively recently, compared to other democratic nations. Half of the country's population aged 65 and over lives in relative poverty, or nearly four times the 13% average for member countries of the Organisation for Economic Co-operation and Development (OECD). This makes old age poverty an urgent social problem. Public social spending by general government is half the OECD average, and is the lowest as a percentage of GDP among OECD member countries.

Somalis in Norway are citizens and residents of Norway who are of Somali descent. They are the biggest African migration group in Norway. 36.5% of Somalis in Norway live in the capital Oslo. Almost all Somali in Norway have come to Norway as refugees from the Somali Civil War. In 2016, Somalis were the largest non-European migrant group in Norway.

Poverty in Norway had been declining from World War II until the Global Financial Crisis. It is now increasing slowly, and is significantly higher among immigrants from the Middle East and Africa. Before an analysis of poverty can be undertaken, the definition of poverty must first be established, because it is a subjective term. The measurement of poverty in Norway deviates from the measurement used by the OECD. Norway traditionally has been a global model and leader in maintaining low levels on poverty and providing a basic standard of living for even its poorest citizens. Norway combines a free market economy with the welfare model to ensure both high levels of income and wealth creation and equal distribution of this wealth. It has achieved unprecedented levels of economic development, equality and prosperity.