Mining is the extraction of valuable geological materials and minerals from the surface of the Earth. Mining is required to obtain most materials that cannot be grown through agricultural processes, or feasibly created artificially in a laboratory or factory. Ores recovered by mining include metals, coal, oil shale, gemstones, limestone, chalk, dimension stone, rock salt, potash, gravel, and clay. The ore must be a rock or mineral that contains valuable constituent, can be extracted or mined and sold for profit. Mining in a wider sense includes extraction of any non-renewable resource such as petroleum, natural gas, or even water.

The rare-earth elements (REE), also called the rare-earth metals or rare earths or, in context, rare-earth oxides, and sometimes the lanthanides, are a set of 17 nearly indistinguishable lustrous silvery-white soft heavy metals. Compounds containing rare earths have diverse applications in electrical and electronic components, lasers, glass, magnetic materials, and industrial processes.

Trade justice is a campaign by non-governmental organisations, plus efforts by other actors, to change the rules and practices of world trade in order to promote fairness. These organizations include consumer groups, trade unions, faith groups, aid agencies and environmental groups.

Prospecting is the first stage of the geological analysis of a territory. It is the search for minerals, fossils, precious metals, or mineral specimens. It is also known as fossicking.

Mining in Japan is minimal because Japan does not possess many on-shore mineral resources. Many of the on-shore minerals have already been mined to the point that it has become less expensive to import minerals. There are small deposits of coal, oil, iron and minerals in the Japanese archipelago. Japan is scarce in critical natural resources and has been heavily dependent on imported energy and raw materials. There are major deep sea mineral resources in the seabed of Japan. This is not mined yet due to technological obstacles for deep sea mining.

Mining in Australia has long been a significant primary sector industry and contributor to the Australian economy by providing export income, royalty payments and employment. Historically, mining booms have also encouraged population growth via immigration to Australia, particularly the gold rushes of the 1850s. Many different ores, gems and minerals have been mined in the past and a wide variety are still mined throughout the country.

Mining in Western Australia, together with the petroleum industry in the state, accounted for 94% of the State's and 46% of Australia's income from total merchandise exports in 2019–20. The state of Western Australia hosted 123 predominantly higher value and export-oriented mining projects and hundreds of smaller quarries and mines. The principal projects produced more than 99 per cent of the industry's total sales value.

The mining of minerals in Nigeria accounts for only 0.3% of its gross domestic product, due to the influence of its vast oil resources. The domestic mining industry is underdeveloped, leading to Nigeria having to import minerals that it could produce domestically, such as salt or iron ore. The rights to ownership of mineral resources is held by the Federal Government of Nigeria, which grants titles to organizations to explore, mine, and sell mineral resources. Organized mining began in 1903, when the Mineral Survey of the Northern Protectorates was created by the British colonial government. A year later, the Mineral Survey of the Southern Protectorates was founded. By the 1940s, Nigeria was a major producer of tin, columbite, and coal. The discovery of oil in 1956 hurt the mineral extraction industries, as government and industry both began to focus on this new resource. The Nigerian Civil War in the late 1960s led many expatriate mining experts to leave the country. Mining regulation is handled by the Ministry of Solid Minerals Development, who are tasked with the responsibility of overseeing the management of all mineral resources in Nigeria. Mining law is codified in the Federal Minerals and Mining Act of 1999. Historically, Nigeria's mining industry was monopolized by state-owned public corporations. This led to a decline in productivity in almost all mineral industries. The Obasanjo administration began a process of selling off government-owned corporations to private investors in 1999. The Nigerian Mining Industry has picked up since the "Economic Diversification Agenda", from Oil & Gas, to Agriculture, Mining, etc., began in the country.

Mining in Afghanistan was controlled by the Ministry of Mines and Petroleum, prior to the August 15th takeover by the Taliban. It is headquartered in Kabul with regional offices in other parts of the country. Afghanistan has over 1,400 mineral fields, containing barite, chromite, coal, copper, gold, iron ore, lead, natural gas, petroleum, precious and semi-precious stones, salt, sulfur, lithium, talc, and zinc, among many other minerals. Gemstones include high-quality emeralds, lapis lazuli, red garnet and ruby. According to a joint study by The Pentagon and the United States Geological Survey, Afghanistan has an estimated US$1 trillion of untapped minerals.

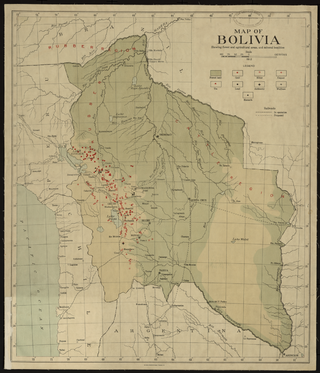

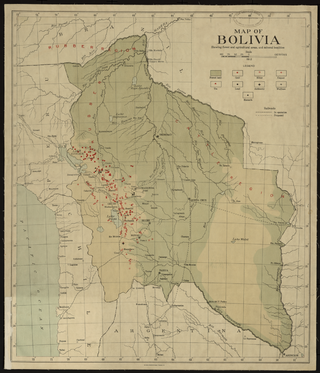

Mining in Bolivia has been a dominant feature of the Bolivian economy as well as Bolivian politics since 1557. Colonial era silver mining in Bolivia, particularly in Potosí, played a critical role in the Spanish Empire and the global economy. Tin mining supplanted silver by the twentieth century and the central element of Bolivian mining, and wealthy tin barons played an important role in national politics until they were marginalized by the industry's nationalization into the Bolivian Mining Corporation that followed the 1952 revolution. Bolivian miners played a critical part to the country's organized labor movement from the 1940s to the 1980s.

