Related Research Articles

Saatchi & Saatchi is a British multinational communications and advertising agency network with 114 offices in 76 countries and over 6,500 staff. It was founded in 1970 and is currently headquartered in London. The parent company of the agency group was known as Saatchi & Saatchi PLC from 1976 to 1994, was listed on the New York Stock Exchange until 2000 and, for a time, was a constituent of the FTSE 100 Index. In 2000, the group was acquired by the Publicis Groupe. In 2005 it went private.

Tribune Media Company, also known as Tribune Company, was an American multimedia conglomerate headquartered in Chicago, Illinois.

An advertising agency, often referred to as a creative agency or an ad agency, is a business dedicated to creating, planning, and handling advertising and sometimes other forms of promotion and marketing for its clients. An ad agency is generally independent of the client; it may be an internal department or agency that provides an outside point of view to the effort of selling the client's products or services, or an outside firm. An agency can also handle overall marketing and branding strategies promotions for its clients, which may include sales as well.

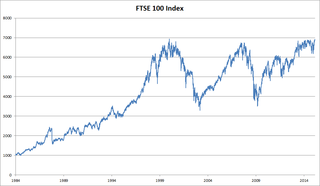

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie", is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalisation. The index is maintained by the FTSE Group, a subsidiary of the London Stock Exchange Group.

Omnicom Group Inc. is an American global media, marketing and corporate communications holding company, headquartered in New York City.

WPP plc is a British multinational communications, advertising, public relations, technology, and commerce holding company headquartered in London, England. It was the world's largest advertising company, as of 2019. WPP plc owns many companies, which includes advertising, public relations, media, and market research networks such as AKQA, BCW, CMI Media Group, Essence Global, Finsbury, Grey, Hill+Knowlton Strategies, Mindshare, Ogilvy, Wavemaker, Wunderman Thompson, and VMLY&R. It is one of the "Big Four" agency companies, alongside Publicis, Interpublic Group of Companies, and Omnicom. WPP has a primary listing on the London Stock Exchange, and is a constituent of the FTSE 100 Index.

The Eurobank Group is a financial organisation that operates in Greece, Cyprus, Luxembourg, Serbia, Bulgaria and UK. As of December 2018, the Eurobank Group counts, €58 billion in assets, 653 customer service locations in Greece and abroad, and 13,162 employees.

Razorfish, part of Publicis Groupe, is one of the world's largest interactive agencies. Razorfish provides services including web development, media planning and buying, technology and innovation, emerging media, analytics, mobile, advertising, creative, social influence marketing and search.

Havas Creative, formerly known as Havas Worldwide and Euro RSCG, is a French advertising agency. It is one of the largest integrated marketing communications agencies in the world, made up of 316 offices located in 75 countries. The firm provides advertising, marketing, and corporate communications services.

Deutsche Börse AG or the Deutsche Börse Group, is a German company offering marketplace organizing for the trading of shares and other securities. It is also a transaction services provider. It gives companies and investors access to global capital markets. It is a joint stock company and was founded in 1993. The headquarters are in Frankfurt. As of December 2010, the over 765 companies listed had a combined market capitalization of EUR 1.4 trillion. On 1 October 2014, Deutsche Börse AG became the 14th announced member of the United Nations Sustainable Stock Exchanges initiative.

TBWA Worldwide is an international advertising agency whose main headquarters are in Midtown Manhattan, New York City, United States.

Publicis Groupe is a French multinational advertising and public relations company. One of the oldest and largest marketing and communications companies in the world by revenue, it is headquartered in Paris.

The Interpublic Group of Companies, Inc. (IPG) is an American publicly traded advertising company. The company consists of five major networks: FCB, IPG Mediabrands, McCann Worldgroup, MullenLowe Group, and Marketing Specialists, as well as a number of independent specialty agencies in the areas of public relations, sports marketing, talent representation, and healthcare. It is one of the "Big Four" agency companies, alongside WPP, Publicis and Omnicom. Phillippe Krakowsky became the company's CEO on January 1, 2021.

