Cost accounting is defined by the Institute of Management Accountants as "a systematic set of procedures for recording and reporting measurements of the cost of manufacturing goods and performing services in the aggregate and in detail. It includes methods for recognizing, allocating, aggregating and reporting such costs and comparing them with standard costs". Often considered a subset of managerial accounting, its end goal is to advise the management on how to optimize business practices and processes based on cost efficiency and capability. Cost accounting provides the detailed cost information that management needs to control current operations and plan for the future.

In management accounting or managerial accounting, managers use accounting information in decision-making and to assist in the management and performance of their control functions.

Inventory or stock refers to the goods and materials that a business holds for the ultimate goal of resale, production or utilisation.

Cost of goods sold (COGS) is the carrying value of goods sold during a particular period.

In accountancy, depreciation refers to two aspects of the same concept: first, an actual reduction in the fair value of an asset, such as the decrease in value of factory equipment each year as it is used and wears, and second, the allocation in accounting statements of the original cost of the assets to periods in which the assets are used.

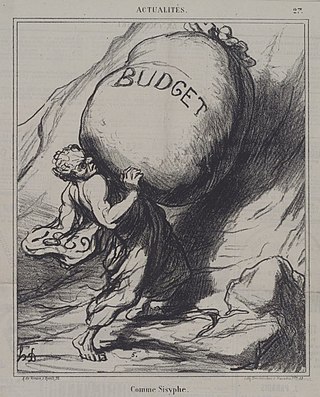

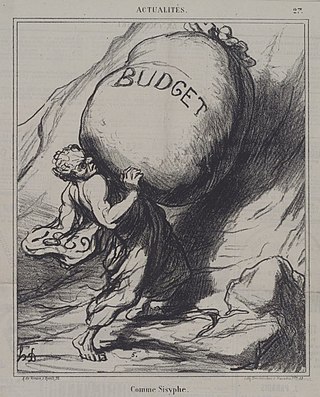

A budget is a calculation plan, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms.

Activity-based costing (ABC) is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each. Therefore, this model assigns more indirect costs (overhead) into direct costs compared to conventional costing.

Throughput accounting (TA) is a principle-based and simplified management accounting approach that provides managers with decision support information for enterprise profitability improvement. This approach that identifies factors which limit an organization's ability to reach its goals, and then focuses on simple measures that drive behavior in key areas towards reaching organizational goals. TA was proposed by Eliyahu M. Goldratt as an alternative to traditional cost accounting. As such, Throughput Accounting is neither cost accounting nor costing because it is cash focused and does not allocate all costs to products and services sold or provided by an enterprise. Considering the laws of variation, only costs that vary totally with units of output e.g. raw materials, are allocated to products and services which are deducted from sales to determine Throughput. Throughput Accounting is a management accounting technique used as the performance measure in the Theory of Constraints (TOC). It is the business intelligence used for maximizing profits, however, unlike cost accounting that primarily focuses on 'cutting costs' and reducing expenses to make a profit, Throughput Accounting primarily focuses on generating more throughput. Conceptually, Throughput Accounting seeks to increase the speed or rate at which throughput is generated by products and services with respect to an organization's constraint, whether the constraint is internal or external to the organization. Throughput Accounting is the only management accounting methodology that considers constraints as factors limiting the performance of organizations.

In business and accounting, net income is an entity's income minus cost of goods sold, expenses, depreciation and amortization, interest, and taxes for an accounting period.

A timesheet is a method for recording the amount of a worker's time spent on each job. Traditionally a sheet of paper with the data arranged in tabular format, a timesheet is now often a digital document or spreadsheet. The time cards stamped by time clocks can serve as a timesheet or provide the data to fill one. These, too, are now often digital. Timesheets came into use in the 19th century as time books. To record time in a more granular fashion, time-tracking software may be used.

Construction management (CM) aims to control the quality of a construction project's scope, time, and cost to maximize the project owner's satisfaction. It uses project management techniques and software to oversee the planning, design, construction and closeout of a construction project safely, on time, on budget and within specifications.

In accounting, the revenue recognitionprinciple states that revenues are earned and recognized when they are realized or realizable, no matter when cash is received.

Construction accounting is a form of project accounting applied to construction projects. See also production accounting. Construction accounting is a vitally necessary form of accounting, especially when multiple contracts come into play. The construction field uses many terms not used in other forms of accounting, such as "draw" and progress billing. Construction accounting may also need to account for vehicles and equipment, which may or may not be owned by the company as a fixed asset. Construction accounting requires invoicing and vendor payment, more or less as to the amount of business done.

A cost overrun, also known as a cost increase or budget overrun, involves unexpected incurred costs. When these costs are in excess of budgeted amounts due to a value engineering underestimation of the actual cost during budgeting, they are known by these terms.

In business, an overhead or overhead expense is an ongoing expense of operating a business. Overheads are the expenditure which cannot be conveniently traced to or identified with any particular revenue unit, unlike operating expenses such as raw material and labor. Overheads cannot be immediately associated with the products or services being offered, and so do not directly generate profits. However, they are still vital to business operations as they provide critical support for the business to carry out profit making activities. One example would be the rent for a factory, which allows workers to manufacture products which can then be sold for a profit. Such expenses are incurred for output generally and not for particular work order; e.g., wages paid to watch and ward staff, heating and lighting expenses of factory, etc. Overheads are an important cost element, alongside direct materials and direct labor.

Job costing is accounting which tracks the costs and revenues by "job" and enables standardized reporting of profitability by job. For an accounting system to support job costing, it must allow job numbers to be assigned to individual items of expenses and revenues. A job can be defined to be a specific project done for one customer, or a single unit of product manufactured, or a batch of units of the same type that are produced together.

A glossary of terms relating to project management and consulting.

The following outline is provided as an overview of and topical guide to project management:

The following is a glossary of terms relating to construction cost estimating.

Standard cost accounting is a traditional cost accounting method introduced in the 1920s, as an alternative for the traditional cost accounting method based on historical costs.