The Mountain Pass Rare Earth Mine and Processing Facility, owned by MP Materials, is an open-pit mine of rare-earth elements on the south flank of the Clark Mountain Range in California, 53 miles (85 km) southwest of Las Vegas, Nevada. In 2020 the mine supplied 15.8% of the world's rare-earth production. It is the only rare-earth mining and processing facility in the United States.

Molycorp Inc. was an American mining corporation headquartered in Greenwood Village, Colorado. The corporation, which was formerly traded on the New York Stock Exchange, owned the Mountain Pass rare earth mine in California. It filed for bankruptcy in June 2015 after changing competitive circumstances, declining prices on output and a 2014 restructuring. It was purchased by its largest creditor Oaktree Capital Management and was reorganized as Neo Performance Materials.

The rare earth industry in China is a large industry. Rare earths are a group of elements on the periodic table with similar properties. Rare earth metals are used to manufacture everything from electric vehicles (EVs), wind turbines, consumer electronics and other clean energy technologies. The rare earths cause improved system performance when for example electric battery terminal LiMn2O4 cathodes are doped with them, and it is known that some EVs use lithium-ion batteries such as these. Tesla automobiles "currently uses an lithium-nickel-cobalt-aluminum (NCA) chemistry, while lithium-nickel-manganese-cobalt (NMC) chemistries are common across the rest of the EV industry." Vehicle "manufacturers are keen to reduce reliance on rare earths, which like cobalt, suffers from highly concentrated supply and unpredictable pricing, with China holding a virtual global monopoly in primary supply and processing." Leading battery manufacturer Samsung SDI uses this technology for its phone and portable computer batteries.

Energy Transition Minerals Ltd is an ASX-listed company focused on the exploration, development and financing of minerals that are critical to a low carbon future. The company’s current projects include the Kvanefjeld, located in Greenland, and Villasrubias, located in Spain.

American Elements is a global manufacturer and distributor of advanced materials with an over 35,000-page online product catalog and compendium of information on the chemical elements, advanced materials, and high technology applications. The company's headquarters and educational programs are based in Los Angeles, California. Its research and production facilities are located in Salt Lake City, Utah; Monterrey, Mexico;China; and Manchester, US.34

Mining in North Korea is important to the country's economy. North Korea is naturally abundant in metals such as magnesite, zinc, tungsten, and iron; with magnesite resources of 6 billion tonnes, particularly in the North and South Hamgyong Province and Chagang Province. However, often these cannot be mined due to the acute shortage of electricity in the country, as well as the lack of proper tools to mine these materials and an antiquated industrial base. Coal, iron ore, limestone, and magnesite deposits are larger than other mineral commodities. Mining joint ventures with other countries include China, Canada, Egypt, and South Korea.

Round Top Mountain is a mountain located at the western end of the Sierra Blanca area in Hudspeth County, Texas near the town of Sierra Blanca. The area includes the Finlay Mountains, Triple Hill, and Sierra Blanca quadrangles as well as parts of the Fort Quitman and McNary quadrangles. Round Top Mountain is known for containing deposits of beryllium as well as the largest deposit of heavy rare-earth elements in the United States.

Simon David Moores is a British businessman and entrepreneur, specializing in the lithium ion battery and electric vehicle industry.

MP Materials Corp. is an American rare-earth materials company headquartered in Las Vegas, Nevada. MP Materials owns and operates the Mountain Pass mine, the only operating rare earth mine and processing facility in the United States. MP Materials focuses its production on Neodymium-Praseodymium (NdPr), a rare earth material used in high-strength permanent magnets that power the traction motors found in electric vehicles, robotics, wind turbines, drones and other advanced motion technologies. MP Materials is listed on the New York Stock Exchange under the ticker symbol "MP". As of December 2021, JHL Capital Group, QVT Financial and CEO James Litinsky were the company's three largest shareholders, with about 7.7% of the company owned by Shenghe Resources, a Chinese rare earth business located in Sichuan.

The electric vehicle supply chain comprises the mining and refining of raw materials and the manufacturing processes that produce lithium ion batteries and other components for electric vehicles. The lithium-ion battery supply chain is a major component of the overall EV supply chain, and the battery accounts for 30–40% of the value of the vehicle. Lithium, cobalt, graphite, nickel, and manganese are all critical minerals that are necessary for electric vehicle batteries. There is rapidly growing demand for these materials because of growth in the electric vehicle market, which is driven largely by the proposed transition to renewable energy. Securing the supply chain for these materials is a major world economic issue. Recycling and advancement in battery technology are proposed strategies to reduce demand for raw materials. Supply chain issues could create bottlenecks, increase costs of EVs and slow their uptake.