Snyder Communications Inc. (SNC) was founded in 1988 by Daniel Snyder and his sister Michelle Snyder. Their activities were mainly outsourced marketing services, such as Direct marketing, database marketing, proprietary product sampling, sponsored information display in prime locations, call centres, field sales.

London Stock Exchange Group plc (LSEG) is a United Kingdom-based stock exchange and financial information company headquartered in the City of London, England. It owns the London Stock Exchange, Refinitiv, LSEG Technology, FTSE Russell, and majority stakes in LCH and Tradeweb.

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign parent, and the original parent company becomes a subsidiary of the foreign parent, thus moving its tax residence to the foreign country. Executives and operational headquarters can stay in the original country. The US definition requires that the original shareholders remain a majority control of the post-inverted company.

United Airlines Holdings, Inc. is a publicly traded airline holding company headquartered in the Willis Tower in Chicago. UAH owns and operates United Airlines, Inc.

American Airlines Group Inc. is an American publicly traded airline holding company headquartered in Fort Worth, Texas. It was formed on December 9, 2013, by the merger of AMR Corporation, the parent company of American Airlines, and US Airways Group, the parent company of US Airways. Integration was completed when the Federal Aviation Administration granted a single operating certificate for both carriers on April 8, 2015, and all flights now operate under the American Airlines brand.

OMD Worldwide is a media communications agency. It is a subsidiary of Omnicom Group and an Omnicom Media Group agency considered the holding company's "media specialist brand". Omnicom Media Group is the media services division of Omnicom Group. OMD is headquartered in New York City and its chief executive officer is George Manas.

The advertising industry is the global industry of public relation and marketing companies, media services and advertising agencies - largely controlled today by just a few international holding companies. It is a global, multibillion-dollar business that connects manufacturers and consumers. The industry ranges from nonprofit organizations to Fortune 500 companies.

References

- 1 2 3 4 5 6 7 Channick, Robert (28 July 2013). "Leo Burnett parent in huge ad merger deal". Chicago Tribune. Retrieved 28 July 2013.

- 1 2 "Merger of Publicis and Omnicom makes biggest ad firm". BBC. 28 July 2013. Retrieved 28 July 2013.

- 1 2 3 4 5 Garside, Juliette (28 July 2013). "Omnicom and Publicis merger creates communications giant". The Guardian . Retrieved 28 July 2013.

- 1 2 3 4 "Omnicom And Publicis Announce Completely Unexpected Merger". Business Insider. 28 July 2013. Retrieved 28 July 2013.

- 1 2 3 4 5 "Publicis-Omnicom Merger Set". AdWeek, 26 July 2013

- 1 2 3 "Publicis and Omnicom announce merger of equals". Financial Times . 28 July 2013. Retrieved 28 July 2013.

- ↑ "UPDATE 1-Ad firms Publicis, Omnicom in merger talks – report". Reuters. 26 July 2013. Retrieved 28 July 2013.

- ↑ "Why Industry should be concerned by Publicis Omnicom Group formation". The Drum. 28 July 2013. Retrieved 28 July 2013.

- ↑ "Omnicom, Publicis Call Off Merger". The Wall Street Journal. May 2014.

- 1 2 "Publicis-Omnicom $35bn merger deal called off". BBC News. 9 May 2014. Retrieved 9 May 2014.

- 1 2 3 Abboud, Leila & Kim, Soyoung (9 May 2014). "Battle for control destroyed $35 billion Omnicom-Publicis merger". Reuters. Retrieved 9 May 2014.

- ↑ Bender, Ruth (9 May 2014). "Sorrell Takes Pleasure From Publicis-Omnicom Deal Collapse". The Wall Street Journal.

- ↑ Bender, Ruth; Tadena, Nathalie; Vranica, Suzanne. "Failed Merger Leaves Holes for Ad Giants". The Wall Street Journal.

- ↑ Reuters in London and New York. "Omnicom-Publicis merger collapses". The Guardian.